Finding an Accountant in Sarn: Do you find it a headache filling out your self-assessment form every year? Lots of self-employed people in Sarn feel the same way that you do. But how do you find an accountant in Sarn to do it for you? This could be a better idea for you if you find self-assessment a tad too taxing. The cost of completing and sending in your self-assessment form is around £200-£300 if carried out by a typical Sarn accountant. Instead of using a local Sarn accountant you could try one of the readily available online self-assessment services which may offer a saving on cost.

So, what do you get for your hard earned cash and exactly what is the best way to locate an accountant in Sarn, Mid Glamorgan? A few likely candidates can soon be found by performing a swift search on the internet. Knowing just who you can trust is of course not quite so easy. The fact that almost anybody in Sarn can set themselves up as an accountant is a thing that you need to keep in mind. They don't need a degree or even relevant qualifications such as A Levels or BTEC's. Peculiar as this may seem.

Finding a properly qualified Sarn accountant should be your priority. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. Qualified accountants may come with higher costs but may also save you more tax. You will of course get a tax deduction on the costs involved in preparing your tax returns. Sole traders and smaller businesses might get away with using a bookkeeper.

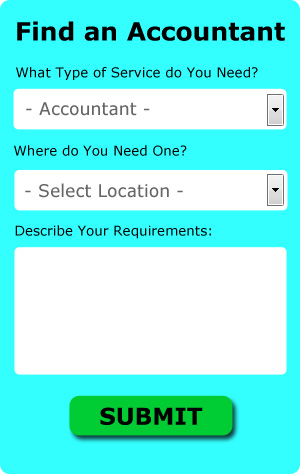

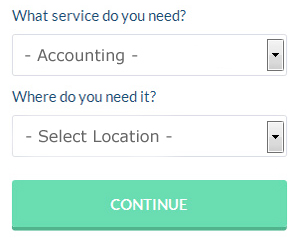

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. All that is required is the ticking of a few boxes so that they can understand your exact needs. Your requirements will be distributed to accountants in the Sarn area and they will be in touch with you directly.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. For many self-employed people this is a convenient and time-effective solution. If you decide to go with this method, pick a company with a decent reputation. Be sure to study customer reviews and testimonials. We are unable to advocate any individual accounting services on this site.

The very best in this profession are chartered accountants, they will also be the most expensive. However, as a sole trader or smaller business in Sarn using one of these specialists may be a bit of overkill. If you want the best person for your business this might be an option.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. Using accounting software like Forbes, Taxfiler, GoSimple, BTCSoftware, Basetax, Capium, Andica, Keytime, Xero, Taxshield, Ajaccts, Gbooks, CalCal, TaxCalc, Nomisma, Taxforward, Absolute Topup, Ablegatio, Sage, 123 e-Filing or ACCTAX will make it even simpler to do yourself. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty. Penalties are £100 for being 3 months late and an extra £10 per day after that, so don't be late.

Auditors Sarn

An auditor is a person authorised to examine and validate the reliability of financial accounts and ensure that businesses observe tax laws. Auditors examine the fiscal actions of the company that hires them and make certain of the unwavering operation of the organisation. To work as an auditor, an individual must be certified by the regulatory body of accounting and auditing and possess specified qualifications.

Forensic Accounting Sarn

You might well run into the term "forensic accounting" when you are looking for an accountant in Sarn, and will no doubt be interested to know about the difference between forensic accounting and normal accounting. The actual word 'forensic' is the thing that gives a clue, meaning literally "denoting or relating to the application of scientific techniques and methods for the investigation of a crime." Also referred to as 'financial forensics' or 'forensic accountancy', it uses auditing, investigative skills and accounting to discover inaccuracies in financial accounts which have lead to theft or fraud. There are even some bigger accountants firms throughout Mid Glamorgan who have got dedicated departments for forensic accounting, addressing personal injury claims, bankruptcy, professional negligence, tax fraud, money laundering, insolvency and false insurance claims.

Small Business Accountants Sarn

Making certain your accounts are accurate can be a stressful job for anyone running a small business in Sarn. A focused small business accountant in Sarn will provide you with a stress free solution to keep your VAT, tax returns and annual accounts in perfect order.

A qualified small business accountant in Sarn will consider that it's their responsibility to develop your business, and offer you sound financial advice for peace of mind and security in your particular circumstances. A decent accounting firm in Sarn will offer you proactive small business advice to optimise your tax efficiency while at the same time lowering expense; crucial in the sometimes shadowy world of business taxation.

It is also essential that you explain the structure of your business, your plans for the future and your company's situation accurately to your small business accountant. (Tags: Small Business Accountants Sarn, Small Business Accountant Sarn, Small Business Accounting Sarn).

Sarn accountants will help with National Insurance numbers, HMRC submissions, bookkeeping, general accounting services, accounting services for the construction industry, business advisory, consulting services, employment law Sarn, assurance services Sarn, capital gains tax, business outsourcing, pension advice, accounting services for media companies, management accounts, payslips, consultancy and systems advice in Sarn, accounting services for buy to let property rentals Sarn, HMRC submissions, monthly payroll Sarn, bureau payroll services, VAT returns, business disposal and acquisition, accounting support services Sarn, company formations, VAT payer registration, contractor accounts in Sarn, tax investigations, mergers and acquisitions, financial statements, tax preparation, PAYE, litigation support and other kinds of accounting in Sarn, Mid Glamorgan. These are just some of the activities that are carried out by local accountants. Sarn providers will let you know their whole range of services.

When searching for inspiration and ideas for self-assessment help, accounting for small businesses, personal tax assistance and auditing & accounting, you do not really need to look much further than the internet to find everything you could possibly need. With such a vast array of well researched blog posts and webpages at your fingertips, you will quickly be overwhelmed with creative ideas for your project. Last week we stumbled across this informative article outlining how to track down an accountant to fill in your yearly tax return.

Sarn Accounting Services

- Sarn Chartered Accountants

- Sarn PAYE Healthchecks

- Sarn Account Management

- Sarn Tax Planning

- Sarn Tax Returns

- Sarn Financial Advice

- Sarn Specialist Tax

- Sarn Bookkeeping

- Sarn Business Accounting

- Sarn Debt Recovery

- Sarn Financial Audits

- Sarn Auditing Services

- Sarn Forensic Accounting

- Sarn Tax Services

Also find accountants in: Talbot Green, Porth, Ystrad, Maesteg, Cross Inn, Betws, Wyndham, Abergarw, Abercynon, Coytrahen, Cefn Cross, Glyncoch, Ynyshir, Penderyn, Treforest, Cwm Parc, Hirwaun, Pontyclun, Glan Llynfi, Brynna, Blackmill, Llangynwyd, Penrhys, Tonyrefail, Kenfig, Glyntaff, Pontypridd, Tynewydd, Llwynypia, Penygraig, Hopkinstown, Pont Y Gwaith, Cwmdare, Brynsadler, Vaynor and more.

Accountant Sarn

Accountant Sarn Accountants Near Sarn

Accountants Near Sarn Accountants Sarn

Accountants SarnMore Mid Glamorgan Accountants: Pontypridd Accountants, Pencoed Accountants, Mountain Ash Accountants, Porth Accountants, Merthyr Tydfil Accountants, Bridgend Accountants, Porthcawl Accountants, Aberdare Accountants, Tonypandy Accountants, Pyle Accountants, Maesteg Accountants, Llantrisant Accountants and Ferndale Accountants.

Self-Assessments Sarn - Tax Accountants Sarn - Investment Accountant Sarn - Online Accounting Sarn - Auditing Sarn - Bookkeeping Sarn - Tax Return Preparation Sarn - Chartered Accountant Sarn - Financial Advice Sarn