Finding an Accountant in Ivinghoe: Do you find that completing your yearly self-assessment form is nothing but a headache? This is a challenge for you and countless other people in Ivinghoe. Is the answer to find yourself a local Ivinghoe professional to do this job on your behalf? Maybe self-assessment is just too challenging for you? The average Ivinghoe accountant or bookkeeper will charge approximately £200-£300 for completing your tax returns. By utilizing an online service instead of a local Ivinghoe accountant you can save quite a bit of money.

Different kinds of accountant will be advertising their services in Ivinghoe. Therefore, make sure you pick one that suits your requirements perfectly. Some Ivinghoe accountants work within a larger accounting business, while others work independently. An accountancy firm in Ivinghoe will employ specialists in each of the major accounting sectors. Expect to find bookkeepers, auditors, chartered accountants, actuaries, tax preparation accountants, accounting technicians, investment accountants, financial accountants, management accountants, costing accountants and forensic accountants within an accountancy company.

You should take care to find a properly qualified accountant in Ivinghoe to complete your self-assessment forms correctly and professionally. Ask if they at least have an AAT qualification or higher. Qualified Ivinghoe accountants might charge a bit more but they may also get you the maximum tax savings. The cost of preparing your self-assessment form can be claimed back as a business expense.

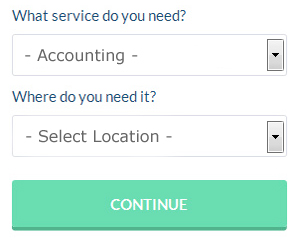

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. You will quickly be able to complete the form and your search will begin. Within a few hours you should hear from some local accountants who are willing to help you.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. It could be that this solution will be more appropriate for you. Picking a reputable company is important if you choose to go with this option. Carefully read reviews online in order to find the best available.

In the final analysis you may decide to do your own tax returns. You can take much of the hard graft out of this procedure by using a software program such as Forbes, Keytime, Nomisma, Taxforward, GoSimple, Taxfiler, Taxshield, Xero, Ajaccts, BTCSoftware, Gbooks, ACCTAX, TaxCalc, Capium, Andica, Basetax, 123 e-Filing, Sage, CalCal, Absolute Topup or Ablegatio. In any event the most important thing is to get your self-assessment set in before the deadline. Self-assessment submissions up to three months late receive a £100 fine, with further fines for extended periods.

Auditors Ivinghoe

Auditors are experts who evaluate the accounts of companies and organisations to verify the validity and legality of their financial records. They can also act as consultants to suggest possible risk prevention measures and the application of cost savings. Auditors should be certified by the regulatory body for accounting and auditing and have the required qualifications. (Tags: Auditors Ivinghoe, Auditing Ivinghoe, Auditor Ivinghoe)

Small Business Accountants Ivinghoe

Managing a small business in Ivinghoe is fairly stressful, without having to worry about your accounts and similar bookkeeping duties. A decent small business accountant in Ivinghoe will provide you with a hassle-free approach to keep your annual accounts, tax returns and VAT in the best possible order.

An experienced small business accountant in Ivinghoe will consider that it is their responsibility to help develop your business, and offer you reliable financial guidance for security and peace of mind in your unique situation. A decent accounting firm in Ivinghoe will offer you practical small business guidance to maximise your tax efficiency while at the same time reducing expense; vital in the sometimes murky sphere of business taxation.

To be able to do their job properly, a small business accountant in Ivinghoe will need to know complete details regarding your current financial situation, business structure and any future investments that you may be looking at, or already have set up. (Tags: Small Business Accountants Ivinghoe, Small Business Accountant Ivinghoe, Small Business Accounting Ivinghoe).

Payroll Services Ivinghoe

Staff payrolls can be a stressful area of running a business enterprise in Ivinghoe, no matter its size. Coping with staff payrolls demands that all legal obligations in relation to their timing, exactness and openness are followed in all cases.

A small business may well not have the advantage of an in-house financial expert and the best way to deal with the issue of staff payrolls is to hire an external accounting company in Ivinghoe. A payroll accountant will work alongside HMRC, work with pensions schemes and set up BACS payments to ensure that your personnel are paid promptly, and that all mandatory deductions are accurate.

A decent payroll management accountant in Ivinghoe will also, in line with the current legislation, provide P60's after the end of the financial year for every staff member. A P45 tax form must also be presented to any employee who stops working for your company, in accordance with current legislations.

Suggestions for Helping You Manage Your Finances Properly

Starting your own business is exciting, and this is true whether you are starting this business online or offline. You get to be in charge of practically everything when you've got your own business -- your time, the work you do, and even your income! Now that can be a little scary! Truly, while exhilarating, starting your own business is also quite intimidating because it can be quite difficult to find your feet. Thus, it can be very helpful if you know a few self-improvement strategies like managing your finances properly. If you'd like to keep your finances in order, continue reading this article.

Avoid combining your business expenses and personal expenses in one account. It might seem simple at first but the truth is that in the long run it just makes everything more difficult. For one, it's a lot harder to prove your income when your business expenses are running through a personal account. Moreover, come tax season, you'll be in for a tough time proving which expenses were business related and which ones were personal. You'll be able to manage your finances better if you separate the business expenses from the personal expenses.

It's a good idea to know where exactly every cent goes in both your business and personal life. Yes, it is a pain to track every little thing you buy, but it is quite helpful. When you meticulously record every expenditure you make, whether personal or business related, you can keep an eye on your spending habits. Have you ever wondered where all your money is going? This can come in handy, especially when you're trying to budget your money because you can see where you can potentially save money. And of course, when you're filling out tax forms, you'll find it so much easier when you have a record of where, what, and how much you spent on business related things.

Of course, if you're keeping track of every penny you're spending, you should keep track of every penny you're getting as well. Whenever a client or customer pays you, record that payment. With this money management strategy, you can easily keep track of how much money you've got on hand, as well as who has already paid their dues and who hasn't. When you know what your income is, you'll also be able to figure out how much taxes you can expect to pay and even how much money you should pay yourself.

There are lots of ways to practice self improvement in your business. For one, you can learn how to manage your finances better. Most people wish they were better money managers. When you learn proper money management, your self-confidence can be helped a lot. Moreover, your business and personal lives will be more organized. Keep in mind the money management tips we shared in this article. Keep applying them to your business and you'll soon see much success.

Ivinghoe accountants will help with employment law, workplace pensions, capital gains tax, taxation accounting services, small business accounting, charities, cash flow Ivinghoe, personal tax, National Insurance numbers Ivinghoe, business outsourcing, year end accounts, double entry accounting, management accounts, assurance services, financial statements, partnership accounts, accounting services for media companies in Ivinghoe, inheritance tax Ivinghoe, estate planning, accounting and financial advice, company secretarial services, accounting services for the construction industry Ivinghoe, mergers and acquisitions, financial planning, corporate tax, corporate finance, VAT returns, payslips in Ivinghoe, payroll accounting, audit and compliance reports, partnership registration Ivinghoe, accounting services for landlords and other types of accounting in Ivinghoe, Buckinghamshire. These are just a small portion of the tasks that are performed by nearby accountants. Ivinghoe companies will be delighted to keep you abreast of their whole range of services.

Ivinghoe Accounting Services

- Ivinghoe Bookkeeping Healthchecks

- Ivinghoe Tax Planning

- Ivinghoe Business Planning

- Ivinghoe Payroll Management

- Ivinghoe Forensic Accounting

- Ivinghoe PAYE Healthchecks

- Ivinghoe Tax Refunds

- Ivinghoe Account Management

- Ivinghoe Self-Assessment

- Ivinghoe Tax Returns

- Ivinghoe Personal Taxation

- Ivinghoe Auditing

- Ivinghoe Taxation Advice

- Ivinghoe Bookkeeping

Also find accountants in: Dorton, Long Crendon, Bishopstone, Lavendon, Willen, Buckland, Turweston, Chalfont St Peter, Bledlow, Wing, Hillesden, Tylers Green, Ledburn, Weedon, Stoke Mandeville, Little Missenden, Denham, Wooburn Green, Ivinghoe Aston, Horton, Bow Brickhill, Chicheley, Wooburn, Rowsham, Beacons Bottom, Buckingham, Prestwood, The Lee, Denham Green, Westlington, Leckhampstead, Dropmore, Marsh Gibbon, Kimble Wick, Worminghall and more.

Accountant Ivinghoe

Accountant Ivinghoe Accountants Near Ivinghoe

Accountants Near Ivinghoe Accountants Ivinghoe

Accountants IvinghoeMore Buckinghamshire Accountants: Princes Risborough Accountants, High Wycombe Accountants, Milton Keynes Accountants, Marlow Accountants, Buckingham Accountants, Bletchley Accountants, Burnham Accountants, Amersham Accountants, Hazlemere Accountants, Great Missenden Accountants, Newport Pagnell Accountants, Wooburn Accountants, Stony Stratford Accountants, Fenny Stratford Accountants, Aylesbury Accountants, Chesham Accountants, Chalfont St Peter Accountants, Iver Accountants and Beaconsfield Accountants.

Bookkeeping Ivinghoe - Tax Return Preparation Ivinghoe - Financial Accountants Ivinghoe - Self-Assessments Ivinghoe - Affordable Accountant Ivinghoe - Chartered Accountant Ivinghoe - Tax Accountants Ivinghoe - Financial Advice Ivinghoe - Online Accounting Ivinghoe