Finding an Accountant in Iver: Does it seem like the only "reward" for filling out your yearly self-assessment form a massive headache? This is an issue for you and countless others in Iver. Of course, you could always get yourself a local Iver accountant to do this task instead. It could be the case that doing your own self-assessment is simply too challenging. You should expect to pay about £200-£300 when retaining the services of a run-of-the-mill Iver accountant or bookkeeper. Online accounting services are available for considerably less than this.

You may be confused when you find that accountants don't just handle tax returns, they've got many different duties. Choosing the right one for your company is critical. It isn't unusual for Iver accountants to operate independently, others favour being part of a larger accountancy business. An accounting practice will offer a wider range of services, while an independent accountant may offer a more personal service. Among the major accountancy positions are: actuaries, auditors, tax preparation accountants, bookkeepers, costing accountants, forensic accountants, chartered accountants, financial accountants, management accountants, accounting technicians and investment accountants.

For completing your self-assessment forms in Iver you should find a properly qualified accountant. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. Qualified Iver accountants might charge a bit more but they may also get you the maximum tax savings. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction. Sole traders and smaller businesses might get away with using a bookkeeper.

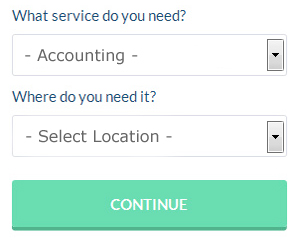

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. You simply answer a few relevant questions so that they can find the most suitable person for your needs. All you have to do then is wait for some responses. There is no fee for this service.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. This kind of service may not suit everyone but could be the answer for your needs. Picking a reputable company is important if you choose to go with this option. The better ones can soon be singled out by carefully studying reviews online. If you are looking for individual recommendations, this website is not the place to find them.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. Software is also available to make doing your self-assessment even easier. Some of the best ones include Gbooks, Nomisma, Sage, CalCal, BTCSoftware, GoSimple, Forbes, Andica, Absolute Topup, Xero, Keytime, Ablegatio, Taxforward, TaxCalc, Basetax, Capium, Ajaccts, ACCTAX, Taxfiler, 123 e-Filing and Taxshield. The most important thing is to make sure your self-assessment is sent in promptly.

Auditors Iver

An auditor is a company or person appointed to evaluate and validate the accuracy of accounts and ensure that organisations or businesses abide by tax laws. They offer businesses from fraud, find irregularities in accounting strategies and, sometimes, operate on a consultancy basis, helping firms to find solutions to boost efficiency. For anybody to start working as an auditor they need to have certain qualifications and be certified by the regulatory authority for accounting and auditing. (Tags: Auditors Iver, Auditing Iver, Auditor Iver)

Forensic Accounting Iver

Whilst conducting your search for a reliable accountant in Iver there's a good likelihood that you'll stumble on the term "forensic accounting" and be wondering what it is, and how it differs from normal accounting. The hint for this is the actual word 'forensic', which basically means "suitable for use in a court of law." Sometimes also referred to as 'forensic accountancy' or 'financial forensics', it uses auditing, accounting and investigative skills to inspect financial accounts so as to detect fraud and criminal activity. Some bigger accounting firms in the Iver area may even have independent forensic accounting departments with forensic accountants concentrating on specific types of fraud, and might be addressing insolvency, professional negligence, bankruptcy, money laundering, personal injury claims, tax fraud and insurance claims.

Small Business Accountants Iver

Operating a small business in Iver is fairly stressful, without needing to fret about your accounts and similar bookkeeping tasks. A dedicated small business accountant in Iver will provide you with a stress free approach to keep your annual accounts, tax returns and VAT in the best possible order.

Offering advice, ensuring your business follows the best fiscal practices and providing methods to help your business to reach its full potential, are just some of the responsibilities of an honest small business accountant in Iver. The capricious and sometimes complicated sphere of business taxation will be cleared and explained to you in order to lower your business expenses, while improving tax efficiency.

In order to do their job correctly, a small business accountant in Iver will have to know accurate details regarding your present financial situation, company structure and any potential investment that you might be thinking about, or already have set up.

Improving Yourself and Your Business with the Help of the Top Money Management Techniques

Want to put up your own business? Making the decision is quite easy. However, knowing exactly how to start it is a different matter altogether, and actually getting the business up and running can be a huge challenge. During the course of your business, so many things can happen that can erode your business and self-confidence, and this is where many business owners have the hardest time. For example, failure on your part to properly manage your finances will contribute to this. During the initial stages of your business, managing your money may be a simple task. But as you grow your business, the money management aspect is only going to become more complex so it's a good idea to keep the following tips in mind.

Don't wait for the due date to pay your taxes because you may not have the funds to pay by then, especially if you're not a good money manager. Here's what you can do: every day or every week, take a portion of the payments you receive and then put that in a separate account. Do this and you'll never have to worry where to get the money to pay your taxes every quarter because you've already got it saved. It sounds lame, but it can be really satisfying to be able to pay your taxes in full and on time.

Think about setting up payment plans for your clients. This isn't just a good idea for your business in terms of landing more clients, it's a good idea for your finances because it means that you will have money coming in regularly. This is a lot better than having payments come in sporadically. Overall, you can properly manage your business finances when your income is a lot more reliable. It's because you can plan your budget, pay your bills on time, and basically keep your books up-to-date. This can certainly boost your self-confidence.

If you deal with cash in any capacity, make sure that you deposit that cash every day, as keeping cash on hand is just too tempting. You might need a few extra bucks to pay for lunch and you might think, "oh I'll put this back in a couple of days." It's actually very easy to forget to put the money back in and if you keep doing this, you'll soon screw up your books. Put your cash in the bank at the end of every work day.

Every adult should learn the proper way of managing their money. Your confidence and your business will sure be given a huge boost if you become skilled at managing your finances properly. So keep in mind the tips we've shared. Developing proper money management skills not only will help boost your business but boost your self-confidence as well.

Iver accountants will help with self-employed registration in Iver, business outsourcing, company formations, financial statements, HMRC liaison, business start-ups, auditing and accounting, accounting services for buy to let property rentals in Iver, accounting and financial advice, double entry accounting Iver, capital gains tax, cash flow, inheritance tax, business support and planning Iver, general accounting services, estate planning, corporate finance, consulting services, personal tax in Iver, payroll accounting, tax preparation, payslips, limited company accounting Iver, business advisory services Iver, contractor accounts in Iver, tax investigations in Iver, audit and compliance reporting Iver, taxation accounting services, mergers and acquisitions in Iver, consultancy and systems advice, National Insurance numbers Iver, accounting support services Iver and other forms of accounting in Iver, Buckinghamshire. Listed are just a few of the tasks that are carried out by nearby accountants. Iver providers will keep you informed about their full range of services.

You actually have the best resource right at your fingertips in the shape of the net. There is such a lot of inspiration and information available online for such things as accounting & auditing, personal tax assistance, small business accounting and self-assessment help, that you will very soon be deluged with suggestions for your accounting requirements. An illustration may be this article about 5 tips for locating a first-rate accountant.

Iver Accounting Services

- Iver Self-Assessment

- Iver Payroll Services

- Iver VAT Returns

- Iver Tax Services

- Iver Forensic Accounting

- Iver Audits

- Iver Financial Advice

- Iver Personal Taxation

- Iver Tax Returns

- Iver Debt Recovery

- Iver Chartered Accountants

- Iver Tax Planning

- Iver Bookkeeping Healthchecks

- Iver PAYE Healthchecks

Also find accountants in: Marsworth, Little Missenden, Little Kingshill, Iver, Bierton, Poundon, Bow Brickhill, Lavendon, Lacey Green, Frieth, Loosley Row, Cryers Hill, Horton, Turville, Great Horwood, Clifton Reynes, Ashley Green, Addington, Bledlow, Amersham, Stewkley, Beaconsfield, Soulbury, Bellingdon, Dorton, Stony Stratford, Wooburn, Flackwell Heath, Whitchurch, Thornborough, Wavendon, South Heath, North Crawley, Pitch Green, Filgrave and more.

Accountant Iver

Accountant Iver Accountants Near Me

Accountants Near Me Accountants Iver

Accountants IverMore Buckinghamshire Accountants: Aylesbury Accountants, High Wycombe Accountants, Milton Keynes Accountants, Hazlemere Accountants, Buckingham Accountants, Princes Risborough Accountants, Fenny Stratford Accountants, Beaconsfield Accountants, Chesham Accountants, Burnham Accountants, Marlow Accountants, Wooburn Accountants, Newport Pagnell Accountants, Amersham Accountants, Great Missenden Accountants, Chalfont St Peter Accountants, Iver Accountants, Bletchley Accountants and Stony Stratford Accountants.

Bookkeeping Iver - Chartered Accountants Iver - Self-Assessments Iver - Investment Accounting Iver - Tax Return Preparation Iver - Financial Accountants Iver - Small Business Accountant Iver - Financial Advice Iver - Online Accounting Iver