Finding an Accountant in Horsley: Having an accountant on board can be very beneficial to anyone who is self-employed or running a business in Horsley. Most significantly you will have more time to focus on your core business operations, while your accountant deals with such things as bookkeeping and annual tax returns. Being able to access professional financial advice is even more vital for new businesses. As you grow and move forward you'll find this help is even more essential.

Your next job will be to search for a local Horsley accountant who you can trust to do a decent job on your books. Some potential candidates can easily be found by conducting a swift search on the internet. But, which of these prospects will you be able to put your trust in? It is always worth considering that it is possible for practically any Horsley individual to promote themselves as a bookkeeper or accountant. It isn't even neccessary for them to have any qualifications.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. Look for an AAT qualified accountant in the Horsley area. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. Make sure that you include the accountants fees in your expenses, because these are tax deductable. Horsley sole traders often opt to use bookkeeper rather than accountants for their tax returns.

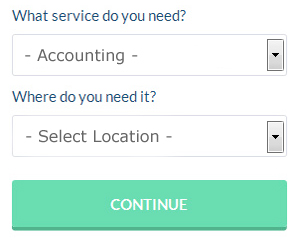

If you need a little help with your online search, there are numerous accountants who can be contacted through a website called Bark.com. You only need to answer a few basic questions and complete a straightforward form. As soon as this form is submitted, your requirements will be forwarded to local accountants. There is no fee for this service.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. While not recommended in every case, it could be the ideal solution for you. Don't simply go with the first company you find on Google, take time to do some research. Have a good look at customer testimonials and reviews both on the company website and on independent review websites. We feel it is not appropriate to list any individual services here.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. Software programs like Ajaccts, Absolute Topup, Forbes, Nomisma, Gbooks, ACCTAX, TaxCalc, Sage, Taxforward, Taxshield, Taxfiler, Ablegatio, Basetax, Capium, Andica, CalCal, Keytime, 123 e-Filing, GoSimple, Xero and BTCSoftware have been developed to help small businesses do their own tax returns. You will get a penalty if your tax return isn't in on time. The fine for late submissions (up to 3 months) is £100.

Auditors Horsley

An auditor is a person or company appointed by a firm to conduct an audit, which is the official inspection of an organisation's accounts, generally by an independent entity. They offer businesses from fraud, find inconsistencies in accounting procedures and, on occasion, work as consultants, helping organisations to find solutions to improve operational efficiency. To become an auditor, an individual must be approved by the regulatory authority for auditing and accounting and have specific qualifications.

Forensic Accountant Horsley

During your search for an experienced accountant in Horsley there's a fair chance that you will happen on the phrase "forensic accounting" and be curious about what it is, and how it is different from regular accounting. With the actual word 'forensic' literally meaning "suitable for use in a court of law", you will get a clue as to precisely what is involved. Also referred to as 'forensic accountancy' or 'financial forensics', it uses investigative skills, accounting and auditing to discover irregularities in financial accounts which have lead to theft or fraud. Some of the bigger accountancy firms in and near Horsley even have specialised divisions dealing with tax fraud, money laundering, insolvency, professional negligence, false insurance claims, bankruptcy and personal injury claims.

Actuaries Horsley

Actuaries and analysts are specialists in the management of risk. They apply their comprehensive knowledge of business and economics, in conjunction with their expertise in probability theory, statistics and investment theory, to provide financial, strategic and commercial guidance. To work as an actuary it is essential to possess a mathematical, economic and statistical understanding of day to day scenarios in the world of finance.

Small Business Accountants Horsley

Operating a small business in Horsley is pretty stressful, without needing to worry about preparing your accounts and other bookkeeping chores. If your annual accounts are getting the better of you and tax returns and VAT issues are causing sleepless nights, it is wise to employ a decent small business accountant in Horsley.

A knowledgeable small business accountant in Horsley will regard it as their responsibility to develop your business, and offer you sound financial guidance for security and peace of mind in your particular circumstances. A responsible accounting firm in Horsley should be able to offer you practical small business advice to maximise your tax efficiency while lowering business expenditure; vital in the sometimes murky sphere of business taxation.

A small business accountant, to do their job effectively, will need to know accurate details with regards to your present financial situation, company structure and any potential investment that you might be considering, or have set up.

Be Better at Managing Your Money

Are you thinking of going into business yourself? You'll find that many like being their own boss because they're in charge of how much they make and how much they get to spend. Nonetheless, this aspect of business is something that people find overwhelming despite the fact that many of them have successfully used a budget in managing their personal finances. Luckily there are plenty of things that you can do to make it easier on yourself. If you'd like to be able to manage your business funds, keep reading.

If you have a lot of regular expenditures, such as hosting account bills, recurring membership dues, etc, you might be tempted to put them all on a credit card. With this method, you don't need to make multiple payment and risk forgetting to pay any one of them on time. Of course, credit cards are tricky things, and if you let yourself carry a balance, the interest charges could make you pay a lot more money than you would have spent by simply paying the fees straight out of your bank account. This isn't to say you shouldn't use your credit card, but if you do, it's best if you pay it all off every month. With this money management strategy, you only have to keep track of one consolidated payment, not pay any interest, and build your credit rating.

Track your personal and business expenditures down to the last cent. It's actually helpful when you know where each penny is being spent. When you actually write down where you spend your money, it helps you keep track of your spending habits. Many people are earning decent money but they have poor money management skills that they often find themselves wondering where all their money has gone. If you keep a record of all your expenditures, you know exactly where you're spending your money. If your budget is a little too tight, you'll be able to identify expenditures that you can cut back on to save money. And of course, when you're filling out tax forms, you'll find it so much easier when you have a record of where, what, and how much you spent on business related things.

Resist the urge to spend. When your business is steadily pulling in a nice income, you may be tempted to go on a buying spree and buy all those things you've always wanted to buy but couldn't afford. Rather than going on a buying spree, spend wisely, which means spend only on those things that will help your business. Put your money in your business savings account so that if unexpected business expenses come up, you'll have the means to deal with it in a prompt manner. In addition, buying your office supplies in bulk will save you money. For computers, it's better if you spend money on a more expensive, but reliable system that will last for many years and won't need replaced every so often. Avoid spending too much on your entertainment as well; be moderate instead.

When it comes to managing your money properly, there are so many things that go into it. It's more than making a list of things you spent on, how much, and when. You have other things to track and many ways to do so. Tracking your money will become a lot easier for you if you apply the tips we've shared in this article. As you work and learn more about how to practice self improvement for your business through money management, you'll come up with plenty of other methods for streamlining things.

Horsley accountants will help with business start-ups, year end accounts, tax preparation, litigation support in Horsley, financial and accounting advice Horsley, consultancy and systems advice, accounting services for media companies, PAYE, sole traders, capital gains tax in Horsley, payroll accounting, business acquisition and disposal, partnership registrations Horsley, investment reviews, general accounting services, bureau payroll services, double entry accounting, partnership accounts Horsley, consulting services, audit and compliance reporting, taxation accounting services, business outsourcing, VAT payer registration, accounting support services in Horsley, company secretarial services in Horsley, tax investigations Horsley, annual tax returns in Horsley, management accounts Horsley, personal tax, small business accounting Horsley, inheritance tax, workplace pensions and other accounting related services in Horsley, Derbyshire. These are just a handful of the tasks that are performed by nearby accountants. Horsley companies will be happy to tell you about their entire range of services.

Horsley Accounting Services

- Horsley Bookkeeping Healthchecks

- Horsley Personal Taxation

- Horsley Forensic Accounting

- Horsley Chartered Accountants

- Horsley Tax Advice

- Horsley Auditing

- Horsley Self-Assessment

- Horsley Debt Recovery

- Horsley Tax Refunds

- Horsley VAT Returns

- Horsley Account Management

- Horsley Bookkeeping

- Horsley Specialist Tax

- Horsley Business Accounting

Also find accountants in: Elton, Earl Sterndale, Ashbourne, Milford, Kirk Ireton, Mackworth, Sparrowpit, Horsley, Windley Meadows, Edensor, Long Duckmanton, Glapwell, Brimington, Low Leighton, Swadlincote, Radbourne, Bolsover, Chellaston, Hayfield, Tideswell, Crich Carr, Little Eaton, Renishaw, Ilkeston, Trusley, Etwall, Unstone, Ault Hucknall, Doveridge, Egginton, Marston Montgomery, Grassmoor, Creswell, Duffield, Doe Lea and more.

Accountant Horsley

Accountant Horsley Accountants Near Horsley

Accountants Near Horsley Accountants Horsley

Accountants HorsleyMore Derbyshire Accountants: Dronfield Accountants, Shirebrook Accountants, Ripley Accountants, Matlock Accountants, Glossop Accountants, Ilkeston Accountants, Brimington Accountants, Derby Accountants, Chapel En Le Frith Accountants, Killamarsh Accountants, Swadlincote Accountants, Buxton Accountants, South Normanton Accountants, New Mills Accountants, Eckington Accountants, Long Eaton Accountants, Heanor Accountants, Somercotes Accountants, Chesterfield Accountants, Belper Accountants, Sandiacre Accountants and Staveley Accountants.

Online Accounting Horsley - Auditing Horsley - Tax Return Preparation Horsley - Financial Advice Horsley - Cheap Accountant Horsley - Financial Accountants Horsley - Tax Advice Horsley - Investment Accounting Horsley - Bookkeeping Horsley