Finding an Accountant in New Mills: Filling out your self-assessment form every year can really give you a headache. A lot of folks in New Mills have the same problem as you. Finding a local New Mills professional to do this for you may be the answer. If you find that doing your self-assessment tax return is too stressful, this may be the best option. A regular accountant in New Mills is liable to charge you around £200-£300 for the privilege. You should be able to get this done significantly cheaper by making use of one of the available online services.

So, precisely what should you expect to pay for this service and what should you get for your cash? An internet search engine will pretty quickly provide a substantial list of possible candidates in New Mills. However, how do you know who you can and can't trust with your yearly tax returns? The fact remains that anyone in New Mills can set themselves up as an accountant. There's no legal requirement that says they have to have particular qualifications or certifications. Which you and many others might think incredible.

It is advisable for you to find an accountant in New Mills who is properly qualified. Membership of the AAT shows that they hold the minimum recommended qualification. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Your accountant will add his/her fees as tax deductable.

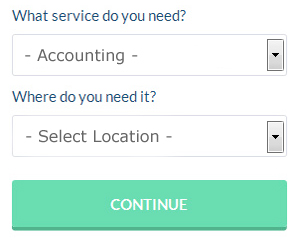

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. Filling in a clear and simple form is all that you need to do to set the process in motion. All you have to do then is wait for some responses. And the great thing about Bark is that it is completely free to use.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. Services like this are convenient and cost effective. Even if you do decide to go down this route, take some time in singling out a trustworthy company. The easiest way to do this is by studying online reviews. Sorry, but we cannot give any recommendations in this respect.

The most qualified of all are chartered accountants, they have the most training and the most expertise. Larger limited companies must use a chartered accountant, smaller businesses do not need to. Hiring the services of a chartered accountant means you will have the best that money can buy.

In the final analysis you may decide to do your own tax returns. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are CalCal, Gbooks, Ablegatio, Xero, ACCTAX, Ajaccts, Sage, Capium, Keytime, Andica, TaxCalc, BTCSoftware, Absolute Topup, GoSimple, Taxshield, Taxforward, 123 e-Filing, Nomisma, Taxfiler, Forbes and Basetax. You should get paperwork to your accountant promptly so that your tax returns can be prepared with time to spare. For being up to 3 months late you will be fined £100, and £10 per day thereafter.

Forensic Accounting New Mills

During your search for a professional accountant in New Mills there's a pretty good chance that you'll stumble on the phrase "forensic accounting" and be wondering what that is, and how it is different from standard accounting. With the actual word 'forensic' meaning literally "relating to or denoting the application of scientific techniques and methods to the investigation of criminal activity", you will get a hint as to what's involved. Using auditing, investigative skills and accounting to identify inconsistencies in financial accounts that have been involved in theft or fraud, it's also often known as 'forensic accountancy' or 'financial forensics'. There are even a few larger accountants firms in Derbyshire who have specialist divisions for forensic accounting, addressing insolvency, bankruptcy, insurance claims, tax fraud, money laundering, personal injury claims and professional negligence. (Tags: Forensic Accounting New Mills, Forensic Accountants New Mills, Forensic Accountant New Mills)

Small Business Accountants New Mills

Making sure that your accounts are accurate can be a challenging job for anyone running a small business in New Mills. If your annual accounts are getting the better of you and VAT and tax return issues are causing sleepless nights, it would be wise to use a focused small business accountant in New Mills.

An experienced small business accountant in New Mills will regard it as their responsibility to develop your business, and provide you with reliable financial advice for security and peace of mind in your unique circumstances. The vagaries and complex world of business taxation will be clearly laid out for you in order to reduce your business costs, while at the same time improving tax efficiency.

It is also crucial that you explain your company's circumstances, your plans for the future and the structure of your business accurately to your small business accountant.

The Best Money Management Techniques for Business Self Improvement

Many business owners have discovered early on that it can be difficult to learn how to properly use money management techniques. Some people think that money management is a skill that should be already learned or mastered. However, there is a huge difference between managing your personal finances and managing your business finances, although it can help if you've got some experience in the former. Your self-confidence could very well take a huge dive should you accidentally ruin your business finances. Continue reading if you want to know how you can better manage your business finances.

Number your invoices. Many business owners don't think much about this, but it's one of those things that are important if you want to run your business smoothly and even keep your sanity! It makes it easy to track invoices if you have them numbered. Not only will it help you find out quickly enough who has already paid their invoices, it will help you find out who still owes you and how much. Expect to have clients who will say they have already paid you. If you've got an invoicing system, you can quickly verify their statement or show proof that no payment has been made. It's so much easier to find errors in your invoicing too if you have an invoicing system in place.

Learn how to keep your books. Don't neglect the importance of having a system set up for both your personal and business finances. You can do this simply by setting up a basic Excel spreadsheet or you could use bookkeeping software like Quicken or QuickBooks. In addition, you can make use of personal budgeting tools such as Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. Keeping your books organized and up to date will help you understand your finances better. And if you simply can't afford to hire a bookkeeper at this time, you'll benefit from taking a basic bookkeeping and accounting class.

Control your spending. When your business is steadily pulling in a nice income, you may be tempted to go on a buying spree and buy all those things you've always wanted to buy but couldn't afford. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. Also, it's better if you build your business savings. This way, should unexpected expenses crop up, you'll be able to deal with it in a timely manner. Buy your office supplies in bulk. For computing equipment, go for quality even if it's a little more expensive. This will actually save you more money because you'll get more years out of the equipment and you won't have to replace them as often. Avoid spending too much on your entertainment as well; be moderate instead.

There are so many different things that go into helping you properly manage your money. Managing your money is not a basic skill or easy thing to learn. It's really a complicated process that requires constant learning and practicing, especially by small business owners. Use the tips in this article to help you keep track of everything. Really, when it comes to self improvement for business, it doesn't get much more basic than learning how to stay on top of your finances.

New Mills accountants will help with sole traders, taxation accounting services in New Mills, HMRC submissions, self-employed registrations, financial planning, mergers and acquisitions, general accounting services, compliance and audit reporting, employment law, audit and auditing in New Mills, inheritance tax, payslips, PAYE, tax preparation, cash flow, limited company accounting, business outsourcing, accounting services for buy to let property rentals, year end accounts, bureau payroll services, financial and accounting advice in New Mills, partnership registration, company formations, accounting services for the construction industry, small business accounting, bookkeeping, business planning and support, accounting support services in New Mills, litigation support, corporate tax, VAT registration, debt recovery and other accounting services in New Mills, Derbyshire. Listed are just an example of the duties that are carried out by nearby accountants. New Mills professionals will be happy to tell you about their entire range of accounting services.

Using the internet as an unlimited resource it is amazingly simple to uncover lots of valuable ideas and information concerning accounting & auditing, small business accounting, personal tax assistance and self-assessment help. To illustrate, with a brief search we discovered this intriguing article on the subject of choosing an accountant.

New Mills Accounting Services

- New Mills Tax Refunds

- New Mills Business Planning

- New Mills Personal Taxation

- New Mills Tax Returns

- New Mills VAT Returns

- New Mills Specialist Tax

- New Mills Audits

- New Mills Chartered Accountants

- New Mills Tax Services

- New Mills Debt Recovery

- New Mills Taxation Advice

- New Mills Bookkeeping Healthchecks

- New Mills PAYE Healthchecks

- New Mills Bookkeeping

Also find accountants in: Danesmoor, Old Glossop, Grassmoor, Turnditch, North Wingfield, Tintwistle, Hazelwood, Alderwasley, Church Broughton, Woodthorpe, Rowsley, Nether End, Chunal, Castle Gresley, Monyash, Weston Underwood, Moorhall, Lane End, Unstone, Brough, Morley, Bakewell, Wessington, Milltown, Sawley, New Mills, Chapel En Le Frith, Bolehill, Nether Padley, Apperknowle, High Cross Bank, Grindlow, Tideswell, Palterton, Aldwark and more.

Accountant New Mills

Accountant New Mills Accountants Near New Mills

Accountants Near New Mills Accountants New Mills

Accountants New MillsMore Derbyshire Accountants: Belper Accountants, Chesterfield Accountants, Sandiacre Accountants, Killamarsh Accountants, Matlock Accountants, Somercotes Accountants, Staveley Accountants, Swadlincote Accountants, Buxton Accountants, Ripley Accountants, New Mills Accountants, Alfreton Accountants, Long Eaton Accountants, Dronfield Accountants, Glossop Accountants, Shirebrook Accountants, Chapel En Le Frith Accountants, Ilkeston Accountants, Eckington Accountants, Brimington Accountants, Derby Accountants and Heanor Accountants.

Self-Assessments New Mills - Small Business Accountant New Mills - Chartered Accountant New Mills - Auditing New Mills - Online Accounting New Mills - Tax Preparation New Mills - Affordable Accountant New Mills - Bookkeeping New Mills - Financial Accountants New Mills