Finding an Accountant in Monkton: Do you find it a headache completing your self-assessment form every year? Other sole traders and small businesses in the Monkton area face the same predicament. Is the answer to find yourself a local Monkton professional to do it on your behalf? Is self-assessment a tad too complicated for you to do by yourself? Regular small business accountants in Monkton will likely charge about two to three hundred pounds for this service. It is possible to get it done more cheaply than this, and using an online service might be worth considering.

There are lots of accountants around, so you shouldn't have too much difficulty finding a good one. In the past the local newspaper or Yellow Pages would have been the first place to head, but these days the internet is far more popular. But, how do you know which of these can be trusted with your paperwork? The fact that somebody in Monkton claims to be an accountant is no real guarantee of quality. There is no legal requirement that says they have to have certain qualifications or certifications.

To get the job done correctly you should search for a local accountant in Monkton who has the right qualifications. For basic tax returns an AAT qualified accountant should be sufficient. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction. A lot of smaller businesses in Monkton choose to use bookkeepers rather than accountants.

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. You just have to fill in a simple form and answer some basic questions. Your requirements will be distributed to accountants in the Monkton area and they will be in touch with you directly.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. More accountants are offering this modern alternative. It would be advisable to investigate that any online company you use is reputable. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable. Sorry but we cannot recommend any individual service on this website.

The real professionals in the field are chartered accountants. Their services are normally required by larger limited companies and big business. Some people might say, you should hire the best you can afford.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. Software is also available to make doing your self-assessment even easier. Some of the best ones include Capium, Sage, Gbooks, Ablegatio, GoSimple, Absolute Topup, CalCal, Taxfiler, ACCTAX, Taxshield, TaxCalc, Keytime, BTCSoftware, Taxforward, Forbes, Nomisma, Ajaccts, Andica, Xero, Basetax and 123 e-Filing. Whatever happens you need to get your self-assessment form in on time. If you send in your tax return up to three months late, HMRC will fine you £100, after that it is an additional £10 per day.

Financial Actuaries Monkton

Actuaries work within government departments and companies, to help them in predicting long-term investment risks and financial costs. They employ their wide-ranging knowledge of economics and business, together with their expertise in statistics, probability theory and investment theory, to provide financial, strategic and commercial guidance. An actuary uses mathematics and statistics to determine the fiscal impact of uncertainty and help customers lessen risks.

Payroll Services Monkton

Dealing with staff payrolls can be a stressful part of running a business enterprise in Monkton, regardless of its size. The regulations concerning payrolls and the legal requirements for accuracy and transparency means that dealing with a company's payroll can be a daunting task.

Small businesses may not have their own in-house financial experts, and an easy way to take care of employee pay is to hire an independent Monkton accounting company. Your chosen payroll company will manage accurate BACS payments to your personnel, as well as working together with any pension scheme administrators that your company may have, and follow current HMRC legislation for NI contributions and tax deductions.

A decent payroll accountant in Monkton will also, in line with current legislations, provide P60 tax forms at the end of the financial year for every staff member. A P45 will also be given to any member of staff who stops working for the company, in accordance with current legislation.

Developing Better Money Management Skills for Improving Yourself and Your Business

One of the things that every small business owner struggles with is managing money properly, and this is especially true in the beginning, when you are just trying to find your feet as a business runner and proprietor. Your self-confidence could be hard hit and should your business have some cash flow issues, you just might find yourself contemplating about going back to a regular job. This can cause you to not succeed in your business endeavor. To help you in properly managing your money, follow these tips.

Retain an accountant. This is a business expense that's really worth it because an accountant can help keep your books straight on a full time basis. With an accountant on board, you can easily monitor your cash flow and more importantly pay the right amount of taxes you owe on time. The good news is that you don't have to tackle with the paperwork that goes with these things yourself. You can leave all that to your accountant. What happens is that you can focus more on building your business, including marketing and getting more clients. The expense of having a business accountant is nothing compared to how much you'll save trying to figure out your finances and keeping everything in order.

Track both your personal and business expenses down to the last penny. There are many benefits to doing this even though it is a pain to track each and every thing you spend money on, no matter how small it is. When you keep a detailed record of where you're spending your money, you'll be able to get a clear picture of your spending habits. Have you ever wondered where all your money is going? This is helpful when you're on a tight budget because you'll be able to see exactly which expenditures you can cut back on so you can save money. And when you're filling out tax forms, it's less harder to identify your business expenses from your personal expenses and you know exactly how much you spent on business related stuff.

Resist the urge to spend. It is tempting, when you have money coming in, to start spending money on the things that you've wanted for a long time but couldn't afford. It's best if you spend money on things that will benefit your business. It's better to build up your business savings so that you can handle unexpected expenses than it is to splurge every time you have the chance. Buy your office supplies in bulk. For computing equipment, go for quality even if it's a little more expensive. This will actually save you more money because you'll get more years out of the equipment and you won't have to replace them as often. Be smart about entertainment expenses, etc.

Proper money management involves a number of different things. Proper management of business finances isn't merely a basic skill. It's actually a complex process that you need to keep developing as a small business owner. Keep in mind the tips we've mentioned in this article so you can properly keep track of your finances. One of the secrets to having a successful business is learning proper money management.

Monkton accountants will help with contractor accounts, accounting and financial advice, audit and compliance reporting, HMRC submissions, partnership accounts, small business accounting, personal tax, business support and planning, general accounting services, debt recovery, workplace pensions, estate planning, annual tax returns, financial statements, tax preparation, National Insurance numbers, year end accounts, double entry accounting, corporation tax, payslips, management accounts, accounting and auditing, business start-ups, partnership registrations, cash flow, retirement advice, accounting support services, mergers and acquisitions, PAYE, inheritance tax, VAT registration, tax investigations and other kinds of accounting in Monkton, South Ayrshire.

You do, of course have the very best resource right at your fingertips in the shape of the net. There is such a lot of information and inspiration readily available online for such things as auditing & accounting, self-assessment help, personal tax assistance and accounting for small businesses, that you'll pretty quickly be swamped with ideas for your accounting needs. A good example could be this interesting article about how to track down an excellent accountant.

Monkton Accounting Services

- Monkton Business Planning

- Monkton Tax Returns

- Monkton Payroll Services

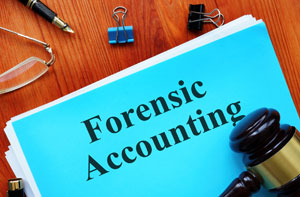

- Monkton Forensic Accounting

- Monkton Self-Assessment

- Monkton Bookkeeping Healthchecks

- Monkton VAT Returns

- Monkton Tax Refunds

- Monkton Business Accounting

- Monkton Specialist Tax

- Monkton Tax Planning

- Monkton Personal Taxation

- Monkton Chartered Accountants

- Monkton PAYE Healthchecks

Also find accountants in: Holmston, Auchairne, Seafield, Dipple, Belston, Low Craighead, Failford, Grimmet, Ballochmorrie, Poundland, Adamhill, Prestwick, Fisherton, Coodham, Glendrissaig, Dowhill, Minishant, Kirkmichael, Barrhill, Cloyntie, Carleton Fishery, Aldons, Barr, Auchincruive, Culroy, Pinminnoch, Monkton, Chapeldonan, Dalreoch, Nether Auchendrane, Symington, New Prestwick, Gass, Sauchrie, Craigneil and more.

Accountant Monkton

Accountant Monkton Accountants Near Monkton

Accountants Near Monkton Accountants Monkton

Accountants MonktonMore South Ayrshire Accountants: Prestwick Accountants, Ayr Accountants, Troon Accountants, Girvan Accountants and Maybole Accountants.

Chartered Accountants Monkton - Tax Return Preparation Monkton - Financial Advice Monkton - Cheap Accountant Monkton - Bookkeeping Monkton - Financial Accountants Monkton - Online Accounting Monkton - Investment Accounting Monkton - Self-Assessments Monkton