Finding an Accountant in York: If you have your own small business or are a self-employed person in York, North Yorkshire, you'll soon discover that there are lots of benefits to be gained from using a professional accountant. At the minimum your accountant can manage important tasks like doing your tax returns and keeping your books up to date, giving you more time to concentrate on your business. This could be particularly vital if you're a start-up business or even if you are just planning to set up a business. This sort of expert help will enable your York business to prosper and grow.

Obtaining an accountant in York is not always that simple with various kinds of accountants available. Check that any prospective York accountant is suitable for what you need. Whether you use an accountant working within a larger accounting practice or one working on their own is your choice to make. Each field of accounting will have their own specialists within an accounting firm. The types of accountant you're likely to find within a practice could include: auditors, actuaries, chartered accountants, cost accountants, investment accountants, financial accountants, bookkeepers, accounting technicians, forensic accountants, tax preparation accountants and management accountants.

Find yourself a properly qualified one and don't take any chances. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. It is worth paying a little more for that extra peace of mind. It should go without saying that accountants fees are tax deductable. Sole traders and smaller businesses might get away with using a bookkeeper.

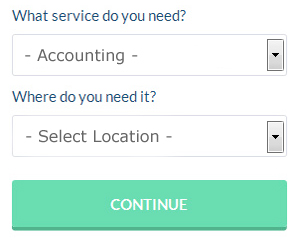

There is an online company called Bark who will do much of the work for you in finding an accountant in York. You'll be presented with a simple form which can be completed in a minute or two. In no time at all you will get messages from accountants in the York area.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. A number of self-employed people in York prefer to use this simple and convenient alternative. There is no reason why this type of service will not prove to be as good as your average High Street accountant. The better ones can soon be singled out by carefully studying reviews online. Sorry but we cannot recommend any individual service on this website.

If you really want the best you could go with a chartered accountant. Their usual clients are big businesses and large limited companies. So, these are your possible options.

The most cost effective method of all is to do it yourself. The process can be simplified even further by the use of software such as 123 e-Filing, Taxforward, Forbes, Sage, Taxfiler, Xero, Nomisma, GoSimple, Capium, CalCal, TaxCalc, Gbooks, Taxshield, Andica, BTCSoftware, Basetax, Ajaccts, Ablegatio, Keytime, Absolute Topup or ACCTAX. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time. You�ll get a penalty of £100 if your tax return is up to 3 months late.

Small Business Accountant York

Managing a small business in York is stressful enough, without needing to fret about preparing your accounts and other bookkeeping duties. A decent small business accountant in York will offer you a hassle-free approach to keep your annual accounts, VAT and tax returns in the best possible order.

A responsible small business accountant will consider it their responsibility to help your business grow, supporting you with good guidance, and giving you peace of mind and security concerning your financial situation at all times. The capricious and complex world of business taxation will be clearly explained to you so as to minimise your business expenses, while at the same time improving tax efficiency.

It is crucial that you clarify your future plans, the structure of your business and your current financial situation truthfully to your small business accountant. (Tags: Small Business Accounting York, Small Business Accountant York, Small Business Accountants York).

Payroll Services York

For any business in York, from large scale organisations down to independent contractors, payrolls for staff can be stressful. Managing company payrolls demands that all legal obligations in relation to their timing, accuracy and transparency are observed to the finest detail.

All small businesses don't have the help that a dedicated financial specialist can provide, and the easiest way to handle employee pay is to use an outside York accountant. The accountant dealing with payrolls will work with HMRC and pension scheme administrators, and set up BACS transfers to ensure accurate and timely payment to all staff.

Adhering to current regulations, a qualified payroll management accountant in York will also provide each of your staff members with a P60 tax form after the end of each financial year. A P45 tax form should also be provided for any employee who finishes working for your business, according to the current regulations.

Proper Money Management for Improving Your Business and Yourself

Business owners, especially the new ones, will find it a struggle to manage their money properly in the early stages of their business. When you're managing your finances poorly, your confidence in yourself might go down, especially when your business isn't being as profitable as you'd hope. This could actually make you feel like giving up and returning to your old job. When this happens, it stops you from achieving the kind of success you want for yourself and your business. Below are a few tips that will help manage your business finances better.

It could be that you use your credit card to pay many of your regular expenditures like web hosting, recurring membership fees, advertising accounts, and so on. This can certainly help your memory because you only have one payment to make each month instead of several. Of course, credit cards are tricky things, and if you let yourself carry a balance, the interest charges could make you pay a lot more money than you would have spent by simply paying the fees straight out of your bank account. Sure, you can keep putting your monthly expenditures on your credit card, but if you do, you should pay the balance in full each month. In addition to making it simpler for you to pay your expenses and avoid paying interest, you're building your credit rating.

Even if you are a sole proprietor, you can still give yourself a salary and a regular paycheck. This will actually help you organize and manage your business and personal finances better. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. How much should you pay yourself? It's up to you. Your salary can be a portion of how much your business brought in for the month or it can be based on how many hours you worked.

Do not forget to pay your taxes on time. Generally, taxes must be paid quarterly by small business owners. It's not that easy to navigate through all the tax laws you need to follow, especially when you're a small business owner, so you're better off getting in touch with the IRS or your local small business center for the most current information. You also have the option of working with a professional who can set up payment plans for you so you're sure that you're abiding by taxation laws and regulations. It's not at all a pleasant experience having the IRS chasing after you for tax evasion.

When you're in business, there are plenty of opportunities for you to improve yourself in the process. Having a business can help you hone your money management skills. Everyone can use help in learning how to manage money better. Your self-confidence can be given a huge boost when you learn how to manage your money properly. It also helps you organize many areas of your life both personally and professionally. Keep in mind the money management tips we shared in this article. Keep applying them to your business and you'll soon see much success.

York accountants will help with litigation support, PAYE, payslips, tax investigations, accounting support services, general accounting services, VAT returns, partnership accounts, HMRC submissions, debt recovery, pension planning, audit and compliance reports, capital gains tax, taxation accounting services, corporate finance, employment law, National Insurance numbers, financial planning, mergers and acquisitions, sole traders, HMRC liaison, partnership registrations, business outsourcing, cashflow projections, charities, assurance services, bookkeeping, consultancy and systems advice, tax preparation, annual tax returns, estate planning, accounting and financial advice and other kinds of accounting in York, North Yorkshire.

York Accounting Services

- York Tax Advice

- York PAYE Healthchecks

- York Business Accounting

- York Tax Returns

- York Chartered Accountants

- York Self-Assessment

- York Business Planning

- York Audits

- York Debt Recovery

- York Specialist Tax

- York Forensic Accounting

- York Tax Services

- York Personal Taxation

- York Bookkeeping Healthchecks

Also find accountants in: Nunthorpe, Newland, Enterpen, High Shaw, Sneatonthorpe, Ramsgill, Church Fenton, Croft On Tees, Rookwith, West Stonesdale, Fairburn, Pannal, Kirkby Malzeard, Great Habton, Greenhow Hill, Grewelthorpe, Thorlby, Healey, Nosterfield, Great Edstone, Muscoates, Scawton, Beck Hole, Silpho, Burnt Yates, Bishop Thornton, Cloughton Newlands, Newton Kyme, Nidd, Barlow, South Duffield, Irton, West Lutton, Nappa, High Bentham and more.

Accountant York

Accountant York Accountants Near York

Accountants Near York Accountants York

Accountants YorkMore North Yorkshire Accountants: Selby Accountants, Knaresborough Accountants, Middlesbrough Accountants, Acomb Accountants, Whitby Accountants, Norton Accountants, Ripon Accountants, Scarborough Accountants, Northallerton Accountants, Skipton Accountants, York Accountants, Richmond Accountants and Harrogate Accountants.

Financial Accountants York - Small Business Accountants York - Tax Return Preparation York - Affordable Accountant York - Financial Advice York - Auditing York - Chartered Accountants York - Online Accounting York - Self-Assessments York