Finding an Accountant in Weldon: Completing your annual self-assessment form can be something of a headache. You are not alone in Weldon if this problem affects you every year. Is tracking down a local Weldon accountant to do this for you a better alternative? Do you find self-assessment way too confusing? A run of the mill accountant or bookkeeper in Weldon is likely to charge you a ball park figure of £200-£300 for the completion of your self-assessment. Online accounting services are available more cheaply than this.

But exactly what will you have to pay, what standard of service should you expect to receive and where can you locate the best individual? The use of your preferred internet search engine should soon provide you with a shortlist of possibles. But, are they all trustworthy? It is always worthwhile considering that it is possible for virtually any Weldon individual to advertise themselves as a bookkeeper or accountant. No formal qualifications are legally required in order to do this.

To get the job done correctly you should search for a local accountant in Weldon who has the right qualifications. Your minimum requirement should be an AAT qualified accountant. Qualified accountants in Weldon might cost more but they will do a proper job. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs.

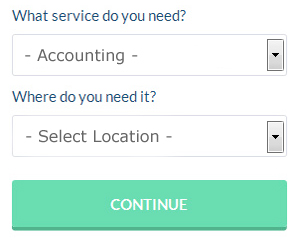

Though you may not have heard of them before there is an online service called Bark who can help you in your search. You will quickly be able to complete the form and your search will begin. Then you just have to wait for some prospective accountants to contact you. Make the most of this service because it is free.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. A number of self-employed people in Weldon prefer to use this simple and convenient alternative. Choose a company with a history of good service. It should be a simple task to find some online reviews to help you make your choice. We are unable to advocate any individual accounting services on this site.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Xero, Andica, GoSimple, BTCSoftware, Taxforward, Keytime, TaxCalc, Nomisma, Absolute Topup, CalCal, ACCTAX, Basetax, Ajaccts, Capium, Ablegatio, Gbooks, Taxfiler, Forbes, 123 e-Filing, Taxshield and Sage. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Auditors Weldon

An auditor is a company or person authorised to review and authenticate the correctness of financial records and ensure that businesses comply with tax legislation. Auditors evaluate the financial actions of the company which employs them and make certain of the constant running of the organisation. Auditors need to be accredited by the regulatory body for accounting and auditing and also have the required qualifications. (Tags: Auditor Weldon, Auditors Weldon, Auditing Weldon)

Forensic Accounting Weldon

Whilst conducting your search for a qualified accountant in Weldon there is a pretty good chance that you will stumble upon the term "forensic accounting" and be wondering what it is, and how it differs from regular accounting. The clue for this is the actual word 'forensic', which basically means "relating to or denoting the application of scientific techniques and methods to the investigation of criminal activity." Also known as 'financial forensics' or 'forensic accountancy', it uses accounting, investigative skills and auditing to discover inconsistencies in financial accounts which have contributed to fraud or theft. Some of the bigger accountancy companies in and near Weldon have even got specialist divisions dealing with personal injury claims, professional negligence, false insurance claims, tax fraud, bankruptcy, money laundering and insolvency. (Tags: Forensic Accountants Weldon, Forensic Accountant Weldon, Forensic Accounting Weldon)

Actuaries Weldon

An actuary measures, gives advice on and manages financial and monetary risks. An actuary applies statistical and financial theories to analyse the possibility of a particular event taking place and the potential financial ramifications. To work as an actuary it is essential to possess a mathematical, economic and statistical understanding of everyday scenarios in the financial world. (Tags: Actuary Weldon, Financial Actuaries Weldon, Actuaries Weldon)

Small Business Accountants Weldon

Ensuring your accounts are accurate can be a stressful job for anyone running a small business in Weldon. Retaining a small business accountant in Weldon will enable you to operate your business knowing that your annual accounts, VAT and tax returns, among many other business tax requirements, are being fully met.

Helping you to develop your business, and giving financial advice relating to your particular circumstances, are just a couple of the means by which a small business accountant in Weldon can benefit you. A quality accounting firm in Weldon should be able to offer you proactive small business guidance to optimise your tax efficiency while lowering business expenditure; essential in the sometimes murky field of business taxation.

It is critical that you clarify your company's financial circumstances, the structure of your business and your plans for the future truthfully to your small business accountant.

Proper Money Management for Improving Your Business and Yourself

If you're a new business owner, you'll discover that managing your money properly is one of those things you will struggle with sooner or later. Your confidence can plummet if you fail to manage your money properly. If your business experience cash flow problems, you might find yourself thinking about throwing in the towel and going back to your old job. When this happens, it stops you from achieving the kind of success you want for yourself and your business. To help you in properly managing your money, follow these tips.

It's certainly tempting to wait until the last minute to pay your taxes, but you're actually playing with fire here, especially if you're not good at money management. When your taxes are due, you may not have any money to actually pay them. You can save yourself the headache by putting a portion of each payment you get in a separate account. Do this and you'll never have to worry where to get the money to pay your taxes every quarter because you've already got it saved. It's extremely satisfying when you know you have the ability to pay the taxes you owe fully and promptly.

Each week, balance your books. However, you should balance your books at the end of business day every day if what you have is a traditional store with cash registers or takes in multiple payments throughout the day every day. You need to keep track of all the payments you receive and payments you make out and make sure that the cash you have on hand or in your bank account matches with the numbers in your record. This way you won't have to track down a bunch of discrepancies at the end of the month (or quarter). Besides, it will only take you a few minutes if you balance your books regularly, whereas if you balance your books once a month, that would take you hours to do.

If you receive cash payments, it's a good idea to deposit it to your bank account daily or as soon as you can to eliminate the temptation. If you know you have cash available, you're a lot more likely to dip into your money pool for unexpected expenses and just promise yourself you'll return the money back in a couple of days. You're bound to forget about it, though, and this will only mess your accounting and bookkeeping. So avoid this problem altogether by depositing your cash in the bank at the end of each business day.

Even if you don't have your own business, you'll still benefit from learning how to manage your money properly. Your confidence and your business will sure be given a huge boost if you become skilled at managing your finances properly. You can get started with the money management tips we've shared. When you take the time to learn how to properly manage money, you'll get the benefit of having a successful business and a higher confidence level.

Weldon accountants will help with consulting services Weldon, year end accounts, payslips, bookkeeping in Weldon, self-employed registrations, VAT returns, company formations, cashflow projections Weldon, accounting services for buy to let rentals, contractor accounts in Weldon, pension forecasts, inheritance tax, limited company accounting, company secretarial services, litigation support, charities in Weldon, estate planning, compliance and audit reporting, partnership accounts Weldon, business support and planning, debt recovery, financial statements Weldon, business advisory services, business start-ups, PAYE Weldon, double entry accounting, investment reviews Weldon, accounting services for the construction industry, tax investigations, annual tax returns, accounting services for media companies Weldon, tax preparation Weldon and other forms of accounting in Weldon, Northamptonshire. These are just a few of the tasks that are conducted by local accountants. Weldon providers will inform you of their full range of accountancy services.

With the world wide web as an unlimited resource it is of course very easy to uncover lots of useful information and ideas about self-assessment help, accounting & auditing, personal tax assistance and accounting for small businesses. For example, with a very quick search we located this super article outlining how to track down a top-notch accountant.

Weldon Accounting Services

- Weldon Payroll Services

- Weldon Chartered Accountants

- Weldon Bookkeeping

- Weldon VAT Returns

- Weldon Audits

- Weldon Debt Recovery

- Weldon PAYE Healthchecks

- Weldon Taxation Advice

- Weldon Tax Refunds

- Weldon Forensic Accounting

- Weldon Specialist Tax

- Weldon Tax Returns

- Weldon Business Accounting

- Weldon Business Planning

Also find accountants in: Blatherwycke, Denton, Piddington, Guilsborough, Upton, Chelveston, Irchester, Preston Deanery, Eastcote, Nether Heyford, Chacombe, Bozeat, Brigstock, Quinton, Deene, Woodend, Weedon Lois, Thorpe Waterville, Cotterstock, Helmdon, Spratton, Yardley Gobion, Evenley, Kilsby, Orton, Thrapston, Woodnewton, Flore, Glapthorn, Hardwick, Moulton, Kettering, Litchborough, Hemington, Hinton In The Hedges and more.

Accountant Weldon

Accountant Weldon Accountants Near Weldon

Accountants Near Weldon Accountants Weldon

Accountants WeldonMore Northamptonshire Accountants: Northampton Accountants, Wellingborough Accountants, Brackley Accountants, Higham Ferrers Accountants, Rushden Accountants, Towcester Accountants, Wootton Accountants, Rothwell Accountants, Daventry Accountants, Duston Accountants, Desborough Accountants, Raunds Accountants, Kettering Accountants, Irthlingborough Accountants, Burton Latimer Accountants and Corby Accountants.

Investment Accounting Weldon - Financial Advice Weldon - Tax Return Preparation Weldon - Online Accounting Weldon - Tax Advice Weldon - Financial Accountants Weldon - Affordable Accountant Weldon - Chartered Accountant Weldon - Self-Assessments Weldon