Finding an Accountant in Shalford: You can eliminate some of the stress of running a business in Shalford, by retaining the expert services of a qualified accountant. Bookkeeping takes up valuable time that you can ill afford to waste, therefore having an accountant deal with this allows you to put more effort into the primary business. The importance of getting this type of financial help cannot be overstated, particularly for start-ups and fledgling businesses who are not yet established.

Your next job will be to search for a local Shalford accountant who you can depend on to do a good job of your books. Any decent quality internet search engine will quickly provide a lengthy list of local Shalford accountants, who'll be happy to help with your books. Though, making certain that you choose an accountant that you can trust may not be so straightforward. The sad truth is that anyone in Shalford can promote their services as an accountant. They aren't required by law to hold any specific qualifications.

It is advisable for you to find an accountant in Shalford who is properly qualified. Membership of the AAT shows that they hold the minimum recommended qualification. A qualified accountant may cost a little more but in return give you peace of mind. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction. Sole traders in Shalford may find that qualified bookkeepers are just as able to do their tax returns.

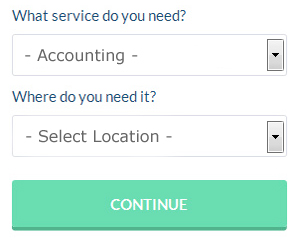

You could use an online service like Bark who will help you find an accountant. In no time at all you can fill out the job form and submit it with a single click. As soon as this form is submitted, your requirements will be forwarded to local accountants.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. This may save time and be more cost-effective for self-employed people in Shalford. Do a bit of research to find a reputable company. Study reviews and customer feedback.

At the top of the tree are chartered accountants, these professionals have all the qualifications and are experts in their field. Their services are normally required by larger limited companies and big business. This widens your choice of accountants.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. A lot of software programs have been developed in recent years to help people do their own self assessment returns. Among the best known are Forbes, Ablegatio, Keytime, Taxforward, ACCTAX, Capium, TaxCalc, GoSimple, Gbooks, Andica, Taxshield, BTCSoftware, Nomisma, Sage, Ajaccts, Taxfiler, Absolute Topup, CalCal, 123 e-Filing, Xero and Basetax. Don't leave your self-assessment until the last minute, allow yourself plenty of time. You can expect a fine of £100 if your assessment is in even 1 day late.

Forensic Accounting Shalford

While engaged on your search for an established accountant in Shalford there's a good likelihood that you will stumble upon the term "forensic accounting" and be curious about what it is, and how it differs from regular accounting. With the actual word 'forensic' meaning literally "appropriate for use in a court of law", you should get an idea as to what is involved. Also often known as 'forensic accountancy' or 'financial forensics', it uses accounting, auditing and investigative skills to identify inconsistencies in financial accounts which have lead to theft or fraud. Some of the larger accountancy companies in and around Shalford even have specialist divisions addressing money laundering, falsified insurance claims, professional negligence, insolvency, bankruptcy, tax fraud and personal injury claims.

Actuaries Shalford

Actuaries and analysts are specialists in risk management. Actuaries apply their mathematical expertise to gauge the probability and risk of future occurrences and to predict their financial effect on a business and their customers. Actuaries supply judgements of financial security systems, with an emphasis on their complexity, their mathematics, and their mechanisms. (Tags: Actuary Shalford, Financial Actuaries Shalford, Actuaries Shalford)

Small Business Accountants Shalford

Making certain your accounts are accurate and up-to-date can be a challenging task for anyone running a small business in Shalford. Retaining a small business accountant in Shalford will allow you to run your business safe in the knowledge that your tax returns, VAT and annual accounts, and various other business tax requirements, are being met.

An experienced small business accountant in Shalford will consider that it is their responsibility to develop your business, and offer you reliable financial guidance for peace of mind and security in your unique situation. The vagaries and often complicated sphere of business taxation will be clearly explained to you in order to lower your business costs, while at the same time maximising tax efficiency.

It is vital that you clarify your plans for the future, your company's circumstances and the structure of your business truthfully to your small business accountant. (Tags: Small Business Accounting Shalford, Small Business Accountant Shalford, Small Business Accountants Shalford).

Practicing Better Money Management to Help Your Business Succeed

If you've just launched your business, you'll find out soon enough that properly using money management strategies is not that easy to learn. Money management seems like one of those things that you should have the ability to do already. The reality, however, is that budgeting and financial planning for your business is a lot different from budgeting and financial planning for your personal life. It does help a lot if you have some experience in the latter. Your confidence can take a hard hit if you ruin your finances on accident. There are many things you can do to properly manage business finances and we'll share just a few of them in this article.

Start numbering your invoice. This may not be that big of a deal to you right now, but you'll thank yourself later on if you implement this tip early on in your business. Numbering your invoices helps you keep track of them. Not only will it help you find out quickly enough who has already paid their invoices, it will help you find out who still owes you and how much. There will be times when a client will tell you that his invoice is all paid up and this can be easily resolved if you have a numbered invoice. In business, errors will happen and numbered invoices is one simple strategy to identify those problems when they take place.

Make it a habit to balance your books every week. However, if you have a traditional store where you have cash registers or you've got many payments from different people coming in, you may have to do the book balancing at the end of each day. You need to keep track of all the payments you receive and payments you make out and make sure that the cash you have on hand or in your bank account matches with the numbers in your record. This will save you the trouble of tracking down discrepancies each month or each quarter. Besides, it will only take you a few minutes if you balance your books regularly, whereas if you balance your books once a month, that would take you hours to do.

f your business deals with cash all the time, you're better off depositing money to your bank account at the end of each business day. Doing so will help you avoid being tempted to use any cash you have on hand for unnecessary expenses. It could be that you need cash when you're out for lunch and you end up getting money from your register and telling yourself you'll return the money later. But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. Put your cash in the bank at the end of every work day.

Not only does learning how to properly manage your money help you improve yourself, it helps improve your business too. Try to implement these tips we've shared because you stand to benefit in the long run. You're in a much better position for business and personal success when you know how to manage your finances better.

Shalford accountants will help with tax investigations in Shalford, compliance and audit issues, assurance services Shalford, annual tax returns, accounting services for media companies, partnership registrations, business acquisition and disposal in Shalford, VAT returns, double entry accounting, charities, business advisory services Shalford, bookkeeping, pension planning in Shalford, consulting services, management accounts in Shalford, investment reviews, corporate tax in Shalford, estate planning Shalford, company secretarial services, accounting services for the construction sector in Shalford, capital gains tax, litigation support Shalford, company formations in Shalford, accounting services for landlords in Shalford, National Insurance numbers in Shalford, corporate finance Shalford, financial and accounting advice, personal tax, workplace pensions, contractor accounts, HMRC liaison, financial planning and other professional accounting services in Shalford, Surrey. Listed are just a handful of the activities that are accomplished by nearby accountants. Shalford specialists will be delighted to keep you abreast of their full range of services.

You do, of course have the perfect resource close at hand in the form of the world wide web. There is so much inspiration and information available online for stuff like self-assessment help, accounting & auditing, accounting for small businesses and personal tax assistance, that you will pretty soon be overwhelmed with ideas for your accounting requirements. An illustration may be this compelling article describing five tips for locating a good accountant.

Shalford Accounting Services

- Shalford Bookkeeping

- Shalford Personal Taxation

- Shalford Tax Services

- Shalford Audits

- Shalford PAYE Healthchecks

- Shalford Business Planning

- Shalford Tax Refunds

- Shalford Tax Planning

- Shalford Self-Assessment

- Shalford Taxation Advice

- Shalford Business Accounting

- Shalford Account Management

- Shalford Forensic Accounting

- Shalford Financial Advice

Also find accountants in: Laleham, Frensham, Old Woking, Thorpe, Byfleet, Seale, Loxhill, Sutton Green, Englefield Green, Albury, Bowlhead Green, Stroud Common, Upper Halliford, Whiteley Village, Wonersh, West Byfleet, Hambledon, Ramsnest Common, Holland, Farley Green, Reigate, Gomshall, Doversgreen, Brook, Headley, Bagshot, Sidlowbridge, Abinger Hammer, Albury Heath, Chobham, Ewell, Grafham, Dormansland, Lythe Hill, Buckland and more.

Accountant Shalford

Accountant Shalford Accountants Near Shalford

Accountants Near Shalford Accountants Shalford

Accountants ShalfordMore Surrey Accountants: Haslemere Accountants, Reigate Accountants, Epsom Accountants, Weybridge Accountants, Hersham Accountants, Banstead Accountants, Woking Accountants, Staines Accountants, Caterham Accountants, Guildford Accountants, Redhill Accountants, Ewell Accountants, Dorking Accountants, Windlesham Accountants, Addlestone Accountants, Walton-on-Thames Accountants, Horley Accountants, Leatherhead Accountants, Farnham Accountants, Ash Accountants, Camberley Accountants, Chertsey Accountants and Godalming Accountants.

Financial Advice Shalford - Auditors Shalford - Online Accounting Shalford - Self-Assessments Shalford - Financial Accountants Shalford - Small Business Accountants Shalford - Investment Accountant Shalford - Bookkeeping Shalford - Tax Return Preparation Shalford