Finding an Accountant in Stamford Hill: If you have your own small business or are a sole trader in Stamford Hill, Greater London, you'll soon realise that there are several advantages to be gained from using a professional accountant. Among the many benefits are the fact that you should have more time to focus on core business activities whilst routine and time consuming bookkeeping can be confidently handled by your accountant. For those who have just started in business it may be vitally important to have somebody at hand who can provide financial advice.

So, how do you go about acquiring a reliable Stamford Hill accountant? A list of potential Stamford Hill accountants can be highlighted with just a few seconds searching the internet. But, are they all trustworthy? The fact that somebody in Stamford Hill claims to be an accountant is no real guarantee of quality. They are not required by law to hold any particular qualifications.

You would be best advised to find a fully qualified Stamford Hill accountant to do your tax returns. The recommended minimum qualification you should look for is an AAT. You can then be sure your tax returns are done correctly. Accounting fees are of course a business expense and can be included as such on your tax return.

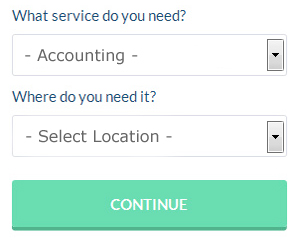

There is a unique online website called Bark which will actually find you a choice of accountants in the Stamford Hill area. You only need to answer a few basic questions and complete a straightforward form. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment. At the time of writing this service was totally free.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. It could be that this solution will be more appropriate for you. There is no reason why this type of service will not prove to be as good as your average High Street accountant. A quick browse through some reviews online should give you an idea of the best and worse services. We prefer not to recommend any particular online accounting company here.

The cheapest option of all is to do your own self-assessment form. Using accounting software like GoSimple, Keytime, Forbes, Andica, Capium, Ajaccts, 123 e-Filing, Gbooks, Ablegatio, ACCTAX, Taxfiler, Basetax, Absolute Topup, CalCal, TaxCalc, Taxshield, Sage, Taxforward, Xero, BTCSoftware or Nomisma will make it even simpler to do yourself. You should get paperwork to your accountant promptly so that your tax returns can be prepared with time to spare. Self-assessment submissions up to three months late receive a £100 fine, with further fines for extended periods.

Forensic Accounting Stamford Hill

While engaged on your search for a professional accountant in Stamford Hill there's a fair chance that you will stumble upon the term "forensic accounting" and be wondering what that is, and how it is different from normal accounting. The actual word 'forensic' is the thing that gives a clue, meaning literally "denoting or relating to the application of scientific techniques and methods for the investigation of criminal activity." Also called 'forensic accountancy' or 'financial forensics', it uses investigative skills, accounting and auditing to identify inaccuracies in financial accounts which have resulted in theft or fraud. Some of the larger accountancy companies in and near Stamford Hill even have specialist departments addressing insurance claims, professional negligence, tax fraud, money laundering, personal injury claims, insolvency and bankruptcy.

Small Business Accountants Stamford Hill

Managing a small business in Stamford Hill is fairly stressful, without needing to worry about your accounts and other bookkeeping duties. A dedicated small business accountant in Stamford Hill will provide you with a hassle-free approach to keep your annual accounts, VAT and tax returns in the best possible order.

A good small business accountant will consider it their duty to help your business to develop, supporting you with sound guidance, and providing you with security and peace of mind about your financial situation at all times. The capricious and complicated field of business taxation will be clearly laid out for you in order to reduce your business costs, while maximising tax efficiency.

To be able to do their job effectively, a small business accountant in Stamford Hill will have to know precise details with regards to your present financial situation, business structure and any possible investment you may be thinking about, or already have put in place. (Tags: Small Business Accountant Stamford Hill, Small Business Accounting Stamford Hill, Small Business Accountants Stamford Hill).

Payroll Services Stamford Hill

An important aspect of any business enterprise in Stamford Hill, big or small, is having an accurate payroll system for its staff. The regulations regarding payrolls and the legal obligations for transparency and accuracy means that handling a business's payroll can be a daunting task.

A small business may well not have the advantage of its own financial specialist and the simplest way to work with staff payrolls is to use an independent payroll company in Stamford Hill. A managed payroll service accountant will work with HMRC, work with pensions providers and oversee BACS payments to guarantee that your personnel are always paid promptly, and all mandatory deductions are accurate.

It will also be necessary for a payroll management company in Stamford Hill to prepare a P60 declaration for each worker at the end of the financial year (by May 31st). At the end of a staff member's contract, the payroll accountant must also provide an updated P45 form relating to the tax paid during the last financial period.

How Proper Money Management Helps Your Business and Yourself

Starting your own business is exciting, and this is true whether you are starting this business online or offline. When you're your own boss, you get to be in charge of basically everything. Now that can be a little scary! In addition to the excitement of being your own boss, it can be a bit intimidating particularly if you have no business experience. It then pays to be aware of a few self-improvement strategies like knowing how to manage finances the proper way. In this article, we'll share a few tips proper money management.

Putting your regular expenditures like recurring dues for membership sites, web hosting, and so on, on your credit card can be a good idea. Instead of having to pay many separate bills, you only have to pay your credit card bill each month. But beware of credit cards. If you keep a balance there every month, you're going to be paying interest and it can actually cost you more than if you just went ahead and paid for your expenses directly from your bank account. You can continue using your credit card to make it easier on you to pay your bills, but make sure you don't carry a balance on your card to avoid accruing interest charges. When you do this, you streamline your process and not have to pay interest. Your credit rating will get a boost in the process.

Balance your books at least once a week. But if your business is one where you use registers or you receive multiple payments every day, it might be better if you balance your books at the end of the day every day. It's important that you keep track of the money coming in and the money you're spending. At the end of each business day or business week, tally it all up and the amount you come up with should match the amount you should have in the bank or on hand. This way you won't have to track down a bunch of discrepancies at the end of the month (or quarter). If you regularly balance your books, you won't need to spend too long a time doing it. If you do it every once in a while, though, it can take hours.

It's a good idea to keep your receipts. You'll save yourself a lot of grief if you've got your receipts with you if ever the IRS wants to see where you've been spending your money on. These receipts are also a record of your business expenditures. Be organized with your receipts and have them together in just one place. This will make it easy for you to track down certain amounts for expenditures you may not recognize in your bank account because you didn't write them down. Keep all your receipts in an accordion file in your desk drawer.

When it comes to managing your money properly, there are so many things that go into it. It doesn't just involve listing the amount you spent and when you spent it. There are different things to keep track of and different ways to track them. With the tips above, you'll have an easier time tracking your money. As you become more skilled in managing your business finances, you'll be able to implement other things that will help make the process easier for you.

Stamford Hill accountants will help with pension forecasts, tax preparation, cashflow projections, business start-ups, general accounting services, consultancy and systems advice Stamford Hill, estate planning, accounting and auditing, taxation accounting services, mergers and acquisitions in Stamford Hill, payslips, monthly payroll, workplace pensions, inheritance tax Stamford Hill, accounting services for media companies, accounting support services in Stamford Hill, company formations Stamford Hill, business planning and support in Stamford Hill, charities Stamford Hill, business disposal and acquisition, year end accounts in Stamford Hill, partnership accounts in Stamford Hill, double entry accounting, self-employed registration, small business accounting, debt recovery, consulting services Stamford Hill, capital gains tax, assurance services Stamford Hill, business outsourcing Stamford Hill, VAT returns, National Insurance numbers and other kinds of accounting in Stamford Hill, Greater London. Listed are just an example of the tasks that are accomplished by nearby accountants. Stamford Hill specialists will keep you informed about their entire range of services.

Stamford Hill Accounting Services

- Stamford Hill PAYE Healthchecks

- Stamford Hill Tax Planning

- Stamford Hill Specialist Tax

- Stamford Hill Tax Returns

- Stamford Hill Bookkeeping Healthchecks

- Stamford Hill Auditing

- Stamford Hill Chartered Accountants

- Stamford Hill Bookkeeping

- Stamford Hill Business Accounting

- Stamford Hill Business Planning

- Stamford Hill Tax Advice

- Stamford Hill Tax Refunds

- Stamford Hill Account Management

- Stamford Hill Self-Assessment

Also find accountants in: Brompton, Lower Clapton, Neasden, Clapham North, Oakwood, Locksbottom, Cockfosters, Lea Bridge, Borough, Belgravia, Longford, North Kensington, Bexley, Colindale, Copthall, Becontree, Sydenham Hill, Notting Hill Gate, Orpington, Upper Clapton, Acton Town, Westminster Bridge, Keston, Mornington Crescent, Highams Park, Islington, Catford, Forest Hill, Dartmouth Park, Old Kent Road, Ruislip, Clapton, Mortlake, Leytonstone, New Kent Road and more.

Accountant Stamford Hill

Accountant Stamford Hill Accountants Near Me

Accountants Near Me Accountants Stamford Hill

Accountants Stamford HillMore Greater London Accountants: Barnet Accountants, Wandsworth Accountants, Enfield Accountants, Brent Accountants, Greenwich Accountants, Hammersmith Accountants, Camden Accountants, Fulham Accountants, Lewisham Accountants, Ealing Accountants, Barking Accountants, Southwark Accountants, Havering Accountants, Haringey Accountants, Islington Accountants, Lambeth Accountants, Redbridge Accountants, Newham Accountants, Hounslow Accountants, Bromley Accountants, Dagenham Accountants, Croydon Accountants, Sutton Accountants, Kensington Accountants, Hackney Accountants, Richmond upon Thames Accountants, Hillingdon Accountants, Harrow Accountants, Merton Accountants, Bexley Accountants, Kingston upon Thames Accountants and Chelsea Accountants.

TOP - Accountants Stamford Hill

Financial Accountants Stamford Hill - Small Business Accountants Stamford Hill - Affordable Accountant Stamford Hill - Bookkeeping Stamford Hill - Chartered Accountant Stamford Hill - Self-Assessments Stamford Hill - Tax Advice Stamford Hill - Investment Accountant Stamford Hill - Auditors Stamford Hill