Finding an Accountant in Rainham: If you've got your own small business or are a self-employed person in Rainham, Kent, you will soon discover that there are lots of benefits to be gained from using a competent accountant. At the minimum your accountant can manage important tasks like doing your tax returns and keeping your books up to date, giving you more time to focus on your business. If you are only just getting started in business you'll find the help of a professional accountant invaluable. A lot of Rainham businesses have been able to prosper through having this sort of expert help.

Different kinds of accountant will be marketing their services in Rainham. Your aim is to choose one that matches your precise requirements. Another decision you'll have to make is whether to go for an accounting company or an independent accountant. Within an accounting business will be experts in distinct areas of accountancy. Most accounting companies will be able to offer: cost accountants, tax accountants, management accountants, investment accountants, forensic accountants, bookkeepers, accounting technicians, auditors, financial accountants, actuaries and chartered accountants.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. A certified Rainham accountant might be more costly than an untrained one, but should be worth the extra expense. You will of course get a tax deduction on the costs involved in preparing your tax returns. A bookkeeper may be qualified enough to do your tax returns unless you are a large Limited Company.

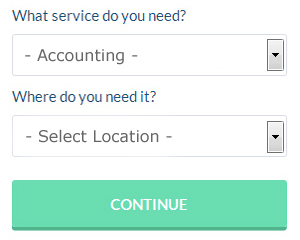

You could use an online service like Bark who will help you find an accountant. You simply answer a few relevant questions so that they can find the most suitable person for your needs. As soon as this form is submitted, your requirements will be forwarded to local accountants.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. The popularity of these services has been increasing in recent years. Some of these companies are more reputable than others. The better ones can soon be singled out by carefully studying reviews online. Apologies, but we do not endorse, recommend or advocate any specific company.

At the end of the day you could always do it yourself and it will cost you nothing but time. Software programs like Keytime, Forbes, Ablegatio, Taxfiler, Basetax, ACCTAX, Nomisma, Taxforward, CalCal, Xero, GoSimple, Andica, Ajaccts, Gbooks, BTCSoftware, Taxshield, TaxCalc, Sage, 123 e-Filing, Capium and Absolute Topup have been developed to help small businesses do their own tax returns. If you don't get your self-assessment in on time you will get fined by HMRC. You will receive a fine of £100 if you are up to three months late with your tax return.

Auditors Rainham

An auditor is an individual or a firm appointed by a company or organisation to perform an audit, which is the official evaluation of the financial accounts, normally by an impartial body. Auditors evaluate the monetary behaviour of the firm that employs them to ensure the steady running of the business. For anyone to become an auditor they need to have certain specific qualifications and be certified by the regulating body for auditing and accounting. (Tags: Auditing Rainham, Auditor Rainham, Auditors Rainham)

Forensic Accountant Rainham

Whilst conducting your search for a certified accountant in Rainham there is a good likelihood that you'll stumble on the expression "forensic accounting" and be curious about what that is, and how it differs from regular accounting. The clue for this is the word 'forensic', which essentially means "relating to or denoting the application of scientific methods and techniques to the investigation of criminal activity." Also called 'financial forensics' or 'forensic accountancy', it uses auditing, accounting and investigative skills to detect discrepancies in financial accounts that have been involved in theft or fraud. Some of the bigger accountancy companies in and around Rainham have even got specialised sections addressing tax fraud, professional negligence, insurance claims, bankruptcy, personal injury claims, money laundering and insolvency. (Tags: Forensic Accountant Rainham, Forensic Accountants Rainham, Forensic Accounting Rainham)

Actuaries Rainham

An actuary is a business expert who deals with the measurement and managing of risk and uncertainty. These risks can impact on both sides of a company's balance sheet and call for professional asset management, valuation and liability management skills. An actuary uses mathematics and statistical concepts to determine the fiscal effect of uncertainty and help customers minimize risks. (Tags: Actuary Rainham, Financial Actuaries Rainham, Actuaries Rainham)

Small Business Accountants Rainham

Operating a small business in Rainham is stressful enough, without having to fret about your accounts and other similar bookkeeping tasks. If your annual accounts are getting you down and VAT and tax return issues are causing you sleepless nights, it would be a good idea to employ a small business accountant in Rainham.

Helping you to improve your business, and giving sound financial advice for your particular circumstances, are just a couple of the means by which a small business accountant in Rainham can benefit you. A decent accounting firm in Rainham will give proactive small business advice to optimise your tax efficiency while reducing costs; crucial in the sometimes shady sphere of business taxation.

You should also be offered a dedicated accountancy manager who has a good understanding of your company's circumstances, your business structure and your future plans.

Payroll Services Rainham

Staff payrolls can be a complicated part of running a business enterprise in Rainham, no matter its size. The laws relating to payroll requirements for accuracy and transparency mean that processing a business's payroll can be an intimidating task.

Using a reputable accountant in Rainham, to handle your payroll is the easiest way to lessen the workload of your own financial department. The accountant dealing with payrolls will work with HMRC and pension scheme administrators, and oversee BACS payments to ensure accurate and timely wage payment to all employees.

It will also be necessary for a payroll management service in Rainham to prepare an accurate P60 declaration for each employee at the end of the financial year (by 31st May). Upon the termination of a staff member's contract, the payroll company will provide an updated P45 outlining what tax has been paid in the previous financial period.

Learning the Top Money Management Strategies for Business Success

One of the hardest aspects of starting a business is learning the proper use of money management strategies. You may be thinking that money management is something that you should already be able to do. Personal money management, however, is completely different from business money management, although being experienced in the former can be handy when you go into business. Your self-confidence could very well take a huge dive should you accidentally ruin your business finances. Keep reading to learn some of the things that you can do to practice better money management for your business.

Implement a numbering system for your invoices. This may not be that big of a deal to you right now, but you'll thank yourself later on if you implement this tip early on in your business. When your invoices are numbered, you won't have a difficult time tracking things down. You'll be able to easily track who has paid you and who still owes you. There are going to come times when a client will insist that he has paid you and having a numbered invoice to look up can be very helpful in that situation. It's so much easier to find errors in your invoicing too if you have an invoicing system in place.

Track your personal and business expenditures down to the last cent. Yes, it is a pain to track every little thing you buy, but it is quite helpful. This way, you'll be able to see your spending habits. No one likes to have that feeling of "I'm making decent money, but where is it?" When you write all your personal and business expenditures, you won't ever have to wonder where your money is going. And when you're creating a budget, you can pinpoint those places where you're spending unnecessarily, cut back on them, and save yourself money in the process. You're also streamlining things when you're completing your tax forms when you have a complete, detailed record of your business and personal expenditures.

Keep a tight lid on your spending. It's certainly very tempting to start buying things you've always wanted when the money is coming in. You should, however, spend money on things that will benefit your business. Also, it's better if you build your business savings. This way, should unexpected expenses crop up, you'll be able to deal with it in a timely manner. Buy your office supplies in bulk. For computers, it's better if you spend money on a more expensive, but reliable system that will last for many years and won't need replaced every so often. Avoid spending too much on your entertainment as well; be moderate instead.

As a business owner, you can practice self-improvement in many ways. Managing your money is one of those things. Who doesn't wish they weren't better at managing their money? Learning how to manage, plan a budget your money can do quite a lot for your confidence. In addition, it becomes easier to organize most areas of your professional and personal life. We've shared some tips for better money management for your small business in this article, and as you work and learn, you'll come up with plenty of others.

Rainham accountants will help with consulting services, PAYE, debt recovery, HMRC liaison, accounting services for the construction industry, accounting services for buy to let rentals, company secretarial services Rainham, annual tax returns Rainham, consultancy and systems advice, limited company accounting, corporate finance in Rainham, HMRC submissions, estate planning Rainham, VAT registration, pension forecasts, bureau payroll services, business outsourcing, partnership registration in Rainham, assurance services in Rainham, employment law in Rainham, accounting services for start-ups, accounting services for media companies, business acquisition and disposal, workplace pensions in Rainham, partnership accounts in Rainham, investment reviews in Rainham, accounting support services, tax investigations, cashflow projections, inheritance tax in Rainham, financial statements in Rainham, accounting and financial advice and other kinds of accounting in Rainham, Kent. These are just a selection of the duties that are carried out by nearby accountants. Rainham companies will be delighted to keep you abreast of their entire range of accountancy services.

Rainham Accounting Services

- Rainham Financial Audits

- Rainham Personal Taxation

- Rainham Self-Assessment

- Rainham VAT Returns

- Rainham Financial Advice

- Rainham Bookkeeping Healthchecks

- Rainham Forensic Accounting

- Rainham Chartered Accountants

- Rainham Tax Planning

- Rainham PAYE Healthchecks

- Rainham Tax Services

- Rainham Specialist Tax

- Rainham Auditing Services

- Rainham Account Management

Also find accountants in: Oversland, West Cliffe, Kingston, West Farleigh, Rodmersham, Monkton, Farthingloe, Nettlestead, Edenbridge, Folkestone, Winchet Hill, West End, Clapham Hill, Bonnington, Ashford, Sissinghurst, Harrietsham, Kingsnorth, Eastry, Westwell, Halstead, Wingmore, Crundale, Curteis Corner, Paddock Wood, Maypole, Brenzett, Matfield, Newington, Sevenoaks, Guston, Densole, Coxheath, Chart Corner, Cobham and more.

Accountant Rainham

Accountant Rainham Accountants Near Me

Accountants Near Me Accountants Rainham

Accountants RainhamMore Kent Accountants: East Malling Accountants, Tonbridge Accountants, Royal Tunbridge Wells Accountants, Folkestone Accountants, Sittingbourne Accountants, Faversham Accountants, Dartford Accountants, Dover Accountants, Margate Accountants, Hythe Accountants, Southborough Accountants, Ashford Accountants, Canterbury Accountants, Gravesend Accountants, Minster-on-Sea Accountants, Aylesford Accountants, Deal Accountants, Ramsgate Accountants, Broadstairs Accountants, Maidstone Accountants, Sevenoaks Accountants and Swanley Accountants.

Bookkeeping Rainham - Cheap Accountant Rainham - Online Accounting Rainham - Small Business Accountants Rainham - Chartered Accountant Rainham - Investment Accounting Rainham - Financial Advice Rainham - Financial Accountants Rainham - Tax Advice Rainham