Finding an Accountant in North Hill: Does filling in your yearly self-assessment form put your head in a spin? Plenty of folks in North Hill and throughout the British Isles have to cope with this each year. But is there a simple way to find a local North Hill accountant to accomplish this task for you? Is self-assessment just a little too complicated for you? A regular North Hill accountant will probably charge around £200-£300 for filling in these forms. You can definitely get it done more cheaply by using online services.

You might be confused when you find that accountants don't just do tax returns, they have many different duties. Choosing the right one for your company is vital. You may prefer to pick one that works independently or one within a company or practice. Accounting firms will have experts in each specific accounting department. With an accounting company you will have a pick of: financial accountants, bookkeepers, management accountants, chartered accountants, forensic accountants, investment accountants, tax preparation accountants, auditors, actuaries, costing accountants and accounting technicians.

Therefore you should check that your chosen North Hill accountant has the appropriate qualifications to do the job competently. The AAT qualification is the minimum you should look for. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. Make sure that you include the accountants fees in your expenses, because these are tax deductable.

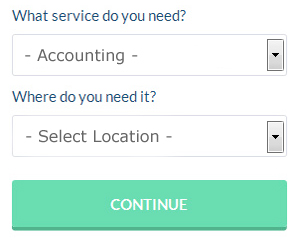

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. You simply answer a few relevant questions so that they can find the most suitable person for your needs. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment. Try this free service because you've got nothing to lose.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. The popularity of these services has been increasing in recent years. Should you decide to go down this route, take care in choosing a legitimate company. Study reviews and customer feedback. We cannot endorse or recommend any of the available services here.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. Software programs like Taxshield, CalCal, Keytime, BTCSoftware, Capium, Absolute Topup, Taxfiler, Gbooks, TaxCalc, Andica, Ablegatio, Sage, ACCTAX, GoSimple, Xero, Basetax, 123 e-Filing, Forbes, Taxforward, Ajaccts and Nomisma have been developed to help the self-employed do their own tax returns. The most important thing is to make sure your self-assessment is sent in promptly.

Financial Actuaries North Hill

An actuary is a professional who analyses the measurement and managing of risk and uncertainty. An actuary applies financial and statistical theories to figure out the odds of a specific event transpiring and its possible monetary consequences. Actuaries provide judgements of fiscal security systems, with a focus on their complexity, their mathematics, and their mechanisms. (Tags: Actuary North Hill, Financial Actuary North Hill, Actuaries North Hill)

Small Business Accountants North Hill

Company accounting can be a fairly stress-filled experience for any owner of a small business in North Hill. Using the services of a small business accountant in North Hill will enable you to operate your business knowing that your VAT, tax returns and annual accounts, and various other business tax requirements, are being fully met.

A good small business accountant will see it as their responsibility to help your business to develop, encouraging you with sound guidance, and giving you security and peace of mind about your financial situation. The capricious and complex sphere of business taxation will be clearly laid out for you in order to minimise your business costs, while maximising tax efficiency.

A small business accountant, to do their job correctly, will need to know exact details with regards to your current financial standing, company structure and any possible investment that you might be considering, or have put in place.

Boost Your Confidence and Your Business By Learning Better Money Management

It can be a very exciting thing to start your own business -- whether your business is online of offline. When you're a business owner, you're your own boss and in control of your income. How scary is that? While putting up your own business is indeed exciting, it's also intimidating, especially when you're only getting started. This is where you'll find it very helpful to know a few self-improvement techniques such as properly managing your finances. Today, we've got a few suggestions on how you can keep your finances in order.

Don't mix your business and personal expenses by having just one account. If you do, you run the risk of confusion. It may be simple to keep track of everything in the beginning, but over time, you'll find it's so much easier to track your expenses if you have separate accounts. For one thing, proving your income is much more difficult when you run your business expenses through a personal account. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. It's better if you streamline your finances by separating your business expenses from your personal expenses.

Learn how to keep your books. You need to have a system set up for your money -- both personally and professionally. You can do this simply by setting up a basic Excel spreadsheet or you could use bookkeeping software like Quicken or QuickBooks. You could also try to use a personal budgeting tool like Mint.com. There are a lot of free resources online to help small business owners better manage their bookkeeping. It's crucial that you keep your books in order because they provide you a clear picture of what your finances (both personal and business) look like. It might even be in your best interest, particularly if you don't have the money to hire a professional to help you, to take a class is basic bookkeeping and accounting.

Be a responsible business owner by paying your taxes when they're due. Small businesses typically pay file taxes quarterly. When it comes to taxes, you want to make sure you have accurate information, so it's a good idea to consult with someone at the small business center in your town, city, or county or even with someone from the IRS. You can also work with a professional to set up payments and plans for ensuring that you are meeting all of your obligations and following the letter of the law. You wouldn't want the IRS to come knocking on your door because you were remiss in paying your taxes.

When it comes to managing your money properly, there are so many things that go into it. It's a lot more than simply keeping a list of your expenditures. As a business owner, you've got numerous things you need to keep track of when it comes to your money. We've shared some things in this article that should make tracking your money easier for you to do. And as you continue to hone your skills in proper money management, you'll be able to find ways of streamlining your financial activities.

North Hill accountants will help with VAT returns in North Hill, debt recovery, personal tax, cashflow projections, consulting services, company formations, business advisory services, consultancy and systems advice, double entry accounting North Hill, charities, accounting and auditing in North Hill, business acquisition and disposal in North Hill, National Insurance numbers, assurance services North Hill, business support and planning North Hill, accounting services for buy to let rentals, small business accounting, accounting support services, accounting services for media companies North Hill, capital gains tax, mergers and acquisitions in North Hill, corporation tax, investment reviews, workplace pensions North Hill, tax investigations, inheritance tax North Hill, limited company accounting in North Hill, bureau payroll services, year end accounts North Hill, financial statements North Hill, litigation support, employment law and other professional accounting services in North Hill, Cornwall. These are just a small portion of the tasks that are conducted by nearby accountants. North Hill providers will be delighted to keep you abreast of their entire range of accountancy services.

North Hill Accounting Services

- North Hill Chartered Accountants

- North Hill Bookkeeping

- North Hill Payroll Management

- North Hill Personal Taxation

- North Hill Forensic Accounting

- North Hill Tax Services

- North Hill Tax Planning

- North Hill Financial Advice

- North Hill Tax Refunds

- North Hill Account Management

- North Hill Auditing

- North Hill PAYE Healthchecks

- North Hill Business Planning

- North Hill Specialist Tax

Also find accountants in: Cremyll, Par, Clubworthy, Cury, Portquin, Tregadillett, Camborne, Carn Brea, Michaelstow, Pentewan, Marshgate, Holmbush, Nanstallon, Carnon Downs, Amalebra, Wendron, Fraddon, Kingsand, Baldhu, Downgate, Devoran, Coverack, Helstone, Ponsanooth, Trelights, Coombe, Lesnewth, Probus, Halsetown, Padstow, St Erth, Polkerris, St Breock, Penwithick, Tregeare and more.

Accountant North Hill

Accountant North Hill Accountants Near Me

Accountants Near Me Accountants North Hill

Accountants North HillMore Cornwall Accountants: St Ives Accountants, Illogan Accountants, Bodmin Accountants, Hayle Accountants, Torpoint Accountants, Newquay Accountants, Helston Accountants, Penryn Accountants, St Blazey Accountants, Redruth Accountants, Saltash Accountants, Liskeard Accountants, Launceston Accountants, Bude Accountants, Wadebridge Accountants, Truro Accountants, St Agnes Accountants and Carn Brea Accountants.

Investment Accounting North Hill - Chartered Accountant North Hill - Financial Advice North Hill - Auditors North Hill - Tax Advice North Hill - Online Accounting North Hill - Small Business Accountants North Hill - Bookkeeping North Hill - Self-Assessments North Hill