Finding an Accountant in Newton Flotman: For those of you who are self-employed in Newton Flotman, a major headache each year is filling out your annual self-assessment form. Other sole traders and small businesses in the Newton Flotman area face the same challenge. Of course, you could always get yourself a local Newton Flotman accountant to do it instead. Is self-assessment a tad too complicated for you to do on your own? Regular small business accountants in Newton Flotman will most likely charge around two to three hundred pounds for such a service. Online accounting services are available for considerably less than this.

Newton Flotman accountants are available in many forms and types. Therefore, choosing the right one for your business is vital. Certain accountants work as part of an accountancy practice, whilst some work as sole traders. The benefit of accounting firms is that they have many fields of expertise in one place. Expect to find tax accountants, investment accountants, management accountants, accounting technicians, bookkeepers, auditors, actuaries, forensic accountants, financial accountants, costing accountants and chartered accountants within an accountancy practice.

You would be best advised to find a fully qualified Newton Flotman accountant to do your tax returns. An AAT qualified accountant should be adequate for sole traders and small businesses. Qualified Newton Flotman accountants might charge a bit more but they may also get you the maximum tax savings. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent. A qualified bookkeeper will probably be just as suitable for sole traders and smaller businesses in Newton Flotman.

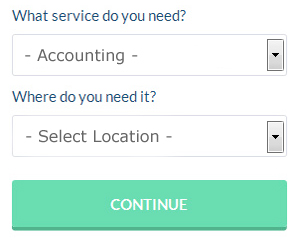

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Newton Flotman accountant. You only need to answer a few basic questions and complete a straightforward form. In the next day or so you should be contacted by potential accountants in your local area.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. You might find that this is simpler and more convenient for you. Picking a reputable company is important if you choose to go with this option. Study online reviews so that you can get an overview of the services available. We cannot endorse or recommend any of the available services here.

If you want to use the most qualified person to deal with your finances, a chartered accountant would be the choice. Accountants must be members of the ICAEW (or ICAS in Scotland) to work as a chartered accountant. You will certainly be hiring the best if you do choose one of these.

The cheapest option of all is to do your own self-assessment form. There is also lots of software available to help you with your returns. These include Ajaccts, Taxshield, Taxforward, Basetax, Keytime, Ablegatio, Xero, Gbooks, Sage, ACCTAX, Absolute Topup, TaxCalc, Nomisma, 123 e-Filing, Andica, GoSimple, BTCSoftware, Capium, Taxfiler, CalCal and Forbes. You'll receive a fine if your self-assessment is late. For being up to 3 months late you will be fined £100, and £10 per day thereafter.

Forensic Accounting Newton Flotman

Whilst conducting your search for a qualified accountant in Newton Flotman there's a good chance that you'll stumble on the expression "forensic accounting" and be curious about what it is, and how it is different from regular accounting. The hint for this is the actual word 'forensic', which basically means "suitable for use in a law court." Sometimes also known as 'financial forensics' or 'forensic accountancy', it uses investigative skills, accounting and auditing to delve into financial accounts in order to identify criminal activity and fraud. There are even a few bigger accountants firms in Norfolk who've got dedicated divisions for forensic accounting, dealing with money laundering, professional negligence, false insurance claims, bankruptcy, tax fraud, insolvency and personal injury claims. (Tags: Forensic Accountant Newton Flotman, Forensic Accountants Newton Flotman, Forensic Accounting Newton Flotman)

Small Business Accountants Newton Flotman

Making sure that your accounts are accurate and up-to-date can be a challenging task for anyone running a small business in Newton Flotman. A decent small business accountant in Newton Flotman will offer you a stress free method to keep your annual accounts, tax returns and VAT in the best possible order.

A professional small business accountant in Newton Flotman will consider that it is their responsibility to help develop your business, and provide you with reliable financial guidance for security and peace of mind in your specific situation. A quality accounting firm in Newton Flotman should be able to give proactive small business guidance to maximise your tax efficiency while at the same time minimising costs; critical in the sometimes shadowy world of business taxation.

It is also essential that you clarify your plans for the future, your current financial circumstances and your business structure truthfully to your small business accountant.

Payroll Services Newton Flotman

A vital element of any business enterprise in Newton Flotman, large or small, is having an effective payroll system for its workforce. The legislation regarding payroll requirements for accuracy and openness mean that processing a company's payroll can be an intimidating task.

Using a reliable accounting company in Newton Flotman, to deal with your payroll needs is the simple way to lessen the workload of your own financial team. A payroll accountant will work with HMRC, with pensions schemes and oversee BACS payments to ensure your employees are paid promptly, and all mandatory deductions are correct.

Following current regulations, a dedicated payroll management accountant in Newton Flotman will also provide each of your staff members with a P60 at the end of each financial year. At the end of a staff member's contract with your company, the payroll accountant will also provide a current P45 form outlining what tax has been paid in the last financial period. (Tags: Payroll Outsourcing Newton Flotman, Payroll Accountant Newton Flotman, Payroll Services Newton Flotman).

Newton Flotman accountants will help with company formations in Newton Flotman, taxation accounting services in Newton Flotman, payslips Newton Flotman, business outsourcing, mergers and acquisitions in Newton Flotman, VAT returns, accounting and financial advice Newton Flotman, corporation tax, management accounts, litigation support in Newton Flotman, workplace pensions Newton Flotman, cash flow in Newton Flotman, debt recovery, National Insurance numbers, accounting services for start-ups, bureau payroll services in Newton Flotman, auditing and accounting Newton Flotman, tax preparation in Newton Flotman, double entry accounting in Newton Flotman, small business accounting, corporate finance, pension forecasts, self-employed registrations in Newton Flotman, contractor accounts, partnership accounts, audit and compliance issues in Newton Flotman, business advisory, partnership registration, tax investigations, accounting services for the construction sector, accounting services for buy to let property rentals, consulting services Newton Flotman and other professional accounting services in Newton Flotman, Norfolk. These are just a selection of the tasks that are carried out by local accountants. Newton Flotman professionals will keep you informed about their full range of services.

Newton Flotman Accounting Services

- Newton Flotman Tax Investigations

- Newton Flotman VAT Returns

- Newton Flotman Debt Recovery

- Newton Flotman Tax Services

- Newton Flotman Personal Taxation

- Newton Flotman Payroll Management

- Newton Flotman Business Accounting

- Newton Flotman Tax Returns

- Newton Flotman Financial Advice

- Newton Flotman Tax Refunds

- Newton Flotman Self-Assessment

- Newton Flotman Forensic Accounting

- Newton Flotman Specialist Tax

- Newton Flotman PAYE Healthchecks

Also find accountants in: Binham, Waxham, Wroxham, Morley St Botolph, Thompson, Strumpshaw, Short Green, Melton Constable, Shelfanger, North Elmham, Briston, Saxlingham Thorpe, Pentney, Barmer, Stoke Ferry, Colkirk, Worthing, Dilham, Terrington St John, Catton, Ranworth, West Raynham, Coltishall, Corpusty, East Barsham, Brooke, Hingham, Besthorpe, Ormesby St Margaret, Buckenham, Great Bircham, West Bradenham, Heydon, Carleton Rode, St Helena and more.

Accountant Newton Flotman

Accountant Newton Flotman Accountants Near Me

Accountants Near Me Accountants Newton Flotman

Accountants Newton FlotmanMore Norfolk Accountants: North Walsham Accountants, Sprowston Accountants, Thetford Accountants, Thorpe St Andrew Accountants, Fakenham Accountants, Attleborough Accountants, Costessey Accountants, Cromer Accountants, Taverham Accountants, Caister-on-Sea Accountants, Hellesdon Accountants, Kings Lynn Accountants, Great Yarmouth Accountants, Dereham Accountants, Wymondham Accountants, Swaffham Accountants, Norwich Accountants and Bradwell Accountants.

TOP - Accountants Newton Flotman

Tax Advice Newton Flotman - Small Business Accountant Newton Flotman - Bookkeeping Newton Flotman - Investment Accounting Newton Flotman - Tax Return Preparation Newton Flotman - Online Accounting Newton Flotman - Chartered Accountant Newton Flotman - Cheap Accountant Newton Flotman - Auditing Newton Flotman