Finding an Accountant in Little Weighton: Does filling in your yearly self-assessment form make your head spin? Other sole traders and small businesses in the Little Weighton area are faced with the same challenge. Perhaps calling on the assistance of a local Little Weighton professional is the solution? This might be the best alternative if you consider self-assessment just too time-consuming. The cost of completing and submitting your self-assessment form is about £200-£300 if carried out by a regular Little Weighton accountant. You will be able to get it done more cheaply by using one of the many online accounting services.

Now you need to ascertain where to locate an accountant, what to expect, and how much will you need to pay? A shortlist of prospective Little Weighton accountants may be identified with just a few minutes searching on the internet. Knowing precisely who you can trust is of course not quite as simple. The fact that almost any individual in Little Weighton can call themselves an accountant is a fact that you need to keep in mind. Surprisingly, there's not even a requirement for them to have any form of qualification.

Find yourself a properly qualified one and don't take any chances. For simple self-assessment work an AAT qualification is what you need to look for. Qualified accountants may come with higher costs but may also save you more tax. Remember that a percentage of your accounting costs can be claimed back on the tax return. Many qualified bookkeepers offer tax returns services for smaller businesses and sole traders.

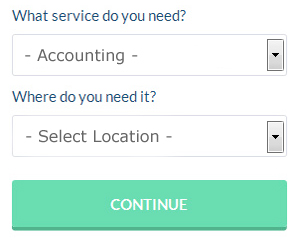

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. You just have to fill in a simple form and answer some basic questions. It is then simply a case of waiting for some suitable responses.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. A number of self-employed people in Little Weighton prefer to use this simple and convenient alternative. Even if you do decide to go down this route, take some time in singling out a trustworthy company. It should be a simple task to find some online reviews to help you make your choice.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! Available software that will also help includes TaxCalc, Taxfiler, BTCSoftware, Taxshield, Nomisma, Keytime, Sage, Andica, Forbes, Xero, GoSimple, Gbooks, ACCTAX, 123 e-Filing, Basetax, Absolute Topup, Taxforward, Ajaccts, CalCal, Ablegatio and Capium. You will get a penalty if your tax return isn't in on time. The fine for late submissions (up to 3 months) is £100.

Forensic Accountant Little Weighton

Whilst conducting your search for a professional accountant in Little Weighton there is a good likelihood that you will stumble upon the phrase "forensic accounting" and be wondering what that is, and how it differs from normal accounting. With the actual word 'forensic' meaning literally "suitable for use in a court of law", you ought to get an idea as to exactly what is involved. Using accounting, investigative skills and auditing to detect inaccuracies in financial accounts which have resulted in theft or fraud, it is also often known as 'financial forensics' or 'forensic accountancy'. There are even several bigger accountants firms throughout East Yorkshire who have specialist sections for forensic accounting, addressing tax fraud, insolvency, money laundering, falsified insurance claims, bankruptcy, professional negligence and personal injury claims.

Small Business Accountants Little Weighton

Operating a small business in Little Weighton is stressful enough, without having to fret about your accounts and other similar bookkeeping chores. A decent small business accountant in Little Weighton will offer you a stress free means to keep your tax returns, annual accounts and VAT in the best possible order.

Helping you to develop your business, and giving financial advice relating to your specific situation, are just a couple of the means by which a small business accountant in Little Weighton can benefit you. An accountancy firm in Little Weighton will provide you with a dedicated small business accountant and adviser who will remove the haze that veils business taxation, in order to improve your tax efficiences.

It is crucial that you explain your plans for the future, your current financial circumstances and your business structure accurately to your small business accountant.

Payroll Services Little Weighton

A crucial component of any business enterprise in Little Weighton, large or small, is having a reliable payroll system for its personnel. The legislation regarding payroll for transparency and accuracy mean that processing a business's staff payroll can be a formidable task for those not trained in this discipline.

A small business may well not have the advantage of a dedicated financial expert and a simple way to deal with the issue of employee payrolls is to retain the services of an independent payroll company in Little Weighton. The payroll management service will work along with HMRC and pension schemes, and set up BACS transfers to guarantee accurate and timely payment to all employees.

A certified payroll management accountant in Little Weighton will also, in line with the current legislation, provide P60's after the end of the financial year for every one of your employees. They'll also be responsible for providing P45 tax forms at the end of a staff member's contract.

How Managing Your Money Better Makes You a Better Business Owner

One of the most difficult parts of starting your own business is learning how to use proper money management techniques. Some people think that money management is a skill that should be already learned or mastered. However, there is a huge difference between managing your personal finances and managing your business finances, although it can help if you've got some experience in the former. Many business owners who have ruined their financial situation accidentally end up having no self-confidence at all. You can be better at money management and if you keep reading, you'll learn a few strategies to help you do so.

Retain an accountant. This is a business expense that's really worth it because an accountant can help keep your books straight on a full time basis. Your accountant will be keeping track of the money that your business is bringing in and the money that goes on your expenditures. She will also help you figure out just how much you should pay yourself as well as how much money you need to pay for taxes. The good news is that you don't have to tackle with the paperwork that goes with these things yourself. You can leave all that to your accountant. As a result, you can put your energy towards making your business more profitable, such as creating new products, marketing, and increasing your customer base. The expense of having a business accountant is nothing compared to how much you'll save trying to figure out your finances and keeping everything in order.

Each week, balance your books. If your business is a traditional store wherein you use registers or you have multiple payments coming in each day, you may be better off balancing your books at the end of each business day. Balance your books every day or every week to make sure that your numbers are the same as the numbers reflected in your bank account or cash you have on hand. This way you won't have to track down a bunch of discrepancies at the end of the month (or quarter). You won't have to spend a long time balancing your books if you do it on a regular basis.

Make sure you account for every penny your business brings in. Make sure that you write down the amount from every payment you receive that's business related. With this money management strategy, you can easily keep track of how much money you've got on hand, as well as who has already paid their dues and who hasn't. When you know what your income is, you'll also be able to figure out how much taxes you can expect to pay and even how much money you should pay yourself.

There are lots of ways to practice self improvement in your business. Managing your money is one of those things. There are very few people who wouldn't want to have better skills at managing their finances. Your confidence stands to gain a lot when you get better at managing your finances. Moreover, your business and personal lives will be more organized. Keep in mind the money management tips we shared in this article. Keep applying them to your business and you'll soon see much success.

Little Weighton accountants will help with self-assessment tax returns in Little Weighton, corporate finance, monthly payroll, investment reviews, litigation support, company formations in Little Weighton, debt recovery Little Weighton, taxation accounting services, self-employed registrations in Little Weighton, payslips, cashflow projections, consultancy and systems advice, double entry accounting, consulting services in Little Weighton, general accounting services, HMRC submissions Little Weighton, VAT registrations, tax preparation, company secretarial services Little Weighton, small business accounting Little Weighton, accounting services for the construction sector in Little Weighton, accounting support services, audit and compliance issues in Little Weighton, accounting services for landlords in Little Weighton, contractor accounts, HMRC liaison, workplace pensions, financial planning, capital gains tax, estate planning, personal tax Little Weighton, sole traders Little Weighton and other kinds of accounting in Little Weighton, East Yorkshire. These are just some of the activities that are undertaken by local accountants. Little Weighton specialists will keep you informed about their entire range of accountancy services.

Little Weighton Accounting Services

- Little Weighton Debt Recovery

- Little Weighton Tax Services

- Little Weighton Business Planning

- Little Weighton Financial Advice

- Little Weighton Payroll Management

- Little Weighton VAT Returns

- Little Weighton Chartered Accountants

- Little Weighton Auditing

- Little Weighton Self-Assessment

- Little Weighton Tax Planning

- Little Weighton Bookkeepers

- Little Weighton Tax Advice

- Little Weighton PAYE Healthchecks

- Little Weighton Account Management

Also find accountants in: Hutton Cranswick, Allerthorpe, Lockington, Flinton, Goxhill, Bridlington, Lowthorpe, Fangfoss, Ulrome, Thearne, Bainton, Withernsea, South Dalton, Low Catton, Kirk Ella, Gribthorpe, Willitoft, North Ferriby, Swine, Wold Newton, Harlthorpe, Scalby, Aughton, Cottingham, Little Catwick, Nafferton, Fraisthorpe, Breighton, Rolston, Kirby Underdale, Kelleythorpe, Goole, Gransmoor, Humbleton, North Cave and more.

Accountant Little Weighton

Accountant Little Weighton Accountants Near Little Weighton

Accountants Near Little Weighton Accountants Little Weighton

Accountants Little WeightonMore East Yorkshire Accountants: Kingston upon Hull Accountants, Willerby Accountants, Cottingham Accountants, Beverley Accountants, Anlaby Accountants, Goole Accountants, Pocklington Accountants, Molescroft Accountants, Market Weighton Accountants, Driffield Accountants, Elloughton Accountants, Woodmansey Accountants, Howden Accountants, Bridlington Accountants, Hornsea Accountants, Hedon Accountants and Hessle Accountants.

TOP - Accountants Little Weighton

Financial Accountants Little Weighton - Small Business Accountant Little Weighton - Financial Advice Little Weighton - Self-Assessments Little Weighton - Bookkeeping Little Weighton - Investment Accountant Little Weighton - Tax Preparation Little Weighton - Affordable Accountant Little Weighton - Chartered Accountant Little Weighton