Finding an Accountant in Langley Mill: If you are a sole trader or run a small business in Langley Mill, you'll find that there are numerous benefits to be gained from having an accountant on board. Time consuming paperwork and bookkeeping can be handed to your accountant, while you're left to focus on your main business. For those who've just started in business it may be vitally important to have someone at hand who can provide financial advice. You may find that you need this help even more as your Langley Mill business grows.

When looking for a nearby Langley Mill accountant, you will notice that there are lots of different kinds on offer. Take the time to uncover an accountant who matches your specific needs. Certain accountants work as part of an accountancy business, whilst some work solo. The different accounting disciplines can be better covered by an accounting firm with several experts on hand. Some of the primary accountancy positions include the likes of: auditors, financial accountants, chartered accountants, actuaries, management accountants, forensic accountants, costing accountants, tax preparation accountants, accounting technicians, bookkeepers and investment accountants.

Finding an accountant in Langley Mill who is qualified is generally advisable. For simple self-assessment work an AAT qualification is what you need to look for. Qualified accountants in Langley Mill might cost more but they will do a proper job. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. Sole traders in Langley Mill may find that qualified bookkeepers are just as able to do their tax returns.

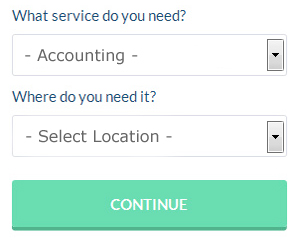

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. With Bark it is simply a process of ticking a few boxes and submitting a form. In the next day or so you should be contacted by potential accountants in your local area.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. Services like this are convenient and cost effective. There is no reason why this type of service will not prove to be as good as your average High Street accountant. The better ones can soon be singled out by carefully studying reviews online. Recommending any specific services is beyond the scope of this short article.

In the final analysis you may decide to do your own tax returns. To make life even easier there is some intuitive software that you can use. Including Ajaccts, Forbes, Basetax, GoSimple, CalCal, Keytime, Taxshield, Taxforward, Absolute Topup, ACCTAX, Gbooks, BTCSoftware, Sage, Andica, 123 e-Filing, Taxfiler, TaxCalc, Nomisma, Ablegatio, Xero and Capium. You should get paperwork to your accountant promptly so that your tax returns can be prepared with time to spare.

Forensic Accounting Langley Mill

When you are hunting for an accountant in Langley Mill you will perhaps encounter the phrase "forensic accounting" and wonder what the differences are between a normal accountant and a forensic accountant. With the word 'forensic' meaning literally "relating to or denoting the application of scientific methods and techniques to the investigation of a crime", you should get a hint as to exactly what is involved. Occasionally also known as 'financial forensics' or 'forensic accountancy', it uses investigative skills, auditing and accounting to dig through financial accounts in order to identify fraud and criminal activity. There are even some bigger accountants firms in Derbyshire who've got specialised divisions for forensic accounting, dealing with professional negligence, money laundering, tax fraud, personal injury claims, insolvency, falsified insurance claims and bankruptcy. (Tags: Forensic Accountants Langley Mill, Forensic Accountant Langley Mill, Forensic Accounting Langley Mill)

Financial Actuaries Langley Mill

Actuaries work within government departments and companies, to help them predict long-term financial expenditure and investment risks. Such risks can have an impact on both sides of the balance sheet and call for professional valuation, asset management and liability management skills. Actuaries present reviews of fiscal security systems, with a focus on their mechanisms, complexity and mathematics.

Small Business Accountants Langley Mill

Ensuring that your accounts are accurate can be a demanding job for anyone running a small business in Langley Mill. Hiring the services of a small business accountant in Langley Mill will enable you to operate your business safe in the knowledge that your VAT, annual accounts and tax returns, and various other business tax requirements, are being fully met.

A competent small business accountant in Langley Mill will consider that it is their responsibility to develop your business, and provide you with sound financial guidance for security and peace of mind in your specific situation. The capricious and often complex sphere of business taxation will be clearly laid out for you in order to lower your business costs, while improving tax efficiency.

A small business accountant, to do their job effectively, will want to know precise details with regards to your current financial standing, company structure and any possible investments that you might be looking at, or have set up.

Learning the Top Money Management Strategies for Business Success

For many people, starting their own business has many advantages. One of the advantages is that they get to be in charge of their income. They're able to control just how much money they make and how much money they spend. Of course, this can also be quite overwhelming, and even people who have managed to live by a budget in their personal lives have a difficult time managing their business finances. Still, this shouldn't deter you from going into business for yourself. You've got a number of things that can help you successfully manage the financial side of your business. Continue reading if you'd like to know how you can be a better money manager for your own business.

If you have a lot of regular expenditures, such as hosting account bills, recurring membership dues, etc, you might be tempted to put them all on a credit card. This can make your life easier because each month, you just make one payment to your credit card company instead of making out payments to several different companies. However, it can be tricky to use credit cards for your business expenses because interest charges can accrue and you may end up paying more if you carry a balance each month. So if you want to keep it all on your bank account, you need to make sure that you pay off your credit card in full each month. With this money management strategy, you only have to keep track of one consolidated payment, not pay any interest, and build your credit rating.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. This way, you won't have a hard time keeping track of your business and personal finances. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. Just how much money you pay yourself is completely up to you. Your salary can be a portion of how much your business brought in for the month or it can be based on how many hours you worked.

Resist the urge to spend. It's understandable that now you've got money coming in, you'll want to start spending money on things you were never able to afford in the past. You should, however, spend money on things that will benefit your business. It's better to build up your business savings so that you can handle unexpected expenses than it is to splurge every time you have the chance. In addition, buying your office supplies in bulk will save you money. For computers, it's better if you spend money on a more expensive, but reliable system that will last for many years and won't need replaced every so often. As for your entertainment expenses, you need to be smart about it as well.

When you know the right way to manage your finances, you can expect not just your business to improve but yourself overall as well. You'll benefit a great deal if you remember and put these tips we've shared to use. Keep your finances under control and you can look forward to a better, more successful personal life and business life.

Langley Mill accountants will help with management accounts, charities in Langley Mill, pension planning in Langley Mill, personal tax, tax preparation, mergers and acquisitions, year end accounts, financial planning, bookkeeping, compliance and audit issues, employment law, taxation accounting services, accounting services for media companies, business disposal and acquisition in Langley Mill, corporate finance Langley Mill, partnership accounts in Langley Mill, HMRC liaison, bureau payroll services, consultancy and systems advice Langley Mill, tax investigations Langley Mill, business advisory, accounting services for buy to let property rentals, investment reviews in Langley Mill, assurance services, accounting and financial advice in Langley Mill, business support and planning, National Insurance numbers, estate planning, small business accounting, accounting support services, financial statements in Langley Mill, company formations Langley Mill and other forms of accounting in Langley Mill, Derbyshire. Listed are just a selection of the tasks that are handled by local accountants. Langley Mill professionals will let you know their whole range of accounting services.

Langley Mill Accounting Services

- Langley Mill Audits

- Langley Mill Self-Assessment

- Langley Mill Business Accounting

- Langley Mill VAT Returns

- Langley Mill Tax Advice

- Langley Mill Financial Audits

- Langley Mill Tax Refunds

- Langley Mill Specialist Tax

- Langley Mill PAYE Healthchecks

- Langley Mill Financial Advice

- Langley Mill Bookkeeping Healthchecks

- Langley Mill Account Management

- Langley Mill Payroll Management

- Langley Mill Forensic Accounting

Also find accountants in: Newton Solney, Peak Dale, Matlock Bath, Thornsett, West Handley, Bradbourne, Long Eaton, Idridgehay, Norbury, Quarndon, Linton, Alport, Allestree, Flagg, Hodthorpe, Rowthorne, Woodthorpe, Crowdecote, Turnditch, Breadsall, Kirk Langley, Somercotes, Calow, Roston, Millers Dale, Long Duckmanton, West Hallam, Heage, Stubley, Wormhill, Alkmonton, Coxbench, Swanwick, Peak Forest, Caldwell and more.

Accountant Langley Mill

Accountant Langley Mill Accountants Near Langley Mill

Accountants Near Langley Mill Accountants Langley Mill

Accountants Langley MillMore Derbyshire Accountants: Staveley Accountants, Matlock Accountants, Long Eaton Accountants, Eckington Accountants, Shirebrook Accountants, Heanor Accountants, Ripley Accountants, Chesterfield Accountants, New Mills Accountants, Swadlincote Accountants, Chapel En Le Frith Accountants, Killamarsh Accountants, Buxton Accountants, Belper Accountants, Ilkeston Accountants, Glossop Accountants, Brimington Accountants, Clay Cross Accountants, Dronfield Accountants, Sandiacre Accountants, Derby Accountants and Somercotes Accountants.

TOP - Accountants Langley Mill

Investment Accountant Langley Mill - Financial Advice Langley Mill - Chartered Accountants Langley Mill - Bookkeeping Langley Mill - Self-Assessments Langley Mill - Small Business Accountant Langley Mill - Tax Preparation Langley Mill - Auditors Langley Mill - Tax Advice Langley Mill