Finding an Accountant in Hensall: Is the only "reward" for filling in your yearly self-assessment form a massive headache? Plenty of folks in Hensall and throughout the United Kingdom have to contend with this each year. Is it a much better idea to get someone else to do this task for you? If you find self-assessment too taxing, this could be much better for you. A typical Hensall accountant will probably charge around £200-£300 for filling in these forms. If you don't have any issues with online services you will be able to get it done for a lower figure than this.

So, how do you go about locating a decent Hensall accountant? In this day and age the first place to head is the internet when hunting for any local services, including bookkeepers and accountants. However, how do you know which accountant you can and can't trust with your yearly tax returns? You should never forget that anybody in Hensall can claim to be an accountant. Remarkably, there isn't even a necessity for them to hold any kind of qualification. Which you and many others might find astonishing.

You would be best advised to find a fully qualified Hensall accountant to do your tax returns. For basic tax returns an AAT qualified accountant should be sufficient. The extra peace of mind should compensate for any higher costs. Make sure that you include the accountants fees in your expenses, because these are tax deductable. It is perfectly acceptable to use a qualified bookkeeper in Hensall if you are a sole trader or a smaller business.

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. They provide an easy to fill in form that gives an overview of your requirements. It is then simply a case of waiting for some suitable responses.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. While not recommended in every case, it could be the ideal solution for you. Make a short list of such companies and do your homework to find the most reputable. Carefully read reviews online in order to find the best available. Sorry but we cannot recommend any individual service on this website.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of BTCSoftware, Taxfiler, Xero, TaxCalc, ACCTAX, Capium, Gbooks, 123 e-Filing, GoSimple, Ablegatio, Sage, Ajaccts, Taxforward, Basetax, Nomisma, CalCal, Andica, Taxshield, Forbes, Absolute Topup and Keytime. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns. If you send in your tax return up to three months late, HMRC will fine you £100, after that it is an additional £10 per day.

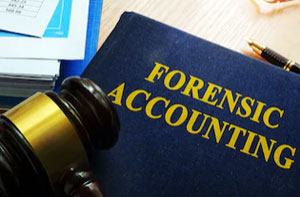

Forensic Accounting Hensall

While engaged on your search for a competent accountant in Hensall there is a fair chance that you will stumble on the phrase "forensic accounting" and be curious about what that is, and how it differs from standard accounting. The actual word 'forensic' is the thing that gives it away, meaning basically "appropriate for use in a court of law." Using investigative skills, accounting and auditing to identify inconsistencies in financial accounts that have resulted in theft or fraud, it's also often called 'forensic accountancy' or 'financial forensics'. Some of the bigger accounting companies in the Hensall area may even have specialist forensic accounting divisions with forensic accountants focusing on specific kinds of fraud, and might be dealing with money laundering, insurance claims, professional negligence, insolvency, bankruptcy, tax fraud and personal injury claims.

Financial Actuaries Hensall

Actuaries work within businesses, organisations and government departments, to help them forecast long-term investment risks and financial expenditure. These risks can have an impact on both sides of a company's balance sheet and require valuation, liability management and asset management skills. An actuary uses statistics and math concepts to calculate the fiscal effect of uncertainty and help clients minimize risks.

Small Business Accountants Hensall

Making sure that your accounts are accurate can be a stressful task for any small business owner in Hensall. If your annual accounts are getting the better of you and VAT and tax return issues are causing you sleepless nights, it is wise to use a decent small business accountant in Hensall.

A seasoned small business accountant in Hensall will consider that it's their responsibility to help develop your business, and provide you with reliable financial guidance for peace of mind and security in your unique situation. An accountancy firm in Hensall should provide a dedicated small business accountant and adviser who will clear away the fog that shrouds business taxation, in order to optimise your tax efficiency.

A small business accountant, to do their job properly, will want to know accurate details with regards to your current financial standing, company structure and any future investments that you may be considering, or have set up.

Hensall accountants will help with financial planning, sole traders, HMRC submissions, investment reviews in Hensall, corporation tax, accounting and financial advice, National Insurance numbers, inheritance tax, estate planning, business start-ups, accounting services for property rentals, VAT returns, bureau payroll services, general accounting services, capital gains tax Hensall, pension forecasts, business outsourcing Hensall, compliance and audit issues Hensall, business support and planning, mergers and acquisitions, tax preparation in Hensall, PAYE Hensall, accounting support services in Hensall, partnership accounts, business advisory in Hensall, monthly payroll, company secretarial services, partnership registration, management accounts in Hensall, small business accounting, self-employed registration, consulting services and other types of accounting in Hensall, North Yorkshire. These are just an example of the activities that are undertaken by nearby accountants. Hensall providers will let you know their full range of services.

When looking for inspiration and advice for personal tax assistance, accounting for small businesses, self-assessment help and accounting & auditing, you will not need to look any further than the world wide web to find all the information that you need. With such a diversity of painstakingly researched webpages and blog posts to select from, you will quickly be awash with amazing ideas for your planned project. Just recently we spotted this illuminating article on how to locate an accountant to complete your income tax return.

Hensall Accounting Services

- Hensall Taxation Advice

- Hensall Tax Refunds

- Hensall Specialist Tax

- Hensall Payroll Management

- Hensall Self-Assessment

- Hensall Tax Investigations

- Hensall Account Management

- Hensall Financial Advice

- Hensall Tax Services

- Hensall Tax Returns

- Hensall Chartered Accountants

- Hensall Business Accounting

- Hensall Tax Planning

- Hensall VAT Returns

Also find accountants in: Thorgill, Harwood Dale, Netherby, East Ness, Scotch Corner, Hellifield, Camblesforth, East Heslerton, Earswick, Aldfield, Castleton, Galphay, Askrigg, Fylingthorpe, West Barnby, Newby, Healey, Arrathorne, Clareton, Thornton In Craven, Newton On Rawcliffe, Chop Gate, Well, Kennythorpe, Hunton, Coneysthorpe, Suffield, Whaw, Buttercrambe, Melsonby, Arncliffe, Fremington, Long Drax, Thornton Steward, Osmotherley and more.

Accountant Hensall

Accountant Hensall Accountants Near Me

Accountants Near Me Accountants Hensall

Accountants HensallMore North Yorkshire Accountants: Middlesbrough Accountants, Richmond Accountants, Acomb Accountants, Northallerton Accountants, Skipton Accountants, Ripon Accountants, Knaresborough Accountants, Norton Accountants, Selby Accountants, York Accountants, Harrogate Accountants, Whitby Accountants and Scarborough Accountants.

Bookkeeping Hensall - Small Business Accountant Hensall - Financial Accountants Hensall - Chartered Accountants Hensall - Financial Advice Hensall - Tax Accountants Hensall - Online Accounting Hensall - Tax Preparation Hensall - Cheap Accountant Hensall