Finding an Accountant in Findon: Does filling in your yearly self-assessment form give you nightmares? You are not alone in Findon if this predicament affects you every year. But is there an easy way to find a local Findon accountant to do this task for you? This could be the best alternative if you consider self-assessment just too time-consuming. A typical Findon accountant will probably charge around £200-£300 for completing these forms. If you're looking for a cheap option you might find the answer online.

So, how do you go about locating a good Findon accountant? Not so long ago the Yellow Pages or local newspaper would have been the first place to look, but these days the internet is far more popular. But, how do you tell which ones you can trust? Always keep in mind that just about any individual in Findon can call themselves an accountant. They don't even have to hold any qualifications such as A Levels or BTEC's. This can of course lead to abuse.

Finding an accountant in Findon who is qualified is generally advisable. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat.

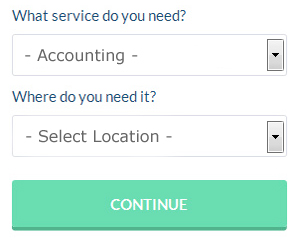

If you need a little help with your online search, there are numerous accountants who can be contacted through a website called Bark.com. Filling in a clear and simple form is all that you need to do to set the process in motion. Just sit back and wait for the responses to roll in. There are absolutely no charges for using this service.

If you think your needs are comparatively simple, using an online tax returns service will be your cheapest option. More accountants are offering this modern alternative. Make a short list of such companies and do your homework to find the most reputable. Study online reviews so that you can get an overview of the services available. Recommending any specific services is beyond the scope of this short article.

The real professionals in the field are chartered accountants. These people are financial experts and are more commonly used by bigger companies. Having the best person for the job may appeal to many.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! It is also a good idea to make use of some self-assessment software such as Nomisma, 123 e-Filing, Andica, BTCSoftware, Taxshield, CalCal, Capium, Forbes, GoSimple, Basetax, Taxforward, TaxCalc, Taxfiler, Absolute Topup, Xero, Ajaccts, Gbooks, Keytime, Ablegatio, Sage or ACCTAX to simplify the process. Getting your self-assessment form submitted on time is the most important thing. You�ll get a penalty of £100 if your tax return is up to 3 months late.

Auditors Findon

An auditor is an individual authorised to examine and verify the correctness of accounts to make certain that organisations or businesses conform to tax laws. Auditors examine the monetary behaviour of the firm which appoints them and make certain of the constant functioning of the business. To work as an auditor, an individual must be authorised by the regulatory authority for auditing and accounting and have earned specified qualifications. (Tags: Auditor Findon, Auditing Findon, Auditors Findon)

Forensic Accounting Findon

You might well encounter the term "forensic accounting" when you're looking to find an accountant in Findon, and will doubtless be wondering what is the distinction between forensic accounting and standard accounting. The actual word 'forensic' is the thing that gives a clue, meaning basically "relating to or denoting the application of scientific methods and techniques for the investigation of criminal activity." Using auditing, accounting and investigative skills to discover inaccuracies in financial accounts that have contributed to theft or fraud, it's also sometimes known as 'financial forensics' or 'forensic accountancy'. Some larger accounting firms in the Findon area may even have independent forensic accounting divisions with forensic accountants targeting specific sorts of fraud, and may be dealing with professional negligence, tax fraud, insolvency, bankruptcy, personal injury claims, insurance claims and money laundering.

Small Business Accountants Findon

Operating a small business in Findon is fairly stressful, without having to fret about your accounts and similar bookkeeping duties. If your annual accounts are getting the better of you and tax returns and VAT issues are causing sleepless nights, it is a good idea to hire a focused small business accountant in Findon.

A responsible small business accountant will consider it their duty to help your business to expand, supporting you with sound guidance, and giving you security and peace of mind concerning your financial situation. An accountancy firm in Findon should provide you with an assigned small business accountant and mentor who will remove the haze that shrouds business taxation, so as to enhance your tax efficiences.

It is also vital that you clarify your future plans, your company's circumstances and your business structure accurately to your small business accountant.

Payroll Services Findon

A crucial element of any business enterprise in Findon, big or small, is having a reliable payroll system for its workers. The legislation regarding payrolls and the legal requirements for accuracy and transparency means that handling a business's payroll can be a daunting task.

Using an experienced accounting firm in Findon, to handle your payroll is a easiest way to minimise the workload of your own financial team. Working with HMRC and pension scheme administrators, a payroll service accountant will also handle BACS payments to employees, ensuring that they are paid on time every month, and that all required deductions are done correctly.

A qualified payroll management accountant in Findon will also, in accordance with the current legislation, organise P60's at the conclusion of the financial year for every one of your employees. At the end of a staff member's contract with your company, the payroll accountant will also provide a current P45 form relating to the tax paid during the previous financial period.

Proper Money Management for Improving Your Business and Yourself

One of the most difficult parts of starting your own business is learning how to use proper money management techniques. It can seem like money management is something anyone should be able to do already by the time they get their business up and running. But managing your business finances is a lot different from managing your personal finances. It will help, though, if you are already experienced in the latter. Many business owners who have ruined their financial situation accidentally end up having no self-confidence at all. In this article, we'll share a few tips you can apply to help you be a better money manager for your business.

Find yourself an accountant who's competent. An accountant is well worth the business expense because she can manage your books for you full time. She will help you keep track of the money you have coming in and the money you are sending out, help you pay yourself, and help you meet your tax obligations. The best part is that you won't have to deal with the paperwork because your accountant will take care of that for you. You can then focus your attention towards the more profitable aspects of your business, such as increasing your customer base, creating new products, and such. You'll save yourself the trouble of having to figure out your business finances if you hire an accountant.

It's a good idea to do a weekly balancing of your books. But if your business is one where you use registers or you receive multiple payments every day, it might be better if you balance your books at the end of the day every day. You need to record all of the payments you receive and make. At the end of the day or week, you need to make sure that the amount you have on hand and in the bank tallies with the amount you have in your records. This way at the end of each month or every quarter, you lessen your load of having to trace back where the discrepancies are in your accounting. Besides, you will only need to devote a few minutes of your time to balancing your books if you do it regularly as opposed to doing it once in a while, which could take hours.

Save every receipt. You'll save yourself a lot of grief if you've got your receipts with you if ever the IRS wants to see where you've been spending your money on. These receipts serve as a record of expenses related to your business. Make sure you keep your receipts together in one place. Tracking your expenses becomes easy if you have all your receipts in one place. The easiest way to keep track of them is with a small accordion file that you keep in your desk drawer.

There are so many little things that go into properly managing your money. It's more than listing what you spend and when. As a business owner, you've got numerous things you need to keep track of when it comes to your money. The tips we have shared will help you track your money more easily. Continue learning proper money management and you can expect improvement in yourself and in your business.

Findon accountants will help with general accounting services, VAT registration, charities, audit and compliance reports in Findon, financial statements, employment law Findon, accounting services for the construction industry in Findon, taxation accounting services, payslips in Findon, partnership registrations in Findon, business start-ups in Findon, auditing and accounting in Findon, pension forecasts, business outsourcing, tax preparation, capital gains tax, bookkeeping in Findon, HMRC submissions, business disposal and acquisition, bureau payroll services, management accounts, partnership accounts, double entry accounting, accounting services for media companies, accounting and financial advice, estate planning, inheritance tax, VAT returns in Findon, National Insurance numbers, debt recovery, personal tax, self-employed registration and other accounting related services in Findon, West Sussex. These are just an example of the activities that are handled by local accountants. Findon professionals will be happy to inform you of their full range of services.

Findon Accounting Services

- Findon Tax Returns

- Findon Tax Advice

- Findon Chartered Accountants

- Findon Payroll Services

- Findon Forensic Accounting

- Findon VAT Returns

- Findon Audits

- Findon PAYE Healthchecks

- Findon Account Management

- Findon Debt Recovery

- Findon Tax Refunds

- Findon Bookkeeping

- Findon Financial Advice

- Findon Specialist Tax

Also find accountants in: Keymer, East Wittering, Walberton, Arundel, Billingshurst, Rudgwick, Stedham, West Tarring, Westergate, Highleigh, East Ashling, Northchapel, Wisborough Green, Rackham, Durrington, The Haven, Povey Cross, Tangmere, Church Norton, Pound Hill, Bognor Regis, Twineham, Chichester, Patching, Nyetimber, Felpham, Kingston, West Lavington, Eastergate, Wick, Eartham, Worthing, Mannings Heath, Graffham, Fulking and more.

Accountant Findon

Accountant Findon Accountants Near Me

Accountants Near Me Accountants Findon

Accountants FindonMore West Sussex Accountants: Bognor Regis Accountants, Haywards Heath Accountants, Worth Accountants, Felpham Accountants, Shoreham-by-Sea Accountants, Chichester Accountants, Worthing Accountants, Southwater Accountants, Selsey Accountants, Aldwick Accountants, East Grinstead Accountants, Littlehampton Accountants, Burgess Hill Accountants, Crawley Accountants, Southwick Accountants, Hassocks Accountants, Horsham Accountants and Rustington Accountants.

Self-Assessments Findon - Investment Accounting Findon - Tax Return Preparation Findon - Auditors Findon - Chartered Accountant Findon - Financial Accountants Findon - Small Business Accountants Findon - Bookkeeping Findon - Cheap Accountant Findon