Finding an Accountant in Eastburn: Do you get little else but a headache when you fill out your annual self-assessment form? Other sole traders and small businesses in the Eastburn area face the same challenge. Tracking down a local Eastburn professional to accomplish this task for you may be the answer. If self-assessment is too complex for you, this could be the way forward. Expect to pay roughly two to three hundred pounds for the average small business accountant. Online accounting services are available more cheaply than this.

But exactly what will you have to pay, what standard of service should you expect to receive and where can you uncover the best individual? In this day and age the first port of call is the internet when hunting for any local service, including bookkeepers and accountants. But, how do you know which of these can be trusted with your accounts? You should keep in mind that practically anyone in Eastburn can advertise themselves as an accountant or bookkeeper. They have no legal obligation to attain any qualifications for this kind of work. Which, when considering the importance of the work would seem a little strange.

It is advisable for you to find an accountant in Eastburn who is properly qualified. Look for an AAT qualified accountant in the Eastburn area. Qualified accountants may come with higher costs but may also save you more tax. You will of course get a tax deduction on the costs involved in preparing your tax returns. Only larger Limited Companies are actually required by law to use a trained accountant.

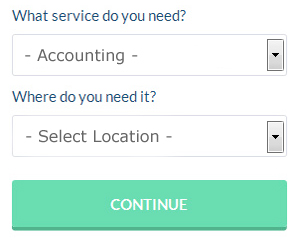

If you need a little help with your online search, there are numerous accountants who can be contacted through a website called Bark.com. A couple of minutes is all that is needed to complete their simple and straighforward search form. In the next day or so you should be contacted by potential accountants in your local area.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. A number of self-employed people in Eastburn prefer to use this simple and convenient alternative. You still need to pick out a company offering a reliable and professional service. Be sure to study customer reviews and testimonials.

At the other extreme of the accounting spectrum are chartered accountants, these highly trained professional are at the top of their game. Accountants must be members of the ICAEW (or ICAS in Scotland) to work as a chartered accountant. The decision of who to use is of course up to you.

Although filling in your own tax return may seem too complicated, it is not actually that hard. There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example Taxshield, Sage, Taxfiler, Keytime, Taxforward, Nomisma, Andica, Gbooks, GoSimple, CalCal, Forbes, Absolute Topup, 123 e-Filing, Xero, TaxCalc, ACCTAX, Capium, Basetax, BTCSoftware, Ablegatio and Ajaccts. Getting your self-assessment form submitted on time is the most important thing.

Auditors Eastburn

An auditor is a person or a firm appointed by a company to conduct an audit, which is an official assessment of the financial accounts, typically by an unbiased entity. They offer businesses from fraud, discover inconsistencies in accounting techniques and, now and again, operate on a consultancy basis, helping firms to determine solutions to increase operational efficiency. Auditors have to be approved by the regulating body for accounting and auditing and have the necessary accounting qualifications.

Small Business Accountants Eastburn

Making sure that your accounts are accurate can be a challenging job for any small business owner in Eastburn. If your accounts are getting on top of you and tax returns and VAT issues are causing you sleepless nights, it would be a good idea to use a focused small business accountant in Eastburn.

Helping you grow your business, and providing sound financial advice for your specific circumstances, are just two of the ways that a small business accountant in Eastburn can benefit you. An accountancy firm in Eastburn will provide you with an assigned small business accountant and consultant who will clear the haze that shrouds the field of business taxation, so as to maximise your tax efficiency.

You should also be offered an assigned accountancy manager who understands your future plans, the structure of your business and your company's situation.

Payroll Services Eastburn

Dealing with staff payrolls can be a challenging aspect of running a business in Eastburn, regardless of its size. The laws regarding payroll for accuracy and transparency mean that running a business's payroll can be a daunting task.

Using a professional accountant in Eastburn, to take care of your payroll requirements is a easiest way to reduce the workload of yourself or your financial team. Working along with HMRC and pension schemes, a payroll accountant will also manage BACS payments to personnel, making certain that they're paid promptly every month, and that all deductions are done correctly.

Working to current regulations, a dedicated payroll management accountant in Eastburn will also present every one of your staff members with a P60 tax form after the end of each financial year. Upon the termination of a staff member's contract, the payroll accountant should also supply an updated P45 form outlining what tax has been paid during the last financial period. (Tags: Payroll Accountant Eastburn, Payroll Services Eastburn, Payroll Companies Eastburn).

How to Be a Better Money Manager for Your Business

Starting your own business is exciting, and this is true whether you are starting this business online or offline. You are finally in charge of yourself, you are finally in charge of your income -- you are in charge of everything! Now that can be a little scary! In addition to the excitement of being your own boss, it can be a bit intimidating particularly if you have no business experience. This is where knowing some simple self improvement techniques, like learning how to properly manage your money, can be quite helpful. So if you wish to know how you can manage your money correctly, keep reading.

It's certainly tempting to wait until the last minute to pay your taxes, but you're actually playing with fire here, especially if you're not good at money management. When your taxes are due, you may not have any money to actually pay them. Here's what you can do: every day or every week, take a portion of the payments you receive and then put that in a separate account. Thus, when it's time for you to pay your quarterly taxes, you only need to take the money out from this account and not your current account. You actually save yourself the trouble of wondering where or how you're going to come up with the money. You never want to be late in paying your taxes and this simple money management strategy will help you avoid paying late because you don't have the funds to make the payment on time.

It's a good idea to do a weekly balancing of your books. However, you should balance your books at the end of business day every day if what you have is a traditional store with cash registers or takes in multiple payments throughout the day every day. Keep track of every payment received and every payment made, then at the end of the week, make sure that what you have on hand and in the bank actually matches what your numbers say you should have. This way you won't have to track down a bunch of discrepancies at the end of the month (or quarter). If you regularly balance your books, you won't need to spend too long a time doing it. If you do it every once in a while, though, it can take hours.

It's a good idea to keep your receipts. If the IRS ever demands proof of your business expenses, receipts will come in handy. These receipts serve as a record of expenses related to your business. It's better if you keep all your receipts in one drawer. This way, if you're wondering why your bank account is showing an expenditure for a certain amount, and you forgot to write it down, you can go through your receipts to find evidence of the purchase. You can easily keep track of and access your receipts by putting them in an accordion file and placing that file in your desk drawer.

There are so many different things that go into helping you properly manage your money. Proper management of business finances isn't merely a basic skill. It's actually a complex process that you need to keep developing as a small business owner. Hopefully, the tips we've shared in this article will help you get started in managing your finances better. Really, when it comes to self improvement for business, it doesn't get much more basic than learning how to stay on top of your finances.

Eastburn accountants will help with personal tax, self-employed registrations, VAT payer registration, partnership accounts, business start-ups, assurance services Eastburn, bookkeeping, general accounting services in Eastburn, auditing and accounting, PAYE, business support and planning Eastburn, investment reviews, corporation tax, litigation support Eastburn, corporate finance, HMRC submissions in Eastburn, company formations, business advisory services, mergers and acquisitions in Eastburn, management accounts in Eastburn, partnership registrations in Eastburn, contractor accounts, charities in Eastburn, payslips, accounting services for media companies, year end accounts, estate planning, consulting services, accounting services for the construction sector, double entry accounting in Eastburn, company secretarial services, monthly payroll and other kinds of accounting in Eastburn, West Yorkshire. These are just an example of the tasks that are conducted by nearby accountants. Eastburn specialists will inform you of their entire range of services.

You do, of course have the perfect resource at your fingertips in the shape of the net. There is so much information and inspiration available online for things like accounting for small businesses, self-assessment help, personal tax assistance and accounting & auditing, that you will pretty quickly be awash with suggestions for your accounting needs. One example might be this super article about how to find an accountant to do your tax return.

Eastburn Accounting Services

- Eastburn Tax Advice

- Eastburn Debt Recovery

- Eastburn Bookkeepers

- Eastburn Bookkeeping Healthchecks

- Eastburn Business Accounting

- Eastburn Tax Returns

- Eastburn Auditing Services

- Eastburn Business Planning

- Eastburn Tax Refunds

- Eastburn Personal Taxation

- Eastburn Tax Planning

- Eastburn Financial Advice

- Eastburn Specialist Tax

- Eastburn Forensic Accounting

Also find accountants in: Liversedge, East Hardwick, Mytholm, Upton, Horbury, Booth Wood, Menston, Milnsbridge, Pool, Mill Bank, Ferrybridge, Ryhill, Elland, Lindley, Yeadon, Luddenden, Queensbury, Thorner, Widdop, Pecket Well, Stainland, Lumb, Shipley, Harden, East Ardsley, Rawdon, Pontefract, Lumbutts, Carlton, South Hiendley, Farsley, Westgate Hill, Rastrick, Methley, Thorpe On The Hill and more.

Accountant Eastburn

Accountant Eastburn Accountants Near Me

Accountants Near Me Accountants Eastburn

Accountants EastburnMore West Yorkshire Accountants: Normanton Accountants, Keighley Accountants, Liversedge Accountants, Bingley Accountants, Dewsbury Accountants, Rothwell Accountants, Wakefield Accountants, Horsforth Accountants, Shipley Accountants, Brighouse Accountants, Pontefract Accountants, Castleford Accountants, Ossett Accountants, Halifax Accountants, Holmfirth Accountants, Huddersfield Accountants, Ilkley Accountants, Morley Accountants, Mirfield Accountants, Batley Accountants, Pudsey Accountants, Leeds Accountants, Yeadon Accountants and Bradford Accountants.

Tax Advice Eastburn - Small Business Accountant Eastburn - Tax Return Preparation Eastburn - Financial Advice Eastburn - Financial Accountants Eastburn - Auditors Eastburn - Chartered Accountants Eastburn - Online Accounting Eastburn - Self-Assessments Eastburn