Finding an Accountant in Dowend: Does completing your yearly self-assessment form give you nightmares? This is an issue for you and countless other folks in Dowend. The obvious solution would be to pay a dependable Dowend accountant to tackle this process instead. If you find that doing your self-assessment tax return is too stressful, this might be the best solution. You should expect to pay roughly two to three hundred pounds for the average small business accountant. If you don't mind using an online service rather than somebody local to Dowend, you might be able to get this done for much less.

There are many different branches of accounting. So, it's essential that you pick one that suits your specific needs. Some Dowend accountants work alone, some within larger practices. An accounting firm will comprise accountants with different fields of expertise. The level of specialization within an accounting company might include actuaries, bookkeepers, investment accountants, forensic accountants, management accountants, auditors, chartered accountants, accounting technicians, financial accountants, costing accountants and tax preparation accountants.

For completing your self-assessment forms in Dowend you should find a properly qualified accountant. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. You can then have peace of mind knowing that your tax affairs are being handled professionally. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat. A lot of smaller businesses in Dowend choose to use bookkeepers rather than accountants.

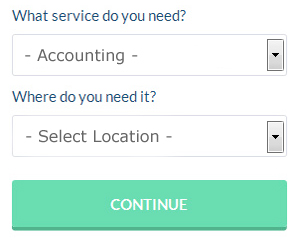

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Dowend accountant. All that is required is the ticking of a few boxes so that they can understand your exact needs. Then you just have to wait for some prospective accountants to contact you. When this article was written Bark was free to use.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. Services like this are convenient and cost effective. Some of these companies are more reputable than others. The better ones can soon be singled out by carefully studying reviews online. We will not be recommending any individual online accounting service in this article.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. You could even use a software program like Ablegatio, ACCTAX, Andica, Basetax, Gbooks, CalCal, Keytime, Taxforward, Taxshield, Nomisma, GoSimple, BTCSoftware, TaxCalc, Ajaccts, Forbes, Sage, Taxfiler, 123 e-Filing, Absolute Topup, Xero or Capium to make life even easier. Don't leave your self-assessment until the last minute, allow yourself plenty of time. If you send in your tax return up to three months late, HMRC will fine you £100, after that it is an additional £10 per day.

Auditors Dowend

An auditor is an individual or company authorised to examine and validate the accuracy of accounts to make certain that organisations comply with tax laws. They offer businesses from fraud, highlight irregularities in accounting methods and, sometimes, work as consultants, helping firms to determine ways to boost operational efficiency. To become an auditor, an individual has to be approved by the regulatory body for accounting and auditing or have earned certain specific qualifications.

Tips to Help You Manage Your Money Better

One of the things that every small business owner struggles with is managing money properly, and this is especially true in the beginning, when you are just trying to find your feet as a business runner and proprietor. Poor money management can be a real drag on your confidence, and when you are having money problems, you are more willing to take on any old job. This can cause you to not succeed in your business endeavor. Below are a few tips that will help manage your business finances better.

Keep separate accounts for your business and personal expenses, as trying to run everything through one account just makes everything confusing. It might seem simple at first but the truth is that in the long run it just makes everything more difficult. When your business expenses are running through your personal account, it can be very confusing and difficult to prove your income. In addition, it will be difficult to sort through your financial record when tax season comes and figure out which expenses are business related and which expenses were personal in nature. You'll be able to manage your finances better if you separate the business expenses from the personal expenses.

Each week, balance your books. If you run a traditional store with registers or that brings in multiple payments a day, it is better to balance your books at the end of every day, and this is particularly true if you handle cash. Keep track of every payment received and every payment made, then at the end of the week, make sure that what you have on hand and in the bank actually matches what your numbers say you should have. This way at the end of each month or every quarter, you lessen your load of having to trace back where the discrepancies are in your accounting. Balancing regularly will only take a few minutes, while balancing only every so often could take hours.

Make sure you deposit any money you receive at the end of the day if your business deals with cash on a fairly regular basis. This will help you eliminate the temptation of using money for non-business related things. If you know you have cash available, you're a lot more likely to dip into your money pool for unexpected expenses and just promise yourself you'll return the money back in a couple of days. You're bound to forget about it, though, and this will only mess your accounting and bookkeeping. So avoid this problem altogether by depositing your cash in the bank at the end of each business day.

There are many things involved in the proper management of your money. It's a lot more than simply keeping a list of your expenditures. When you're in business, you have several things you need to keep track of. We've shared some things in this article that should make tracking your money easier for you to do. As you become more skilled in managing your business finances, you'll be able to implement other things that will help make the process easier for you.

Dowend accountants will help with small business accounting, employment law, management accounts, corporate tax, charities, contractor accounts, partnership registrations, VAT returns, debt recovery, VAT registrations, financial statements, corporate finance, mergers and acquisitions, investment reviews, assurance services, double entry accounting, partnership accounts, cash flow, tax preparation, workplace pensions, year end accounts, bureau payroll services, tax investigations, company formations, business start-ups, financial planning, consultancy and systems advice, auditing and accounting, compliance and audit reporting, self-assessment tax returns, pension forecasts, general accounting services and other forms of accounting in Dowend, Gloucestershire.

When you're hunting for ideas and inspiration for personal tax assistance, self-assessment help, accounting for small businesses and accounting & auditing, you don't really need to look any further than the internet to get all the information that you need. With so many meticulously researched webpages and blog posts to select from, you will shortly be overwhelmed with new ideas for your forthcoming project. The other day we stumbled across this article on the subject of choosing the right accountant.

Dowend Accounting Services

- Dowend Auditing Services

- Dowend Tax Planning

- Dowend VAT Returns

- Dowend Chartered Accountants

- Dowend Debt Recovery

- Dowend Financial Advice

- Dowend Tax Advice

- Dowend Forensic Accounting

- Dowend Payroll Management

- Dowend Financial Audits

- Dowend Tax Refunds

- Dowend Account Management

- Dowend Tax Returns

- Dowend PAYE Healthchecks

Also find accountants in: Thrupp, Ruspidge, Haresfield, Great Barrington, Awkley, Foss Cross, Cannop, Lower Slaughter, Westcote, Acton Turville, Fiddington, Broad Campden, Randwick, Barton End, Lower Swell, Mork, Coln Rogers, Abson, Tormarton, Ashchurch, Alveston, Blockley, Syde, Down Hatherley, Leigh, Uckington, Tetbury Upton, Hardwicke, Andoversford, Duntisbourne Leer, Bussage, Gretton, Winstone, North Cerney, Pilley and more.

Accountant Dowend

Accountant Dowend Accountants Near Me

Accountants Near Me Accountants Dowend

Accountants DowendMore Gloucestershire Accountants: Stroud Accountants, Patchway Accountants, Tewkesbury Accountants, Cheltenham Accountants, Bradley Stoke Accountants, Thornbury Accountants, Yate Accountants, Oldland Accountants, Dodington Accountants, Bishops Cleeve Accountants, Churchdown Accountants, Gloucester Accountants, Bitton Accountants, Filton Accountants, Mangotsfield Accountants, Quedgeley Accountants, Cirencester Accountants and Stoke Gifford Accountants.

Auditors Dowend - Cheap Accountant Dowend - Tax Advice Dowend - Bookkeeping Dowend - Tax Preparation Dowend - Small Business Accountant Dowend - Online Accounting Dowend - Financial Accountants Dowend - Chartered Accountants Dowend