Finding an Accountant in Carlton: Filling out your yearly self-assessment form can certainly be a bit of a headache. This will be a challenge for you, together with innumerable other folks in Carlton, Suffolk. The obvious solution would be to pay a dependable Carlton accountant to tackle this job instead. If self-assessment is too complex for you, this may be the way forward. £200-£300 is the normal cost for such a service when using Carlton High St accountants. Online accounting services are available more cheaply than this.

Finding an accountant in Carlton is not always that easy with various types of accountants available. Therefore, it is vital that you pick an appropriate one for your company. It's not unusual for Carlton accountants to operate independently, others favour being part of a larger accounting firm. Accounting companies will have specialists in each particular accounting sector. Expect to find chartered accountants, cost accountants, management accountants, investment accountants, actuaries, financial accountants, forensic accountants, accounting technicians, auditors, tax preparation accountants and bookkeepers within an average sized accountancy company.

Finding an accountant in Carlton who is qualified is generally advisable. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. Qualified Carlton accountants might charge a bit more but they may also get you the maximum tax savings. Remember that a percentage of your accounting costs can be claimed back on the tax return. Many qualified bookkeepers offer tax returns services for smaller businesses and sole traders.

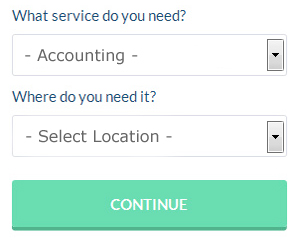

Though you may not have heard of them before there is an online service called Bark who can help you in your search. You'll be presented with a simple form which can be completed in a minute or two. Your requirements will be distributed to accountants in the Carlton area and they will be in touch with you directly. You will not be charged for this service.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. Over the last few years many more of these services have been appearing. Choose a company with a history of good service. A quick browse through some reviews online should give you an idea of the best and worse services.

At the top of the tree are chartered accountants, these professionals have all the qualifications and are experts in their field. While such specialists can deal with all aspects of finance, they may be over qualified for your modest needs. With a chartered accountant you will certainly have the best on your side.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Ablegatio, Forbes, ACCTAX, Sage, CalCal, Gbooks, Taxshield, Ajaccts, TaxCalc, Taxfiler, Xero, BTCSoftware, Absolute Topup, Keytime, Basetax, GoSimple, 123 e-Filing, Andica, Taxforward, Nomisma and Capium. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns. You�ll get a penalty of £100 if your tax return is up to 3 months late.

Auditors Carlton

Auditors are experts who review the accounts of organisations and companies to substantiate the validity and legality of their current financial records. They may also act as consultants to recommend potential the prevention of risk and the introduction of cost efficiency. For anybody to start working as an auditor they need to have specified qualifications and be licensed by the regulatory body for accounting and auditing.

Small Business Accountants Carlton

Ensuring that your accounts are accurate can be a demanding task for anyone running a small business in Carlton. Retaining a small business accountant in Carlton will allow you to operate your business knowing your annual accounts, tax returns and VAT, among many other business tax requirements, are being fully met.

Giving advice, ensuring that your business follows the optimum financial practices and providing ways to help your business to reach its full potential, are just some of the duties of an honest small business accountant in Carlton. The capricious and complicated field of business taxation will be clearly explained to you so as to minimise your business expenses, while maximising tax efficiency.

It is also essential that you clarify the structure of your business, your plans for the future and your company's financial circumstances accurately to your small business accountant. (Tags: Small Business Accounting Carlton, Small Business Accountant Carlton, Small Business Accountants Carlton).

Payroll Services Carlton

Staff payrolls can be a complicated area of running a business enterprise in Carlton, regardless of its size. The laws relating to payroll requirements for accuracy and openness mean that processing a company's payroll can be a formidable task for the uninitiated.

Using a professional accounting company in Carlton, to take care of your payroll requirements is the simple way to reduce the workload of yourself or your financial team. Your payroll service company can provide accurate BACS payments to your staff, as well as working together with any pension schemes that your company might have, and use current HMRC regulations for NI contributions and tax deductions.

It will also be necessary for a qualified payroll accountant in Carlton to provide a P60 declaration for all employees after the end of the financial year (by May 31st). At the end of a staff member's contract, the payroll company will also supply an updated P45 form outlining what tax has been paid during the last financial period.

Suggestions for Helping You Manage Your Finances Properly

There are many things you can do in life that are exciting, and one of them is starting up your own online or offline business. You are finally in charge of yourself, you are finally in charge of your income -- you are in charge of everything! That sounds a little scary, doesn't it? In addition to the excitement of being your own boss, it can be a bit intimidating particularly if you have no business experience. Thus, it can be very helpful if you know a few self-improvement strategies like managing your finances properly. Keep reading this article to learn how to correctly manage your money.

Don't mix your business and personal expenses by having just one account. If you do, you run the risk of confusion. You may not have problems in the beginning, but you can expect to have a hard time down the road. When your business expenses are running through your personal account, it can be very confusing and difficult to prove your income. Moreover, come tax season, you'll be in for a tough time proving which expenses were business related and which ones were personal. Streamline your process with two accounts.

Learn how to keep your books. Don't neglect the importance of having a system set up for both your personal and business finances. For this, you can use a basic spreadsheet or go with software like Quicken. There are also other online tools you can use, like Mint.com. You'll find plenty of free resources on the internet that can help small business owners like you manage your books better. Your books are the key to you knowing precisely how and where your money (personal and business) is being spent. It might even be in your best interest, particularly if you don't have the money to hire a professional to help you, to take a class is basic bookkeeping and accounting.

Control your spending. It may be that you've got a lot of things you wished you could buy before and now that you have a steady stream of income coming in, you're tempted to finally buy them. Stick to buying only the things that you honestly need to keep your business running. Anything you don't spend, put in your business savings account so you know you've got money for those unexpected business expenses. In addition, buying your office supplies in bulk will save you money. For computers, it's better if you spend money on a more expensive, but reliable system that will last for many years and won't need replaced every so often. Be smart about entertainment expenses, etc.

When it comes to properly managing your business finances, you'll find that there are a lot of things that go into doing so. You might assume that proper money management is a skill that isn't hard to acquire, but the reality is that it's a complicated process, especially when you're a small business owner. The tips we've shared should help you get started in managing your finances properly. One of the secrets to having a successful business is learning proper money management.

Carlton accountants will help with business start-ups Carlton, capital gains tax, accounting services for buy to let landlords, consultancy and systems advice, year end accounts in Carlton, accounting services for media companies Carlton, tax investigations in Carlton, HMRC liaison in Carlton, inheritance tax, corporate finance Carlton, litigation support in Carlton, contractor accounts, self-employed registrations, debt recovery, partnership accounts Carlton, audit and compliance reporting, small business accounting in Carlton, payslips Carlton, bureau payroll services in Carlton, company secretarial services Carlton, consulting services Carlton, estate planning, charities, corporation tax, personal tax, sole traders in Carlton, accounting and financial advice, financial planning, limited company accounting, investment reviews, cashflow projections, business outsourcing in Carlton and other forms of accounting in Carlton, Suffolk. Listed are just some of the duties that are accomplished by local accountants. Carlton providers will keep you informed about their whole range of services.

With the internet as a powerful resource it is possible to uncover a host of invaluable information and ideas about accounting for small businesses, self-assessment help, auditing & accounting and personal tax assistance. To illustrate, with a very quick search we came across this fascinating article detailing five tips for obtaining a quality accountant.

Carlton Accounting Services

- Carlton Auditing

- Carlton Tax Services

- Carlton Forensic Accounting

- Carlton Bookkeepers

- Carlton Account Management

- Carlton Payroll Services

- Carlton Tax Planning

- Carlton Debt Recovery

- Carlton VAT Returns

- Carlton Tax Advice

- Carlton Personal Taxation

- Carlton Chartered Accountants

- Carlton Self-Assessment

- Carlton Tax Returns

Also find accountants in: Frostenden, Kenton, Brabling Green, Redlingfield, Beck Row, Hawkedon, Thurston, Wissett, Exning, Brent Eleigh, Copdock, Hitcham, Barrow, Needham Market, Kirkley, Acton, Rodbridge Corner, Braiseworth, Hollesley, Middlewood Green, Lower Holbrook, Gedgrave Hall, Gipping, Fornham St Martin, Chelsworth, Ringsfield Corner, Thorns, Mendlesham Green, Gromford, Little Whittingham Green, Baylham, Snape, Martlesham Heath, Stanstead, Risby and more.

Accountant Carlton

Accountant Carlton Accountants Near Carlton

Accountants Near Carlton Accountants Carlton

Accountants CarltonMore Suffolk Accountants: Great Cornard Accountants, Stowmarket Accountants, Kesgrave Accountants, Woodbridge Accountants, Brandon Accountants, Felixstowe Accountants, Haverhill Accountants, Beccles Accountants, Bury St Edmunds Accountants, Ipswich Accountants, Mildenhall Accountants, Lowestoft Accountants, Sudbury Accountants and Newmarket Accountants.

Financial Advice Carlton - Tax Return Preparation Carlton - Self-Assessments Carlton - Tax Advice Carlton - Chartered Accountants Carlton - Financial Accountants Carlton - Auditors Carlton - Online Accounting Carlton - Bookkeeping Carlton