Finding an Accountant in Brize Norton: Have you found that filling out your self-assessment form every year gives you a headache? Many other people in Brize Norton have to overcome this very same problem. But how can you find a local accountant in Brize Norton to do this for you? Do you just find self-assessment too challenging to do on your own? You should expect to pay out about £200-£300 when retaining the services of a run-of-the-mill Brize Norton accountant or bookkeeper. If you don't mind using an online service rather than somebody local to Brize Norton, you may be able to get this done less expensively.

But precisely what will you have to pay, what standard of service should you expect and where can you uncover the right person? In the past the Yellow Pages or local newspaper would have been the first place to look, but these days the internet is a lot more popular. However, it is not always that easy to spot the good guys from the bad. The fact remains that anybody in Brize Norton can get themselves set up as an accountant. Qualifications are not even a necessity.

You would be best advised to find a fully qualified Brize Norton accountant to do your tax returns. For basic tax returns an AAT qualified accountant should be sufficient. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form. If your business is small or you are a sole trader you could consider using a bookkeeper instead.

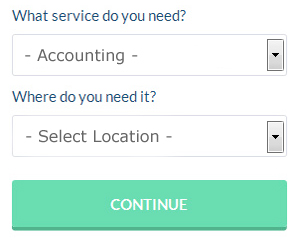

There is now a service available known as Bark, where you can look for local professionals including accountants. In no time at all you can fill out the job form and submit it with a single click. Your requirements will be distributed to accountants in the Brize Norton area and they will be in touch with you directly. You might as well try it because it's free.

You could always try an online tax returns service if your needs are fairly simple. A number of self-employed people in Brize Norton prefer to use this simple and convenient alternative. It would be advisable to investigate that any online company you use is reputable. Reading through reviews for any potential online services is a good way to get a feel for what is out there.

There is always the option of using a chartered accountant, but expect to pay top wack for these high flyers. Larger companies in the Brize Norton area may choose to use their expert services. All that remains is to make your final choice.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are ACCTAX, Gbooks, CalCal, Nomisma, Ablegatio, Forbes, Taxfiler, Andica, BTCSoftware, Absolute Topup, Ajaccts, Keytime, TaxCalc, GoSimple, Taxforward, Taxshield, Sage, Basetax, Xero, 123 e-Filing and Capium. You should get paperwork to your accountant promptly so that your tax returns can be prepared with time to spare.

Auditors Brize Norton

An auditor is a company or individual sanctioned to examine and verify the correctness of financial records and make sure that organisations observe tax legislation. Auditors appraise the financial behaviour of the firm that employs them and ensure the unwavering running of the business. To act as an auditor, a person must be authorised by the regulatory body for accounting and auditing and possess specified qualifications. (Tags: Auditing Brize Norton, Auditor Brize Norton, Auditors Brize Norton)

Small Business Accountants Brize Norton

Managing a small business in Brize Norton is stressful enough, without having to fret about your accounts and other bookkeeping tasks. A decent small business accountant in Brize Norton will offer you a stress free solution to keep your tax returns, annual accounts and VAT in the best possible order.

A quality small business accountant will see it as their duty to help your business to improve, supporting you with sound advice, and providing you with peace of mind and security regarding your financial situation. The fluctuating and complex world of business taxation will be clearly laid out for you in order to lower your business expenses, while at the same time maximising tax efficiency.

It is also crucial that you explain your plans for the future, your company's financial circumstances and the structure of your business truthfully to your small business accountant.

Payroll Services Brize Norton

For any business enterprise in Brize Norton, from large scale organisations down to independent contractors, dealing with staff payrolls can be stressful. Coping with company payrolls requires that all legal requirements regarding their timings, openness and exactness are followed to the finest detail.

Using an experienced accounting firm in Brize Norton, to handle your payroll requirements is a easiest way to reduce the workload of yourself or your financial department. The payroll management service will work with HMRC and pension scheme administrators, and take care of BACS payments to guarantee timely and accurate wage payment to all personnel.

Working to the current regulations, a dedicated payroll accountant in Brize Norton will also present every one of your staff members with a P60 after the end of each fiscal year. A P45 form should also be provided for any staff member who stops working for your business, in line with current legislation. (Tags: Payroll Accountants Brize Norton, Payroll Services Brize Norton, Payroll Administrator Brize Norton).

The Best Money Management Techniques for Business Self Improvement

It's not so hard to make a decision to start your own business. However, it's not so easy to start it up if you don't know how to, and it's even harder to get it up and running actually. It isn't that simple nor painless to get your business at a profitable level because there are things that will affect both your business and self-confidence. For instance, if you don't manage your finances properly, this can hurt you and your business. During the initial stages of your business, managing your money may be a simple task. But as you grow your business, the money management aspect is only going to become more complex so it's a good idea to keep the following tips in mind.

In case you're paying many business expenses on a regular basis, you may find it easier to charge them on your credit card. This can certainly help your memory because you only have one payment to make each month instead of several. But then again, there's a risk to using credit cards because you'll end up paying interest if you don't pay the balance off in full every month. You can continue using your credit card to make it easier on you to pay your bills, but make sure you don't carry a balance on your card to avoid accruing interest charges. When you do this, you streamline your process and not have to pay interest. Your credit rating will get a boost in the process.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. This can make it easier to keep track of your accounting both in your personal life and your professional life. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. You can decide how much you should pay yourself. You can pay yourself by billable hours or a portion of your business income for that month.

Be a prompt tax payer. Generally, taxes must be paid quarterly by small business owners. Taxes are among the most confusing things, so it's best if you check with the IRS or the small business center in your area to get accurate information. Additionally, you can have a professional set up a payment plan for you to ensure that you're paying your taxes promptly and that you're meeting all your business obligation as required by the law. You wouldn't want the IRS to come knocking on your door because you were remiss in paying your taxes.

A lot of things go into proper money management. Managing your money is not a basic skill or easy thing to learn. It's really a complicated process that requires constant learning and practicing, especially by small business owners. The tips we've shared should help you get started in managing your finances properly. One of the secrets to having a successful business is learning proper money management.

Brize Norton accountants will help with partnership registrations, business planning and support, estate planning, workplace pensions, employment law, year end accounts, accounting support services in Brize Norton, limited company accounting, corporation tax, bookkeeping in Brize Norton, VAT returns, capital gains tax, corporate finance, mergers and acquisitions, cash flow, accounting and financial advice, litigation support, investment reviews, business acquisition and disposal, accounting services for the construction industry in Brize Norton, payroll accounting, debt recovery, tax investigations, consulting services, payslips, HMRC liaison Brize Norton, business outsourcing Brize Norton, management accounts, National Insurance numbers in Brize Norton, compliance and audit issues Brize Norton, company secretarial services in Brize Norton, accounting services for buy to let property rentals in Brize Norton and other types of accounting in Brize Norton, Oxfordshire. These are just a selection of the duties that are performed by local accountants. Brize Norton providers will be happy to inform you of their full range of accounting services.

Brize Norton Accounting Services

- Brize Norton Forensic Accounting

- Brize Norton Account Management

- Brize Norton Bookkeeping

- Brize Norton Tax Refunds

- Brize Norton Taxation Advice

- Brize Norton Debt Recovery

- Brize Norton VAT Returns

- Brize Norton Audits

- Brize Norton Chartered Accountants

- Brize Norton Business Accounting

- Brize Norton Tax Planning

- Brize Norton Financial Advice

- Brize Norton Specialist Tax

- Brize Norton Payroll Services

Also find accountants in: Bampton, Launton, Great Rollright, East Hendred, Northmoor, Coleshill, Whitchurch, Milcombe, Shippon, Noke, Leafield, Cropredy, Moulsford, Nether Worton, Radcot, Thame, Bucknell, Shillingford, Stratton Audley, Pyrton, Garford, Headington, Idbury, Yelford, Kidmore End, Highmoor Cross, Gallowstree Common, Carterton, Warborough, Lew, Childrey, Chimney, Deddington, Ewelme, Kirtlington and more.

Accountant Brize Norton

Accountant Brize Norton Accountants Near Me

Accountants Near Me Accountants Brize Norton

Accountants Brize NortonMore Oxfordshire Accountants: Oxford Accountants, Abingdon Accountants, Wantage Accountants, Chipping Norton Accountants, Thame Accountants, Kidlington Accountants, Littlemore Accountants, Henley-on-Thames Accountants, Bicester Accountants, Grove Accountants, Didcot Accountants, Wallingford Accountants, Witney Accountants, Banbury Accountants and Carterton Accountants.

TOP - Accountants Brize Norton

Tax Accountants Brize Norton - Auditing Brize Norton - Financial Advice Brize Norton - Bookkeeping Brize Norton - Cheap Accountant Brize Norton - Self-Assessments Brize Norton - Financial Accountants Brize Norton - Tax Return Preparation Brize Norton - Investment Accounting Brize Norton