Finding an Accountant in Briston: It will come as no surprise if you're running your own business or are self-employed in Briston, that having an accountant can pay big dividends. One of the major advantages will be that with your accountant taking care of the routine financial paperwork and bookkeeping, you should have a lot more free time to commit to what you do best, the actual operation of your core business. The importance of getting this kind of financial assistance cannot be overstated, especially for start-ups and fledgling businesses who are not established yet.

So, exactly how should you set about obtaining an accountant in Briston? A few likely candidates can easily be located by carrying out a quick search on the internet. Though, ensuring that you single out an accountant that you can trust might not be quite as straightforward. The fact of the matter is that in the United Kingdom anyone can set up a business as an accountant or bookkeeper. They don't even have to hold any qualifications such as A Levels or BTEC's. Which is astounding to say the least.

It should be easy enough to track down an accountant who actually does have the relevant qualifications. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat. Many qualified bookkeepers offer tax returns services for smaller businesses and sole traders.

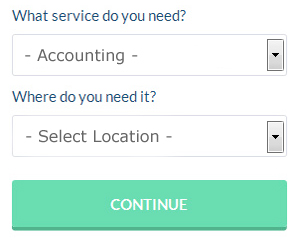

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. You'll be presented with a simple form which can be completed in a minute or two. It is then simply a case of waiting for some suitable responses. There is no fee for this service.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. The popularity of these services has been increasing in recent years. Should you decide to go down this route, take care in choosing a legitimate company. The better ones can soon be singled out by carefully studying reviews online.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? Software programs like Ajaccts, Capium, Andica, Gbooks, Nomisma, Taxforward, Xero, Forbes, Keytime, Basetax, CalCal, ACCTAX, 123 e-Filing, BTCSoftware, Taxshield, Absolute Topup, Taxfiler, Ablegatio, GoSimple, TaxCalc and Sage have been developed to help small businesses do their own tax returns. Make sure your tax returns are sent off promptly to avoid getting a penalty fine. If you send in your tax return up to three months late, HMRC will fine you £100, after that it is an additional £10 per day.

Auditors Briston

Auditors are experts who examine the accounts of organisations and companies to confirm the validity and legality of their current financial records. Auditors analyze the fiscal actions of the company that appoints them and make certain of the constant operation of the organisation. For anybody to start working as an auditor they need to have specific qualifications and be licensed by the regulatory body for auditing and accounting. (Tags: Auditor Briston, Auditors Briston, Auditing Briston)

Actuaries Briston

An actuary evaluates, gives advice on and manages financial risks. Actuaries employ their mathematical expertise to determine the probability and risk of future happenings and to estimate their impact (financially) on a business and their clientele. To be an actuary it's essential to have an economic, statistical and mathematical understanding of everyday situations in the financial world. (Tags: Actuary Briston, Financial Actuary Briston, Actuaries Briston)

Small Business Accountants Briston

Making certain your accounts are accurate and up-to-date can be a challenging task for anyone running a small business in Briston. A dedicated small business accountant in Briston will provide you with a stress free means to keep your annual accounts, tax returns and VAT in perfect order.

Helping you expand your business, and giving financial advice relating to your specific situation, are just a couple of the ways that a small business accountant in Briston can benefit you. An accountancy firm in Briston should provide an assigned small business accountant and adviser who will clear the haze that shrouds the area of business taxation, in order to optimise your tax efficiency.

So as to do their job effectively, a small business accountant in Briston will want to know complete details with regards to your present financial standing, business structure and any possible investments that you might be thinking about, or already have set up. (Tags: Small Business Accounting Briston, Small Business Accountant Briston, Small Business Accountants Briston).

Payroll Services Briston

Payrolls for staff can be a stressful area of running a company in Briston, no matter its size. The legislation on payrolls and the legal requirements for openness and accuracy means that handling a business's payroll can be an intimidating task.

A small business may not have the luxury of an in-house financial specialist and a good way to cope with employee payrolls is to retain the services of an outside accounting company in Briston. Your payroll company can provide accurate BACS payments to your employees, as well as working along with any pension scheme administrators that your company may have, and use the latest HMRC regulations for deductions and NI contributions.

Following the current regulations, a certified payroll accountant in Briston will also present every one of your workers with a P60 at the end of each financial year. At the end of an employee's contract, the payroll service must also supply an updated P45 outlining what tax has been paid in the last financial period.

Learn How to Manage Your Business Budget Properly

When it comes to putting up your own business, it's easy to make the decision but hard to start it up if you have no clue. Even harder is to get your business going. For many new business owners, it's hardest to make their business profitable mainly because of the things that can happen during the process that can adversely impact the business and their self-confidence. If you don't properly manage your money, for example, you and your business will suffer. In the beginning, you might think that money management isn't something you should focus on because you can easily figure out your earning and expenses. We're sharing a few proper money management tips to help you out because the financial aspect of your business is only going to get more complicated as your business grows.

It's best if you have separate account for your personal expenses and business expenses. This will help minimize confusion. You may not have problems in the beginning, but you can expect to have a hard time down the road. For one thing, proving your income is much more difficult when you run your business expenses through a personal account. It is also difficult to prove, come tax time, how much money you are actually spending on business expenses when those are mixed in with withdrawals for things like groceries etc. Having separate accounts for your personal and business finances will save you a lot of headaches in the long run.

Try to balance your books once every week. However, you should balance your books at the end of business day every day if what you have is a traditional store with cash registers or takes in multiple payments throughout the day every day. You need to record all of the payments you receive and make. At the end of the day or week, you need to make sure that the amount you have on hand and in the bank tallies with the amount you have in your records. When you do this, at the end of the month or every quarter, you're going to save yourself a lot of time and trouble trying to find where the discrepancies are if the numbers don't match up. Besides, it will only take you a few minutes if you balance your books regularly, whereas if you balance your books once a month, that would take you hours to do.

Save every receipt. For one thing, you are going to need them if the IRS ever wants to see proof of what you have been spending and where. For another, they act as a record of all of your expenditures. Be organized with your receipts and have them together in just one place. If you do this, you can easily track transactions or expenses. You can easily keep track of and access your receipts by putting them in an accordion file and placing that file in your desk drawer.

You can improve yourself in many ways when you're managing your own business. You can be better at managing your business, for example. There are very few people who wouldn't want to have better skills at managing their finances. When you know how to properly manage your money, your self-confidence will improve in the process. Most importantly, your business and personal life will become a lot easier to organize. There are many other money management tips out there that you can apply to your small business. Give the ones we provided here a try and you'll see yourself improving in your money management skills soon.

Briston accountants will help with accounting services for media companies, payroll accounting in Briston, financial statements Briston, contractor accounts, business advisory services, cash flow, business disposal and acquisition, consultancy and systems advice, partnership accounts, mergers and acquisitions, financial planning, HMRC submissions, business start-ups in Briston, corporate finance, VAT returns, tax investigations, inheritance tax, VAT registrations, corporation tax Briston, management accounts Briston, tax preparation, business outsourcing, year end accounts, consulting services, charities Briston, assurance services, business support and planning Briston, HMRC submissions, self-employed registration, audit and compliance reporting in Briston, litigation support in Briston, small business accounting and other professional accounting services in Briston, Norfolk. Listed are just a few of the duties that are carried out by nearby accountants. Briston professionals will be delighted to keep you abreast of their whole range of services.

When you are searching for inspiration and ideas for personal tax assistance, accounting & auditing, self-assessment help and accounting for small businesses, you will not really need to look any further than the world wide web to get everything you could need. With so many meticulously researched blog posts and webpages on offer, you will quickly be knee-deep in great ideas for your upcoming project. We recently came across this compelling article outlining five tips for finding a top-notch accountant.

Briston Accounting Services

- Briston PAYE Healthchecks

- Briston Personal Taxation

- Briston Business Accounting

- Briston Financial Advice

- Briston Chartered Accountants

- Briston Tax Advice

- Briston Payroll Services

- Briston Debt Recovery

- Briston Tax Refunds

- Briston Self-Assessment

- Briston Business Planning

- Briston Specialist Tax

- Briston Forensic Accounting

- Briston Bookkeepers

Also find accountants in: Repps, Burnham Norton, Ashwellthorpe, Wood Dalling, Antingham, Freethorpe, Colkirk, Beeston, Little Melton, Setchey, Tilney All Saints, Cantley, Oxwick, Beighton, Fundenhall, Irstead, Witton Bridge, Ashill, Tivetshall St Margaret, North Burlingham, Winterton On Sea, Foxley, Raveningham, Rushford, Toftwood, Smallworth, Fring, West Walton, Waxham, Thursford, Melton Constable, Carleton Rode, Clenchwarton, Harleston, Alderford and more.

Accountant Briston

Accountant Briston Accountants Near Me

Accountants Near Me Accountants Briston

Accountants BristonMore Norfolk Accountants: Thorpe St Andrew Accountants, Sprowston Accountants, Taverham Accountants, Hellesdon Accountants, Cromer Accountants, Caister-on-Sea Accountants, Costessey Accountants, Kings Lynn Accountants, Dereham Accountants, Thetford Accountants, Bradwell Accountants, Great Yarmouth Accountants, North Walsham Accountants, Attleborough Accountants, Swaffham Accountants, Wymondham Accountants, Norwich Accountants and Fakenham Accountants.

Chartered Accountant Briston - Tax Preparation Briston - Online Accounting Briston - Tax Advice Briston - Investment Accounting Briston - Self-Assessments Briston - Cheap Accountant Briston - Financial Accountants Briston - Auditors Briston