Finding an Accountant in Brandon: There are many benefits from hiring the services of an accountant if you are running a business or are self-employed in the Brandon area. You should at the very least have much more time to concentrate on your key business activities while the accountant handles the routine bookkeeping and paperwork. While if you've just started in business and feel that your money could be better spent elsewhere, think again, the assistance of an accountant could be vital to your success. Having access to expert financial advice will help your Brandon business to grow and prosper.

Brandon accountants come in various forms. Choosing one that satisfies your needs precisely should be your goal. It's not unusual for Brandon accountants to work independently, others prefer being part of an accounting company. The different accounting fields can be better covered by an accountancy company with several experts on hand. Usually accounting firms will employ: actuaries, financial accountants, forensic accountants, management accountants, chartered accountants, bookkeepers, accounting technicians, investment accountants, costing accountants, auditors and tax preparation accountants.

Therefore you should check that your chosen Brandon accountant has the appropriate qualifications to do the job competently. Your minimum requirement should be an AAT qualified accountant. You can then have peace of mind knowing that your tax affairs are being handled professionally. Your accountant will add his/her fees as tax deductable.

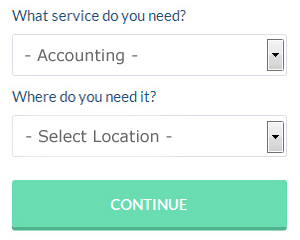

If you need a little help with your online search, there are numerous accountants who can be contacted through a website called Bark.com. With Bark it is simply a process of ticking a few boxes and submitting a form. It is then simply a case of waiting for some suitable responses. Bark do not charge people looking for services.

If you prefer the cheaper option of using an online tax returns service there are several available. More accountants are offering this modern alternative. Do some homework to single out a company with a good reputation. Carefully read reviews online in order to find the best available.

The most highly qualified and generally most expensive within this profession are chartered accountants. However, as a sole trader or smaller business in Brandon using one of these specialists may be a bit of overkill. If you can afford one why not hire the best?

Maybe when you have looked all the options you will still decide to do your own tax returns. You can take much of the hard graft out of this procedure by using a software program such as ACCTAX, CalCal, Taxshield, BTCSoftware, Absolute Topup, Taxforward, Xero, Keytime, Nomisma, Forbes, Taxfiler, Ajaccts, Andica, 123 e-Filing, Capium, TaxCalc, Sage, Ablegatio, GoSimple, Gbooks or Basetax. Whichever service you use your tax returns will need to be in on time to avoid penalties.

Auditors Brandon

An auditor is a person or a firm appointed by a company or organisation to complete an audit, which is the official assessment of the accounts, generally by an unbiased body. They also often adopt an advisory role to advocate potential risk prevention measures and the implementation of cost reductions. To work as an auditor, an individual has to be certified by the regulating body for auditing and accounting and possess certain qualifications. (Tags: Auditing Brandon, Auditor Brandon, Auditors Brandon)

Small Business Accountants Brandon

Doing the accounts can be a stressful experience for any small business owner in Brandon. A focused small business accountant in Brandon will provide you with a stress free means to keep your tax returns, annual accounts and VAT in the best possible order.

A responsible small business accountant will regard it as their responsibility to help your business expand, supporting you with good guidance, and providing you with peace of mind and security regarding your financial situation at all times. A responsible accounting firm in Brandon will be able to offer you proactive small business guidance to maximise your tax efficiency while reducing costs; critical in the sometimes shady sphere of business taxation.

To be able to do their job properly, a small business accountant in Brandon will have to know accurate details with regards to your present financial standing, business structure and any possible investment you may be looking at, or have set up. (Tags: Small Business Accountant Brandon, Small Business Accounting Brandon, Small Business Accountants Brandon).

Improving Yourself and Your Business with the Help of the Top Money Management Techniques

It's not so hard to make a decision to start your own business. However, it's not so easy to start it up if you don't know how to, and it's even harder to get it up and running actually. It is most difficult to make your business profitable because there are so many things that can take place along the way that will not just negatively affect your business but your confidence level as well. For instance, if you don't manage your finances properly, this can hurt you and your business. In the beginning, you might think that money management isn't something you should focus on because you can easily figure out your earning and expenses. We're sharing a few proper money management tips to help you out because the financial aspect of your business is only going to get more complicated as your business grows.

Get yourself an accountant. This is a business expense that will pay for itself a hundredfold because you know your books will be in order. There are many things that an accountant can help you with, including keeping track of your cash flow, paying yourself, and meeting your tax obligations. The great thing is that all the paperwork will be handled by your accountant. You can then focus your attention towards the more profitable aspects of your business, such as increasing your customer base, creating new products, and such. An accountant can save you days of time and quite a lot of headaches.

Try to learn bookkeeping. Don't neglect the importance of having a system set up for both your personal and business finances. You can either use basic spreadsheet or software such as QuickBooks. There are also personal budgeting tools out there that you can use such as Mint.com. You'll find plenty of free resources on the internet that can help small business owners like you manage your books better. It's crucial that you keep your books in order because they provide you a clear picture of what your finances (both personal and business) look like. It's also a good idea to take a couple of classes on basic accounting and bookkeeping, particularly if you're not in a position yet to hire a bookkeeper full-time.

Fight the urge to spend unnecessarily. It's certainly very tempting to start buying things you've always wanted when the money is coming in. Stick to buying only the things that you honestly need to keep your business running. Also, it's better if you build your business savings. This way, should unexpected expenses crop up, you'll be able to deal with it in a timely manner. In addition, buying your office supplies in bulk will save you money. For computing equipment, go for quality even if it's a little more expensive. This will actually save you more money because you'll get more years out of the equipment and you won't have to replace them as often. As for your entertainment expenses, you need to be smart about it as well.

You can improve yourself in many ways when you're managing your own business. Having a business can help you hone your money management skills. Most people wish they were better money managers. When you learn proper money management, your self-confidence can be helped a lot. Most importantly, your business and personal life will become a lot easier to organize. We've shared some tips for better money management for your small business in this article, and as you work and learn, you'll come up with plenty of others.

Brandon accountants will help with audit and compliance reports, general accounting services, annual tax returns, estate planning Brandon, pension forecasts, management accounts, year end accounts, business support and planning, PAYE Brandon, consultancy and systems advice, auditing and accounting Brandon, charities, company formations, company secretarial services in Brandon, corporation tax, inheritance tax, bureau payroll services, litigation support, capital gains tax Brandon, small business accounting Brandon, mergers and acquisitions Brandon, business outsourcing, accounting services for start-ups, limited company accounting, tax preparation Brandon, consulting services, partnership registrations, cash flow Brandon, monthly payroll, workplace pensions, payslips, personal tax and other accounting related services in Brandon, Suffolk. These are just an example of the activities that are performed by local accountants. Brandon companies will inform you of their whole range of accounting services.

Brandon Accounting Services

- Brandon Bookkeeping Healthchecks

- Brandon Account Management

- Brandon Tax Services

- Brandon Financial Advice

- Brandon Taxation Advice

- Brandon Personal Taxation

- Brandon Chartered Accountants

- Brandon PAYE Healthchecks

- Brandon Self-Assessment

- Brandon Audits

- Brandon Debt Recovery

- Brandon VAT Returns

- Brandon Business Planning

- Brandon Tax Planning

Also find accountants in: Wickham Street, Capel St Andrew, Knodishall, Hopton, Henstead, Boyton, Leavenheath, Rede, Halesworth, Stuston, Little Glemham, Herringfleet, Naughton, West Stow, Thorndon, Brightwell, Chickering, Upper Street, Witnesham, Red Lodge, Harkstead, Preston, Brandeston, Boxford, Easton, High Street Green, Great Finborough, Coldfair Green, Carlton, Kirkley, Wetheringsett, Old Felixstowe, Cransford, Homersfield, Felixstowe and more.

Accountant Brandon

Accountant Brandon Accountants Near Brandon

Accountants Near Brandon Accountants Brandon

Accountants BrandonMore Suffolk Accountants: Stowmarket Accountants, Brandon Accountants, Bury St Edmunds Accountants, Great Cornard Accountants, Haverhill Accountants, Kesgrave Accountants, Mildenhall Accountants, Lowestoft Accountants, Newmarket Accountants, Beccles Accountants, Sudbury Accountants, Hadleigh Accountants, Ipswich Accountants and Felixstowe Accountants.

Auditing Brandon - Investment Accounting Brandon - Self-Assessments Brandon - Bookkeeping Brandon - Financial Accountants Brandon - Tax Accountants Brandon - Small Business Accountant Brandon - Cheap Accountant Brandon - Chartered Accountant Brandon