Finding an Accountant in Birstall: Have you found that completing your self-assessment form every year is a real headache? This can be a challenge for you and many other Birstall folks in self-employment. But how do you find an accountant in Birstall to do it for you? This could be the best option if you consider self-assessment just too time-consuming. This should cost you approximately £200-£300 if you use the services of an average Birstall accountant. Instead of using a local Birstall accountant you could try one of the currently available online self-assessment services which might offer a saving.

Accountants don't merely handle tax returns, there are different types of accountant. So, its crucial to identify an accountant who can fulfil your requirements. Another decision that you will have to make is whether to go for an accounting company or an independent accountant. Accounting practices will have experts in each specific accounting department. Among the main accountancy jobs are: auditors, cost accountants, tax preparation accountants, investment accountants, actuaries, bookkeepers, management accountants, chartered accountants, financial accountants, accounting technicians and forensic accountants.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. You will be able to claim the cost of your accountant as a tax deduction. A qualified bookkeeper will probably be just as suitable for sole traders and smaller businesses in Birstall.

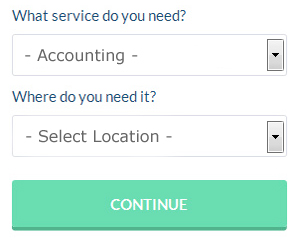

By using an online service such as Bark.com you could be put in touch with a number of local accountants. You will quickly be able to complete the form and your search will begin. Sometimes in as little as a couple of hours you will hear from prospective Birstall accountants who are keen to get to work for you. There is no fee for this service.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. More accountants are offering this modern alternative. It would be advisable to investigate that any online company you use is reputable. Study reviews and customer feedback.

If you really want the best you could go with a chartered accountant. These people are financial experts and are more commonly used by bigger companies. If you want the best person for your business this might be an option.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example 123 e-Filing, Xero, Basetax, Taxforward, Capium, Andica, CalCal, Sage, TaxCalc, Taxfiler, GoSimple, Nomisma, Ajaccts, BTCSoftware, Keytime, Absolute Topup, Ablegatio, Gbooks, Taxshield, ACCTAX and Forbes. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Auditors Birstall

An auditor is a person or company selected by a firm to undertake an audit, which is the official inspection of an organisation's financial accounts, generally by an impartial body. They may also act as advisors to advocate potential risk prevention measures and the introduction of cost efficiency. Auditors need to be licensed by the regulatory body for accounting and auditing and also have the required accounting qualifications. (Tags: Auditors Birstall, Auditing Birstall, Auditor Birstall)

Actuaries Birstall

Actuaries work within government departments and organisations, to help them predict long-term investment risks and financial costs. Actuaries employ their mathematical expertise to estimate the risk and probability of future happenings and to predict their effect (financially) on a business and it's customers. An actuary uses mathematics and statistical concepts to calculate the fiscal effect of uncertainty and help their clientele reduce potential risks. (Tags: Actuary Birstall, Actuaries Birstall, Financial Actuary Birstall)

Small Business Accountants Birstall

Doing the yearly accounts can be a fairly stress-filled experience for anybody running a small business in Birstall. If your annual accounts are getting you down and VAT and tax return issues are causing sleepless nights, it is wise to hire a small business accountant in Birstall.

A quality small business accountant will regard it as their duty to help your business to improve, encouraging you with sound guidance, and providing you with security and peace of mind about your financial situation at all times. An accountancy firm in Birstall should provide you with a dedicated small business accountant and adviser who will clear the fog that veils business taxation, so as to maximise your tax efficiences.

A small business accountant, to do their job effectively, will want to know complete details with regards to your present financial standing, company structure and any future investments that you might be looking at, or have set up. (Tags: Small Business Accountant Birstall, Small Business Accountants Birstall, Small Business Accounting Birstall).

Payroll Services Birstall

For any business in Birstall, from large scale organisations down to independent contractors, staff payrolls can be stressful. Handling payrolls requires that all legal requirements in relation to their timing, exactness and transparency are followed in all cases.

Using a professional accountant in Birstall, to handle your payroll is the simple way to reduce the workload of yourself or your financial team. Your payroll accounting company can provide accurate BACS payments to your personnel, as well as working with any pension providers that your company might have, and use the latest HMRC legislation for NI contributions and deductions.

It will also be a requirement for a decent payroll accountant in Birstall to provide an accurate P60 tax form for each staff member after the end of the financial year (by 31st May). Upon the termination of a staff member's contract with your company, the payroll company must also provide a current P45 outlining what tax has been paid in the previous financial period. (Tags: Payroll Services Birstall, Payroll Accountant Birstall, Payroll Outsourcing Birstall).

Tips to Help You Manage Your Business Finances Better

Whether you're starting up an online or offline business, it can be one of the most exciting things you'd ever do. You get to be in charge of practically everything when you've got your own business -- your time, the work you do, and even your income! It can be kind of scary, can't it? Although it's exhilarating, putting up your own business is also an intimidating process, especially if you're a complete novice. In this case, you'll benefit a great deal from knowing a few simple techniques like managing your business finances properly. Today, we've got a few suggestions on how you can keep your finances in order.

It could be that you use your credit card to pay many of your regular expenditures like web hosting, recurring membership fees, advertising accounts, and so on. This can make your life easier because each month, you just make one payment to your credit card company instead of making out payments to several different companies. Still, there's the risk that with a credit card, you'll be paying interest if you carry a balance each month. If this happens regularly, you'll be better off paying each of your monthly expenditures directly from your business bank account. Sure, you can keep putting your monthly expenditures on your credit card, but if you do, you should pay the balance in full each month. With this money management strategy, you only have to keep track of one consolidated payment, not pay any interest, and build your credit rating.

Each week, balance your books. If you run a traditional store with registers or that brings in multiple payments a day, it is better to balance your books at the end of every day, and this is particularly true if you handle cash. Balance your books every day or every week to make sure that your numbers are the same as the numbers reflected in your bank account or cash you have on hand. When you do this, at the end of the month or every quarter, you're going to save yourself a lot of time and trouble trying to find where the discrepancies are if the numbers don't match up. If you regularly balance your books, you won't need to spend too long a time doing it. If you do it every once in a while, though, it can take hours.

Take control of your spending. When your business is steadily pulling in a nice income, you may be tempted to go on a buying spree and buy all those things you've always wanted to buy but couldn't afford. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. You'll be better off building your business savings than splurging whenever you get the chance. This way, you're in a better position to deal with unexpected expenses in a timely manner. You should also try buying your business supplies in bulk. For computing equipment, go for quality even if it's a little more expensive. This will actually save you more money because you'll get more years out of the equipment and you won't have to replace them as often. Avoid spending too much on your entertainment as well; be moderate instead.

There are lots of ways to practice self improvement in your business. You can be better at managing your business, for example. Most people wish they were better money managers. Your self-confidence can be given a huge boost when you learn how to manage your money properly. Moreover, your business and personal lives will be more organized. Keep in mind the money management tips we shared in this article. Keep applying them to your business and you'll soon see much success.

Birstall accountants will help with corporate tax, management accounts, personal tax in Birstall, audit and compliance reports Birstall, bookkeeping in Birstall, assurance services, self-employed registrations Birstall, financial and accounting advice, financial statements in Birstall, bureau payroll services, consulting services, investment reviews, HMRC submissions, estate planning, mergers and acquisitions, sole traders in Birstall, inheritance tax Birstall, accounting services for landlords in Birstall, small business accounting, consultancy and systems advice, financial planning, litigation support Birstall, debt recovery in Birstall, accounting support services, VAT registrations, payroll accounting in Birstall, National Insurance numbers, tax preparation, charities in Birstall, capital gains tax Birstall, company secretarial services, taxation accounting services and other kinds of accounting in Birstall, Leicestershire. Listed are just a small portion of the activities that are handled by local accountants. Birstall companies will be delighted to keep you abreast of their full range of accounting services.

You actually have the best resource close at hand in the form of the internet. There is such a lot of information and inspiration available online for things like auditing & accounting, small business accounting, self-assessment help and personal tax assistance, that you will pretty quickly be bursting with ideas for your accounting needs. An example might be this super article on how to uncover a quality accountant.

Birstall Accounting Services

- Birstall Tax Planning

- Birstall Specialist Tax

- Birstall Tax Refunds

- Birstall Forensic Accounting

- Birstall Business Planning

- Birstall Chartered Accountants

- Birstall Business Accounting

- Birstall Bookkeeping Healthchecks

- Birstall Financial Advice

- Birstall Tax Services

- Birstall Tax Advice

- Birstall PAYE Healthchecks

- Birstall Account Management

- Birstall Bookkeepers

Also find accountants in: Humberstone, Claybrooke Parva, Stonesby, Ashby Magna, North Kilworth, Wymondham, Mountsorrel, Shawell, Peatling Magna, Stoughton, Groby, Swinford, Knipton, Allexton, Thurmaston, Goadby, Oadby, Syston, Gaulby, Barsby, Burton On The Wolds, Plungar, Woodhouse Eaves, Bitteswell, Rotherby, Church Langton, Botcheston, Misterton, Newton Burgoland, Belvoir, Glenfield, Cold Newton, Husbands Bosworth, Loddington, Bardon and more.

Accountant Birstall

Accountant Birstall Accountants Near Birstall

Accountants Near Birstall Accountants Birstall

Accountants BirstallMore Leicestershire Accountants: Wigston Magna Accountants, Narborough Accountants, Ashby-de-La-Zouch Accountants, Shepshed Accountants, Earl Shilton Accountants, Birstall Accountants, Lutterworth Accountants, Thurmaston Accountants, Market Harborough Accountants, Burbage Accountants, Sileby Accountants, Leicester Accountants, Syston Accountants, Broughton Astley Accountants, Hinckley Accountants, Oadby Accountants, Braunstone Accountants, Melton Mowbray Accountants and Loughborough Accountants.

Online Accounting Birstall - Chartered Accountant Birstall - Investment Accounting Birstall - Financial Advice Birstall - Small Business Accountants Birstall - Self-Assessments Birstall - Financial Accountants Birstall - Tax Advice Birstall - Auditing Birstall