Finding an Accountant in Birmingham: It will come as no surprise if you're self-employed or running your own business in Birmingham, that having your own accountant can pay big dividends. Most significantly you'll have more time to focus on your core business operations, while your accountant handles such things as tax returns and bookkeeping. If you're only just getting started in business you'll find the assistance of a professional accountant invaluable.

So, precisely how should you set about obtaining an accountant in Birmingham? Nowadays the go to place for acquiring local services is the internet, and accountants are certainly no exception, with plenty promoting their services on the web. But, how do you know which ones can be trusted with your paperwork? The fact remains that anyone in Birmingham can set themselves up as an accountant. No certifications or qualifications are required by law in the UK. Which, like me, you might find astounding.

If you want your tax returns to be correct and error free it might be better to opt for a professional Birmingham accountant who is appropriately qualified. An AAT qualified accountant should be adequate for sole traders and small businesses. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. Your accountant will add his/her fees as tax deductable. Small businesses and sole traders can use a bookkeeper rather than an accountant.

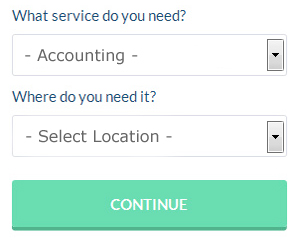

If you need a little help with your online search, there are numerous accountants who can be contacted through a website called Bark.com. You'll be presented with a simple form which can be completed in a minute or two. Your details will be sent out to potential accountants and they will contact you directly with details and prices.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. It could be that this solution will be more appropriate for you. If you decide to go with this method, pick a company with a decent reputation. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable.

If you are prepared to slash out and really get the best, you would be looking at using a chartered accountant for your finances. While such specialists can deal with all aspects of finance, they may be over qualified for your modest needs. This widens your choice of accountants.

The cheapest option of all is to do your own self-assessment form. These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of Forbes, Gbooks, TaxCalc, GoSimple, Taxfiler, Taxforward, Taxshield, Absolute Topup, Capium, Ablegatio, Nomisma, BTCSoftware, Andica, Xero, ACCTAX, Sage, Basetax, Ajaccts, CalCal, 123 e-Filing and Keytime. If you don't get your self-assessment in on time you will get fined by HMRC.

Auditors Birmingham

An auditor is an individual or a firm appointed by a company or organisation to complete an audit, which is an official examination of the accounts, typically by an independent body. They also sometimes act in a consultative role to encourage possible the prevention of risk and the application of cost savings. Auditors have to be certified by the regulatory authority for auditing and accounting and also have the required accounting qualifications. (Tags: Auditor Birmingham, Auditing Birmingham, Auditors Birmingham)

Forensic Accountant Birmingham

You might well encounter the phrase "forensic accounting" when you are looking to find an accountant in Birmingham, and will perhaps be interested to know about the difference between forensic accounting and standard accounting. The hint for this is the actual word 'forensic', which essentially means "appropriate for use in a law court." Occasionally also referred to as 'financial forensics' or 'forensic accountancy', it uses accounting, auditing and investigative skills to inspect financial accounts in order to identify criminal activity and fraud. Some of the bigger accountancy firms in and around Birmingham even have specialist departments addressing personal injury claims, bankruptcy, money laundering, professional negligence, tax fraud, false insurance claims and insolvency. (Tags: Forensic Accountants Birmingham, Forensic Accountant Birmingham, Forensic Accounting Birmingham)

Actuaries Birmingham

Analysts and actuaries are specialists in risk management. These risks can impact on both sides of a company balance sheet and call for liability management, asset management and valuation skills. To work as an actuary it is essential to have a mathematical, statistical and economic awareness of day to day situations in the world of business finance. (Tags: Actuaries Birmingham, Actuary Birmingham, Financial Actuaries Birmingham)

Small Business Accountant Birmingham

Making sure that your accounts are accurate can be a stressful job for any small business owner in Birmingham. Hiring a small business accountant in Birmingham will allow you to operate your business knowing your annual accounts, VAT and tax returns, and various other business tax requirements, are being met.

A good small business accountant will see it as their responsibility to help your business improve, encouraging you with good advice, and giving you peace of mind and security concerning your financial situation at all times. An effective accounting firm in Birmingham will offer you practical small business advice to optimise your tax efficiency while at the same time minimising business expenditure; crucial in the sometimes shadowy world of business taxation.

You also ought to be supplied with a dedicated accountancy manager who understands your business structure, your company's situation and your future plans.

Payroll Services Birmingham

An important element of any business enterprise in Birmingham, large or small, is having an efficient payroll system for its personnel. The regulations on payrolls and the legal obligations for accuracy and transparency means that handling a business's payroll can be a daunting task.

A small business may well not have the luxury of a dedicated financial specialist and the simplest way to work with employee payrolls is to retain the services of an external accountant in Birmingham. The payroll service will work with HMRC and pension providers, and take care of BACS payments to ensure accurate and timely wage payment to all staff.

A dedicated payroll accountant in Birmingham will also, in keeping with the current legislation, organise P60's at the end of the financial year for each of your staff members. They will also be responsible for providing P45 tax forms at the end of an employee's working contract.

Self Improvement for Business Through Better Money Management

It's not so hard to make a decision to start your own business. However, it's not so easy to start it up if you don't know how to, and it's even harder to get it up and running actually. Making your business a profitable success is the most difficult thing of all because a lot can happen along the way to hurt your business and your confidence level. Failing to manage your money properly is one of the things that can contribute to this. You might not think that there is much to money management because in the beginning it might be pretty simple. But as you grow your business, the money management aspect is only going to become more complex so it's a good idea to keep the following tips in mind.

It can be tempting to wait to pay your taxes until they are due, but if you are not good at managing your money, you may not have the funds on hand to actually pay your estimated tax payments and other fees. Try saving a portion of your daily or even weekly earnings and depositing it in a separate bank account. Thus, when it's time for you to pay your quarterly taxes, you only need to take the money out from this account and not your current account. You actually save yourself the trouble of wondering where or how you're going to come up with the money. As a business owner, you'll be able to breathe easily each time knowing that you're able to pay your taxes fully and promptly.

Learn how to keep your books. Having a system in place for your business and personal finance is crucial. You can do this simply by setting up a basic Excel spreadsheet or you could use bookkeeping software like Quicken or QuickBooks. You could also try to use a personal budgeting tool like Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. Your books are your key to truly understanding your money because they help you see what is happening with your business (and personal) finances. It might even be in your best interest, particularly if you don't have the money to hire a professional to help you, to take a class is basic bookkeeping and accounting.

Just as you should track every penny you spend, you should track every penny that goes in as well. Each time you're paid by a client or customer for a service you provided or a product you sold them, record that amount. This is important for two reasons: one, you need to know how much money you have coming in, and two, you need to be able to track who has paid you and who still needs to pay you. It also makes it easy to figure out what you owe in taxes and how much you should pay yourself for that week or month.

There are many things involved in the proper management of your money. It doesn't just involve listing the amount you spent and when you spent it. You have other things to track and many ways to do so. Tracking your money will become a lot easier for you if you apply the tips we've shared in this article. As you work and learn more about how to practice self improvement for your business through money management, you'll come up with plenty of other methods for streamlining things.

Birmingham accountants will help with tax investigations, HMRC liaison, mergers and acquisitions, business start-ups, audit and auditing, sole traders, employment law, management accounts, monthly payroll, investment reviews, debt recovery, business acquisition and disposal, contractor accounts, bookkeeping, business planning and support, audit and compliance reports, estate planning, consultancy and systems advice, tax preparation, partnership registrations, limited company accounting, VAT returns, capital gains tax, self-employed registrations, accounting support services, consulting services, business outsourcing, financial and accounting advice, payslips, personal tax, PAYE, HMRC submissions and other accounting related services in Birmingham, West Midlands.

Birmingham Accounting Services

- Birmingham Tax Returns

- Birmingham Taxation Advice

- Birmingham Financial Advice

- Birmingham Forensic Accounting

- Birmingham Account Management

- Birmingham Chartered Accountants

- Birmingham VAT Returns

- Birmingham Personal Taxation

- Birmingham Payroll Management

- Birmingham Business Planning

- Birmingham PAYE Healthchecks

- Birmingham Tax Planning

- Birmingham Tax Refunds

- Birmingham Debt Recovery

Also find accountants in: Dudley Port, Sutton Coldfield, Walsgrave On Sowe, Balsall Common, Old Hill, Kirby Corner, Tettenhall Wood, Bloxwich, Foleshill, Allesley, Elmdon, Harborne, Marston Green, Bournbrook, Bradley, Longford, Knowle, Kings Heath, Aldridge, Oxley, Shire Oak, Halesowen, Queslett, Coventry, Clayhanger, Brierley Hill, Radford, Bradmore, Shelfield, Springfield, Walsall, Ward End, Eastcote, Amblecote, Blossomfield and more.

Accountant Birmingham

Accountant Birmingham Accountants Near Me

Accountants Near Me Accountants Birmingham

Accountants BirminghamMore West Midlands Accountants: Rowley Regis Accountants, Smethwick Accountants, Willenhall Accountants, Sutton Coldfield Accountants, Brierley Hill Accountants, Bloxwich Accountants, Wolverhampton Accountants, Sedgley Accountants, Walsall Accountants, West Bromwich Accountants, Coventry Accountants, Solihull Accountants, Tipton Accountants, Birmingham Accountants, Wednesfield Accountants, Oldbury Accountants, Dudley Accountants, Aldridge Accountants, Bilston Accountants, Halesowen Accountants, Wednesbury Accountants, Kingswinford Accountants and Stourbridge Accountants.

Bookkeeping Birmingham - Financial Accountants Birmingham - Self-Assessments Birmingham - Investment Accounting Birmingham - Financial Advice Birmingham - Auditors Birmingham - Small Business Accountants Birmingham - Tax Return Preparation Birmingham - Affordable Accountant Birmingham