Finding an Accountant in Barkisland: Do you get little else but a spinning head when filling out your annual tax self-assessment form? This is a frequent predicament for many others in Barkisland, West Yorkshire. Is it a better idea to get someone else to accomplish this task for you? This could be the best option if you consider self-assessment just too taxing. The average Barkisland bookkeeper or accountant will charge approximately £200-£300 for completing your tax returns. If this sounds like a lot to you, then consider using an online service.

Accountants don't just deal with tax returns, there are different sorts of accountant. Consequently, its crucial to identify an accountant who can fulfil your requirements. A lot of accountants work on their own, while others are part of a larger accounting business. The good thing about accountancy companies is that they've got many fields of expertise under one roof. Among the primary accountancy positions are: investment accountants, bookkeepers, tax preparation accountants, actuaries, auditors, chartered accountants, accounting technicians, financial accountants, cost accountants, forensic accountants and management accountants.

You would be best advised to find a fully qualified Barkisland accountant to do your tax returns. Ask if they at least have an AAT qualification or higher. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. Make sure that you include the accountants fees in your expenses, because these are tax deductable.

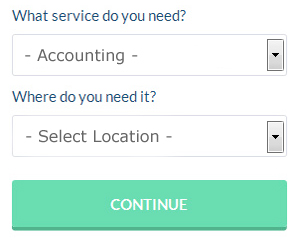

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Barkisland accountant. You will quickly be able to complete the form and your search will begin. Just sit back and wait for the responses to roll in. At the time of writing this service was totally free.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. More accountants are offering this modern alternative. If you decide to go with this method, pick a company with a decent reputation. Reading through reviews for any potential online services is a good way to get a feel for what is out there. Sorry, but we cannot give any recommendations in this respect.

At the end of the day you could always do it yourself and it will cost you nothing but time. A lot of software programs have been developed in recent years to help people do their own self assessment returns. Among the best known are Sage, Gbooks, Ajaccts, Taxforward, CalCal, Forbes, Basetax, ACCTAX, Andica, Keytime, Absolute Topup, Taxfiler, GoSimple, BTCSoftware, Nomisma, Ablegatio, Capium, Xero, TaxCalc, 123 e-Filing and Taxshield. You should get paperwork to your accountant promptly so that your tax returns can be prepared with time to spare. You will receive a fine of £100 if you are up to three months late with your tax return.

Forensic Accountant Barkisland

You could well run into the term "forensic accounting" when you are on the lookout for an accountant in Barkisland, and will doubtless be interested to find out about the distinction between forensic accounting and regular accounting. The hint for this is the word 'forensic', which basically means "appropriate for use in a law court." Occasionally also known as 'forensic accountancy' or 'financial forensics', it uses auditing, investigative skills and accounting to search through financial accounts in order to discover fraud and criminal activity. There are even a few bigger accountants firms in West Yorkshire who have got specialist divisions for forensic accounting, dealing with money laundering, insolvency, professional negligence, personal injury claims, bankruptcy, insurance claims and tax fraud. (Tags: Forensic Accounting Barkisland, Forensic Accountants Barkisland, Forensic Accountant Barkisland)

Small Business Accountants Barkisland

Making certain your accounts are accurate and up-to-date can be a stressful job for any small business owner in Barkisland. Using the services of a small business accountant in Barkisland will allow you to run your business with the knowledge that your tax returns, annual accounts and VAT, among many other business tax requirements, are being fully met.

Helping you improve your business, and offering financial advice for your specific circumstances, are just two of the ways that a small business accountant in Barkisland can benefit you. A responsible accounting firm in Barkisland will offer proactive small business advice to optimise your tax efficiency while lowering business expenditure; critical in the sometimes murky field of business taxation.

It is essential that you clarify the structure of your business, your future plans and your company's situation truthfully to your small business accountant.

Payroll Services Barkisland

An important part of any business in Barkisland, large or small, is having a reliable payroll system for its personnel. The regulations on payrolls and the legal obligations for accuracy and openness means that handling a business's payroll can be a daunting task.

A small business may well not have the advantage of a dedicated financial expert and an easy way to work with employee payrolls is to use an external accounting firm in Barkisland. Your payroll accounting company can provide accurate BACS payments to your personnel, as well as working along with any pension scheme administrators that your company may have, and follow current HMRC legislation for NI contributions and deductions.

A decent payroll management accountant in Barkisland will also, in line with the current legislation, organise P60 tax forms after the end of the financial year for every one of your staff members. At the end of an employee's contract, the payroll accountant will supply a current P45 form relating to the tax paid in the previous financial period.

Improve Your Business and Yourself By Learning Better Money Management

Properly using money management strategies is one of those things that is most difficult to learn when you're just starting a business. It can seem like money management is something anyone should be able to do already by the time they get their business up and running. Personal money management, however, is completely different from business money management, although being experienced in the former can be handy when you go into business. It can be quite a confidence killer to accidentally ruin your financial situation. In this article, we'll share a few tips you can apply to help you be a better money manager for your business.

If you have a lot of regular expenditures, such as hosting account bills, recurring membership dues, etc, you might be tempted to put them all on a credit card. This can certainly help your memory because you only have one payment to make each month instead of several. However, it can be tricky to use credit cards for your business expenses because interest charges can accrue and you may end up paying more if you carry a balance each month. This isn't to say you shouldn't use your credit card, but if you do, it's best if you pay it all off every month. With this money management strategy, you only have to keep track of one consolidated payment, not pay any interest, and build your credit rating.

Learn how to keep your books. Having a system in place for your business and personal finance is crucial. You can set up your system using a basic spreadsheet or get yourself a bookkeeping software like QuickBooks or Quicken. There are also other online tools you can use, like Mint.com. You'll find plenty of free resources on the internet that can help small business owners like you manage your books better. You'll know exactly what's happening to your business and personal finances when you've got your books in order. It won't hurt if you take a class or two on basic bookkeeping and accounting, as this could prove helpful to you especially if you don't think you can afford to hire a professional to manage your books.

Be a responsible business owner by paying your taxes when they're due. Small businesses typically pay file taxes quarterly. When it comes to taxes, you want to make sure you have accurate information, so it's a good idea to consult with someone at the small business center in your town, city, or county or even with someone from the IRS. You can also work with a professional to set up payments and plans for ensuring that you are meeting all of your obligations and following the letter of the law. You wouldn't want the IRS to come knocking on your door because you were remiss in paying your taxes.

Not only does learning how to properly manage your money help you improve yourself, it helps improve your business too. You'll benefit a great deal if you remember and put these tips we've shared to use. When you've got your finances under control, you can expect your business and personal life to be a success.

Barkisland accountants will help with financial statements, general accounting services, self-employed registrations Barkisland, consulting services, sole traders in Barkisland, tax investigations, litigation support, financial and accounting advice, corporate finance, PAYE, accounting services for the construction industry in Barkisland, corporation tax, accounting support services, business advisory, company formations, bookkeeping, contractor accounts, tax preparation, consultancy and systems advice in Barkisland, VAT returns, financial planning, charities Barkisland, cash flow Barkisland, pension forecasts Barkisland, employment law, limited company accounting in Barkisland, investment reviews, debt recovery, year end accounts, mergers and acquisitions Barkisland, business disposal and acquisition Barkisland, company secretarial services Barkisland and other types of accounting in Barkisland, West Yorkshire. These are just a few of the activities that are undertaken by nearby accountants. Barkisland professionals will keep you informed about their whole range of services.

With the world wide web as an unlimited resource it is of course very easy to find a whole host of useful inspiration and ideas relating to auditing & accounting, self-assessment help, small business accounting and personal tax assistance. For instance, with a brief search we located this enlightening article describing choosing the right accountant for your business.

Barkisland Accounting Services

- Barkisland Bookkeeping

- Barkisland Self-Assessment

- Barkisland Debt Recovery

- Barkisland Forensic Accounting

- Barkisland Tax Planning

- Barkisland Financial Advice

- Barkisland Payroll Services

- Barkisland Specialist Tax

- Barkisland Tax Refunds

- Barkisland Account Management

- Barkisland Tax Returns

- Barkisland Bookkeeping Healthchecks

- Barkisland Auditing Services

- Barkisland Tax Investigations

Also find accountants in: Bardsey, Thorpe On The Hill, Drighlington, West Hardwick, Upperthong, Boston Spa, Upper Hopton, Lydgate, Shipley, Dewsbury, Woodlesford, Harewood, Mill Bank, Sowerby, High Gate, Linthwaite, Menston, Oulton, Kirkhamgate, Luddenden, Wilsden, Wibsey, Garforth, Hebden Bridge, Lumb, Flockton Green, Castleford, Denby Dale, Kinsley, Ledsham, Whitkirk, Northowram, Purston Jaglin, Meltham, Denholme and more.

Accountant Barkisland

Accountant Barkisland Accountants Near Barkisland

Accountants Near Barkisland Accountants Barkisland

Accountants BarkislandMore West Yorkshire Accountants: Yeadon Accountants, Brighouse Accountants, Wakefield Accountants, Batley Accountants, Keighley Accountants, Horsforth Accountants, Bingley Accountants, Pudsey Accountants, Dewsbury Accountants, Huddersfield Accountants, Shipley Accountants, Normanton Accountants, Halifax Accountants, Rothwell Accountants, Morley Accountants, Mirfield Accountants, Pontefract Accountants, Liversedge Accountants, Ossett Accountants, Ilkley Accountants, Holmfirth Accountants, Bradford Accountants, Castleford Accountants and Leeds Accountants.

Self-Assessments Barkisland - Tax Advice Barkisland - Bookkeeping Barkisland - Tax Return Preparation Barkisland - Chartered Accountant Barkisland - Small Business Accountant Barkisland - Online Accounting Barkisland - Financial Accountants Barkisland - Financial Advice Barkisland