Finding an Accountant in Aldwych: Does completing your annual self-assessment form cause you a lot of frustration? This is a frequent predicament for lots of others in Aldwych, Greater London. Tracking down a local Aldwych professional to do this for you might be the answer. This could be a better idea for you if you find self-assessment too taxing. Small business accountants in Aldwych will most likely charge you approximately two to three hundred pounds for such a service. You'll be able to get it done at a reduced rate by using one of the numerous online accounting services.

So, what type of accounting service should you look for and how much should you expect to pay? Finding a few local Aldwych accountants should be fairly simple by doing a a short search on the net. But, exactly who can you trust? You should not forget that advertising as an accountant or bookkeeper is something that practically anyone in Aldwych can do if they are so inclined. It is not even neccessary for them to have any qualifications.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. Your minimum requirement should be an AAT qualified accountant. Qualified accountants may come with higher costs but may also save you more tax. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. Many qualified bookkeepers offer tax returns services for smaller businesses and sole traders.

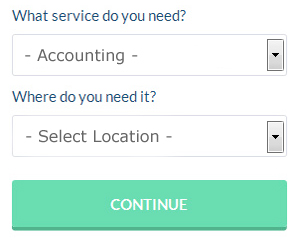

There is an online company called Bark who will do much of the work for you in finding an accountant in Aldwych. Tick a few boxes on their form and submit it in minutes. In no time at all you will get messages from accountants in the Aldwych area.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. An increasing number of self-employed people are plumping for this option. Don't simply go with the first company you find on Google, take time to do some research. Carefully read reviews online in order to find the best available. This is something you need to do yourself as we do not wish to favour any particular service here.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. It is also a good idea to make use of some self-assessment software such as Taxfiler, Basetax, Gbooks, Forbes, ACCTAX, Absolute Topup, Ablegatio, Taxshield, Andica, Sage, Taxforward, Ajaccts, GoSimple, 123 e-Filing, CalCal, Capium, TaxCalc, Keytime, Xero, BTCSoftware or Nomisma to simplify the process. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns.

Auditors Aldwych

Auditors are specialists who review the accounts of organisations and businesses to confirm the validity and legality of their current financial reports. They sometimes also take on an advisory role to advocate potential the prevention of risk and the implementation of cost efficiency. To become an auditor, a person must be approved by the regulatory authority of auditing and accounting and have earned certain qualifications.

Financial Actuaries Aldwych

An actuary manages, evaluates and offers advice on financial and monetary risks. These risks can impact on both sides of a company balance sheet and require expert valuation, liability management and asset management skills. An actuary uses mathematics and statistical concepts to determine the fiscal effect of uncertainty and help clients cut down on potential risks. (Tags: Financial Actuaries Aldwych, Actuary Aldwych, Actuaries Aldwych)

Small Business Accountants Aldwych

Doing the yearly accounts can be a stressful experience for any owner of a small business in Aldwych. Retaining a small business accountant in Aldwych will permit you to operate your business knowing that your VAT, tax returns and annual accounts, amongst many other business tax requirements, are being met.

Offering guidance, ensuring that your business adheres to the optimum financial practices and providing ways to help your business achieve its full potential, are just a sample of the duties of an experienced small business accountant in Aldwych. The capricious and complicated world of business taxation will be clearly laid out for you in order to reduce your business expenses, while at the same time improving tax efficiency.

In order to do their job effectively, a small business accountant in Aldwych will have to know accurate details regarding your current financial situation, company structure and any possible investment that you may be thinking about, or have put in place.

Improving Yourself and Your Business with the Help of the Top Money Management Techniques

Business owners, especially the new ones, will find it a struggle to manage their money properly in the early stages of their business. Your self-confidence could be hard hit and should your business have some cash flow issues, you just might find yourself contemplating about going back to a regular job. You won't reach the level of success you're aiming to reach when this happens. To help you in properly managing your money, follow these tips.

It's certainly tempting to wait until the last minute to pay your taxes, but you're actually playing with fire here, especially if you're not good at money management. When your taxes are due, you may not have any money to actually pay them. You can save yourself the headache by putting a portion of each payment you get in a separate account. Thus, when it's time for you to pay your quarterly taxes, you only need to take the money out from this account and not your current account. You actually save yourself the trouble of wondering where or how you're going to come up with the money. You want to be able to pay taxes promptly and in full and being able to do so every quarter is a great feeling.

Try to balance your books once every week. But if your business is one where you use registers or you receive multiple payments every day, it might be better if you balance your books at the end of the day every day. Keep track of every payment received and every payment made, then at the end of the week, make sure that what you have on hand and in the bank actually matches what your numbers say you should have. If there are any discrepancies in your records, there won't be a lot of them or they won't be too difficult to track when you do your end-of-month or quarterly balancing. Besides, it will only take you a few minutes if you balance your books regularly, whereas if you balance your books once a month, that would take you hours to do.

If you deal with cash in any capacity, make sure that you deposit that cash every day, as keeping cash on hand is just too tempting. It could be that you need cash when you're out for lunch and you end up getting money from your register and telling yourself you'll return the money later. But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. So avoid this problem altogether by depositing your cash in the bank at the end of each business day.

A lot of things go into proper money management. You might assume that proper money management is a skill that isn't hard to acquire, but the reality is that it's a complicated process, especially when you're a small business owner. Make sure that you use the suggestions we've provided to help you track and manage your finances better. It's crucial that you stay on top of your business finances.

Aldwych accountants will help with personal tax, capital gains tax, financial statements, consultancy and systems advice, litigation support, business disposal and acquisition, tax preparation Aldwych, year end accounts Aldwych, management accounts in Aldwych, VAT registrations, HMRC submissions Aldwych, audit and auditing, business planning and support, compliance and audit issues, consulting services, tax returns, taxation accounting services Aldwych, partnership registration, accounting services for the construction sector in Aldwych, financial and accounting advice, employment law in Aldwych, small business accounting, National Insurance numbers, PAYE Aldwych, VAT returns, contractor accounts, financial planning, double entry accounting, accounting support services, accounting services for start-ups in Aldwych, mergers and acquisitions, charities and other forms of accounting in Aldwych, Greater London. These are just a selection of the activities that are accomplished by nearby accountants. Aldwych companies will be happy to inform you of their entire range of services.

Aldwych Accounting Services

- Aldwych Tax Returns

- Aldwych Forensic Accounting

- Aldwych Tax Services

- Aldwych Financial Advice

- Aldwych Personal Taxation

- Aldwych VAT Returns

- Aldwych Self-Assessment

- Aldwych Specialist Tax

- Aldwych Business Accounting

- Aldwych Bookkeepers

- Aldwych Debt Recovery

- Aldwych Auditing

- Aldwych Chartered Accountants

- Aldwych Tax Planning

Also find accountants in: Willesden Green, Broadgate, Totteridge, Southgate, West Dulwich, Silvertown, Latimer Road, Farnborough, Peckham, Havering Atte Bower, Victoria, Queens Road, Monument, Upton, Lower Holloway, Westminster Abbey, Clapham Junction, Ponders End, Noel Park, Green Street Green, Highbury And Islington, Belmont, London Bridge, Oxford Street, Rocks Lane, Liverpool Street, Bushy Park, Edmonton, Kew, Slade Green, Moorgate, Bromley Common, Lea Bridge, Enfield Chase, Camden Town and more.

Accountant Aldwych

Accountant Aldwych Accountants Near Aldwych

Accountants Near Aldwych Accountants Aldwych

Accountants AldwychMore Greater London Accountants: Harrow Accountants, Greenwich Accountants, Sutton Accountants, Kingston upon Thames Accountants, Haringey Accountants, Islington Accountants, Lambeth Accountants, Enfield Accountants, Hackney Accountants, Dagenham Accountants, Richmond upon Thames Accountants, Barnet Accountants, Newham Accountants, Croydon Accountants, Brent Accountants, Southwark Accountants, Bexley Accountants, Havering Accountants, Redbridge Accountants, Hillingdon Accountants, Lewisham Accountants, Bromley Accountants, Hammersmith Accountants, Merton Accountants, Fulham Accountants, Ealing Accountants, Kensington Accountants, Wandsworth Accountants, Camden Accountants, Chelsea Accountants, Barking Accountants and Hounslow Accountants.

Affordable Accountant Aldwych - Auditing Aldwych - Bookkeeping Aldwych - Tax Advice Aldwych - Self-Assessments Aldwych - Tax Preparation Aldwych - Chartered Accountant Aldwych - Online Accounting Aldwych - Financial Accountants Aldwych