Finding an Accountant in Sarratt: There are many advantages to be had from retaining the services of a qualified accountant if you are self-employed or run a small business in Sarratt, Hertfordshire. By handling some of those mundane financial tasks such as tax returns and bookkeeping you accountant will be able to free up more time for you to get on with your main business. If you are only just getting started in business you will find the assistance of a professional accountant invaluable.

But which accounting service is best for your requirements and how should you go about finding it? An internet search engine will pretty soon provide a shortlist of likely candidates in Sarratt. However, which of these Sarratt accountants is best for you and which one can be trusted? The sad fact is that anyone in Sarratt can promote their services as an accountant. They are not required by law to hold any specific qualifications.

To get the job done correctly you should search for a local accountant in Sarratt who has the right qualifications. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. The extra peace of mind should compensate for any higher costs. Your accountant's fees are tax deductable. If your business is small or you are a sole trader you could consider using a bookkeeper instead.

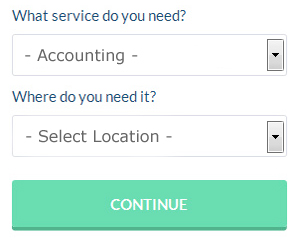

If you don't have the time to do a proper online search for local accountants, try using the Bark website. They provide an easy to fill in form that gives an overview of your requirements. Accountants in your local area will be sent your details, and if they are interested in doing the work will contact you shortly. Why not give Bark a try since there is no charge for this useful service.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. Nowadays more and more people are using this kind of service. There is no reason why this type of service will not prove to be as good as your average High Street accountant. A good method for doing this is to check out any available customer reviews and testimonials.

If you want to use the most qualified person to deal with your finances, a chartered accountant would be the choice. These high achievers will hold qualifications like an ACA or an ICAEW. All that remains is to make your final choice.

Although filling in your own tax return may seem too complicated, it is not actually that hard. These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of GoSimple, BTCSoftware, Andica, Capium, Gbooks, CalCal, Keytime, Taxshield, Nomisma, Absolute Topup, TaxCalc, Sage, ACCTAX, Forbes, Ablegatio, Basetax, Taxfiler, Xero, 123 e-Filing, Ajaccts and Taxforward. Whatever happens you need to get your self-assessment form in on time. You will receive a fine of £100 if you are up to three months late with your tax return.

Auditors Sarratt

An auditor is a person or company brought in by a firm to carry out an audit, which is an official examination of an organisation's financial accounts, usually by an unbiased entity. Auditors assess the fiscal activities of the firm that appoints them to make certain of the steady operation of the business. For anybody to become an auditor they need to have specified qualifications and be approved by the regulating body for auditing and accounting. (Tags: Auditing Sarratt, Auditor Sarratt, Auditors Sarratt)

Actuary Sarratt

An actuary is a business professional who deals with the managing and measurement of uncertainty and risk. These risks can impact both sides of a company's balance sheet and require valuation, liability management and asset management skills. To work as an actuary it is vital to possess an economic, statistical and mathematical understanding of day to day situations in the financial world.

Small Business Accountants Sarratt

Managing a small business in Sarratt is pretty stressful, without needing to fret about doing your accounts and similar bookkeeping duties. If your annual accounts are getting the better of you and tax returns and VAT issues are causing you sleepless nights, it is a good idea to employ a decent small business accountant in Sarratt.

Helping you to expand your business, and giving sound financial advice relating to your specific circumstances, are just two of the means by which a small business accountant in Sarratt can be of benefit to you. The fluctuating and often complicated field of business taxation will be clearly explained to you so as to minimise your business costs, while at the same time maximising tax efficiency.

It is also essential that you explain your plans for the future, your company's situation and your business structure accurately to your small business accountant. (Tags: Small Business Accounting Sarratt, Small Business Accountants Sarratt, Small Business Accountant Sarratt).

Be Better at Managing Your Money

Many new business owners have a hard time managing money the right away, especially when they're still trying to figure out most of the things they need to do to run a business. Your self-confidence could be hard hit and should your business have some cash flow issues, you just might find yourself contemplating about going back to a regular job. You won't reach the level of success you're aiming to reach when this happens. Below are a few tips that will help manage your business finances better.

It's certainly tempting to wait until the last minute to pay your taxes, but you're actually playing with fire here, especially if you're not good at money management. When your taxes are due, you may not have any money to actually pay them. Try saving a portion of your daily or even weekly earnings and depositing it in a separate bank account. Thus, when it's time for you to pay your quarterly taxes, you only need to take the money out from this account and not your current account. You actually save yourself the trouble of wondering where or how you're going to come up with the money. It's extremely satisfying when you know you have the ability to pay the taxes you owe fully and promptly.

Learning a little bit about bookkeeping helps a lot. You need to have a system set up for your money -- both personally and professionally. For this, you can use a basic spreadsheet or go with software like Quicken. Budgeting tools like Mint.com are also an option. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. Your books are your key to truly understanding your money because they help you see what is happening with your business (and personal) finances. It won't hurt if you take a class or two on basic bookkeeping and accounting, as this could prove helpful to you especially if you don't think you can afford to hire a professional to manage your books.

Track every single penny you bring in. Whenever a client or customer pays you, record that payment. You know who has already paid and who hasn't. In addition, you know exactly how much money you've got at any given time. When you know what your income is, you'll also be able to figure out how much taxes you can expect to pay and even how much money you should pay yourself.

There are many things you can do to help you manage your money the right way. Proper management of business finances isn't merely a basic skill. It's actually a complex process that you need to keep developing as a small business owner. Hopefully, the tips we've shared in this article will help you get started in managing your finances better. One of the secrets to having a successful business is learning proper money management.

Sarratt accountants will help with taxation accounting services, contractor accounts in Sarratt, assurance services, cashflow projections Sarratt, partnership registration in Sarratt, mergers and acquisitions, double entry accounting in Sarratt, financial planning, accounting services for the construction industry Sarratt, financial and accounting advice Sarratt, compliance and audit issues, year end accounts in Sarratt, company secretarial services Sarratt, accounting and auditing, sole traders in Sarratt, capital gains tax Sarratt, accounting services for media companies, inheritance tax, payslips, personal tax in Sarratt, charities, VAT returns, VAT payer registration in Sarratt, small business accounting, HMRC submissions Sarratt, employment law, estate planning in Sarratt, business disposal and acquisition, National Insurance numbers in Sarratt, consultancy and systems advice, litigation support, workplace pensions and other forms of accounting in Sarratt, Hertfordshire. Listed are just an example of the tasks that are performed by local accountants. Sarratt companies will inform you of their full range of accountancy services.

Sarratt Accounting Services

- Sarratt Chartered Accountants

- Sarratt Tax Planning

- Sarratt Bookkeeping Healthchecks

- Sarratt Tax Returns

- Sarratt Debt Recovery

- Sarratt PAYE Healthchecks

- Sarratt Personal Taxation

- Sarratt VAT Returns

- Sarratt Business Accounting

- Sarratt Financial Advice

- Sarratt Audits

- Sarratt Bookkeeping

- Sarratt Payroll Services

- Sarratt Forensic Accounting

Also find accountants in: Puckeridge, Langley, Great Wymondley, Hitchin, Markyate, Brookmans Park, Datchworth Green, Smug Oak, Willian, Westmill, Harmer Green, Water End, Little Amwell, Great Amwell, Furneux Pelham, Cockernhoe, Aston End, Northaw, Epping Green, Hadham Cross, Charlton, Harpenden, Codicote, Wormley, Welham Green, Tring, Stanborough, Letchmore Heath, Albury, Great Hormead, Clothall, Great Gaddesden, Stapleford, Woolmer Green, Blackmore End and more.

Accountant Sarratt

Accountant Sarratt Accountants Near Sarratt

Accountants Near Sarratt Accountants Sarratt

Accountants SarrattMore Hertfordshire Accountants: Stevenage Accountants, Bishops Stortford Accountants, Potters Bar Accountants, Hertford Accountants, Rickmansworth Accountants, St Albans Accountants, Welwyn Garden City Accountants, Tring Accountants, Berkhamsted Accountants, Elstree Accountants, Hatfield Accountants, Abbots Langley Accountants, Royston Accountants, Hemel Hempstead Accountants, Hitchin Accountants, Hoddesdon Accountants, Letchworth Accountants, Ware Accountants, Broxbourne Accountants, Cheshunt Accountants, Croxley Green Accountants, Borehamwood Accountants, Sandridge Accountants, Harpenden Accountants, Watford Accountants and Bushey Accountants.

Affordable Accountant Sarratt - Online Accounting Sarratt - Investment Accountant Sarratt - Financial Accountants Sarratt - Bookkeeping Sarratt - Financial Advice Sarratt - Self-Assessments Sarratt - Chartered Accountant Sarratt - Tax Accountants Sarratt