Finding an Accountant in Cheadle: Does filling in your annual self-assessment form give you nightmares? Lots of other folks in Cheadle have to overcome this very predicament. Of course, you could always get yourself a local Cheadle accountant to do this job instead. This may be the best alternative if you consider self-assessment just too time-consuming. Typically Cheadle High Street accountants will do this for approximately £220-£300. If you have no issues with using an online service rather than someone local to Cheadle, you might be able to get this done for less.

When hunting for a nearby Cheadle accountant, you will find that there are lots of different kinds on offer. Finding one that meets your precise needs should be a priority. Accountants sometimes work as sole traders but often as part of a much bigger company. Each particular field of accounting will probably have their own specialists within an accountancy practice. You'll possibly find auditors, bookkeepers, chartered accountants, tax preparation accountants, forensic accountants, financial accountants, accounting technicians, investment accountants, cost accountants, actuaries and management accountants in a good sized accounting practice.

To get the job done correctly you should search for a local accountant in Cheadle who has the right qualifications. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. You can then have peace of mind knowing that your tax affairs are being handled professionally. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. A bookkeeper may be qualified enough to do your tax returns unless you are a large Limited Company.

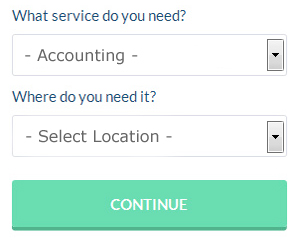

To save yourself a bit of time when searching for a reliable Cheadle accountant online, you might like to try a service called Bark. You will quickly be able to complete the form and your search will begin. Sometimes in as little as a couple of hours you will hear from prospective Cheadle accountants who are keen to get to work for you. When this article was written Bark was free to use.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. An increasing number of self-employed people are plumping for this option. It would be advisable to investigate that any online company you use is reputable. The easiest way to do this is by studying online reviews. If you are looking for individual recommendations, this website is not the place to find them.

Although filling in your own tax return may seem too complicated, it is not actually that hard. Using accounting software like Capium, Ablegatio, Basetax, Nomisma, 123 e-Filing, Gbooks, Ajaccts, CalCal, Absolute Topup, Taxfiler, GoSimple, BTCSoftware, Forbes, Taxforward, Keytime, TaxCalc, Andica, Xero, Taxshield, ACCTAX or Sage will make it even simpler to do yourself. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty. You can expect to pay a minimum penalty of £100 for being late.

Financial Actuaries Cheadle

Actuaries work within businesses and government departments, to help them in predicting long-term fiscal costs and investment risks. They use their wide-ranging knowledge of business and economics, along with their skills in investment theory, statistics and probability theory, to provide commercial, financial and strategic advice. An actuary uses statistics and math concepts to determine the financial impact of uncertainties and help their clientele reduce risks. (Tags: Actuaries Cheadle, Actuary Cheadle, Financial Actuary Cheadle)

Small Business Accountants Cheadle

Company accounting and bookkeeping can be a fairly stressful experience for any small business owner in Cheadle. A dedicated small business accountant in Cheadle will provide you with a hassle-free solution to keep your VAT, tax returns and annual accounts in the best possible order.

A good small business accountant will consider it their responsibility to help your business to expand, supporting you with good advice, and providing you with peace of mind and security concerning your financial situation at all times. The vagaries and sometimes complex field of business taxation will be clearly laid out for you in order to lower your business expenses, while maximising tax efficiency.

A small business accountant, to do their job effectively, will want to know accurate details regarding your current financial situation, company structure and any possible investment that you may be looking at, or already have put in place. (Tags: Small Business Accountants Cheadle, Small Business Accountant Cheadle, Small Business Accounting Cheadle).

How Managing Your Money Better Makes You a Better Business Owner

Many new business owners have a hard time managing money the right away, especially when they're still trying to figure out most of the things they need to do to run a business. Poor money management can be a real drag on your confidence, and when you are having money problems, you are more willing to take on any old job. You won't reach the level of success you're aiming to reach when this happens. Use the following tips to help you manage your money better.

It's best if you have separate account for your personal expenses and business expenses. This will help minimize confusion. You may not have problems in the beginning, but you can expect to have a hard time down the road. When your business expenses are running through your personal account, it can be very confusing and difficult to prove your income. When it's time for you to file your taxes, it'll be a nightmare to sort through your financial records and identifying just which expenses went to your business and which ones went for personal things like groceries, utilities, and such. It's better if you streamline your finances by separating your business expenses from your personal expenses.

Even if you are a sole proprietor, you can still give yourself a salary and a regular paycheck. This way, you won't have a hard time keeping track of your business and personal finances. So how do you do this exactly? First, any payments you get from the sale of your products or services should go to your business account. Next, decide how often you want to receive a salary. Let's say you want to pay yourself once every month, such as on the 15th. When the 15th comes around, write yourself a check. How much should you pay yourself? It's up to you. Your salary can be an hourly rate or a portion of your business income.

Make sure you account for every penny your business brings in. Whenever a client or customer pays you, record that payment. With this money management strategy, you can easily keep track of how much money you've got on hand, as well as who has already paid their dues and who hasn't. It also makes it easy to figure out what you owe in taxes and how much you should pay yourself for that week or month.

When it comes to managing your money properly, there are so many things that go into it. It's not only about keeping a record of when you spent what. When it comes to your business finances, you have many things to keep track of. The tips we have shared will help you track your money more easily. Your business and your self-confidence stand to benefit when you keep on learning how to manage your business finances better.

Cheadle accountants will help with HMRC submissions, corporation tax, accounting and financial advice, workplace pensions, HMRC liaison, payslips in Cheadle, monthly payroll, contractor accounts, consulting services, bureau payroll services, VAT payer registration, cashflow projections, accounting services for the construction industry Cheadle, partnership accounts, PAYE Cheadle, business outsourcing, management accounts, accounting services for property rentals, litigation support, corporate finance, double entry accounting in Cheadle, small business accounting, tax returns, financial statements Cheadle, inheritance tax, accounting and auditing, employment law in Cheadle, business support and planning Cheadle, pension forecasts Cheadle, personal tax, estate planning in Cheadle, taxation accounting services Cheadle and other kinds of accounting in Cheadle, Greater Manchester. These are just a selection of the duties that are performed by nearby accountants. Cheadle professionals will let you know their full range of services.

Cheadle Accounting Services

- Cheadle Bookkeeping Healthchecks

- Cheadle Forensic Accounting

- Cheadle Chartered Accountants

- Cheadle Specialist Tax

- Cheadle Debt Recovery

- Cheadle PAYE Healthchecks

- Cheadle Account Management

- Cheadle Business Accounting

- Cheadle Tax Advice

- Cheadle Tax Returns

- Cheadle Personal Taxation

- Cheadle Payroll Services

- Cheadle Tax Refunds

- Cheadle Financial Advice

Also find accountants in: Hindley Green, Newton, Stretford, Crompton Fold, Lately Common, Gorton, Levenshulme, Wolstenholme, Chorlton Cum Hardy, Delph, Manchester, Mottram In Longdendale, Timperley, Bowdon, Calderbrook, Uppermill, Romiley, Broadbottom, Syke, Pendlebury, Haigh, Horwich, Prestolee, Bleak Hey Nook, Newhey, Boothstown, Rusholm, Abram, Wigan, Lees, Hyde, Lowton Common, Heald Green, Denshaw, Kenyon and more.

Accountant Cheadle

Accountant Cheadle Accountants Near Cheadle

Accountants Near Cheadle Accountants Cheadle

Accountants CheadleMore Greater Manchester Accountants: Heywood Accountants, Leigh Accountants, Eccles Accountants, Ashton-under-Lyne Accountants, Stockport Accountants, Hindley Accountants, Oldham Accountants, Manchester Accountants, Cheadle Hulme Accountants, Droylsden Accountants, Stretford Accountants, Royton Accountants, Swinton Accountants, Middleton Accountants, Sale Accountants, Romiley Accountants, Golborne Accountants, Stalybridge Accountants, Farnworth Accountants, Altrincham Accountants, Chadderton Accountants, Urmston Accountants, Rochdale Accountants, Salford Accountants, Gatley Accountants, Bolton Accountants, Bury Accountants, Denton Accountants and Westhoughton Accountants.

Bookkeeping Cheadle - Chartered Accountants Cheadle - Auditing Cheadle - Tax Return Preparation Cheadle - Financial Accountants Cheadle - Financial Advice Cheadle - Small Business Accountant Cheadle - Tax Advice Cheadle - Online Accounting Cheadle