Finding an Accountant in Castle Cary: If you run a small business or are a sole trader in Castle Cary, you will find that there are several benefits to be gained from having an accountant on board. The least you can expect is to gain a bit of extra time to devote to your core business, while financial concerns are handled by your accountant. The importance of getting this sort of financial help cannot be overstated, particularly for start-ups and fledgling businesses that are not yet established.

Your next job will be to single out a local Castle Cary accountant who you can trust to do a good job on your books. Finding a few local Castle Cary accountants should be fairly simple by doing a a quick search on the internet. But, it is difficult to spot the gems from the rogues. The sad truth is that anyone in Castle Cary can promote their services as an accountant. Qualifications are not even a prerequisite.

You should take care to find a properly qualified accountant in Castle Cary to complete your self-assessment forms correctly and professionally. The AAT qualification is the minimum you should look for. You can then have peace of mind knowing that your tax affairs are being handled professionally. You will of course get a tax deduction on the costs involved in preparing your tax returns.

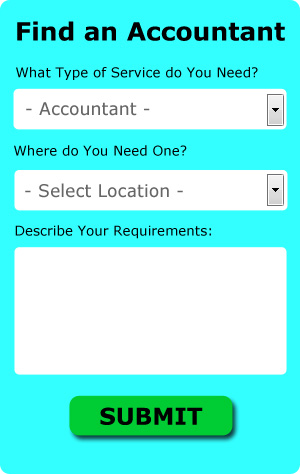

If you need a little help with your online search, there are numerous accountants who can be contacted through a website called Bark.com. In no time at all you can fill out the job form and submit it with a single click. Accountants in your local area will be sent your details, and if they are interested in doing the work will contact you shortly. Bark offer this service free of charge.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. It could be that this solution will be more appropriate for you. Don't simply go with the first company you find on Google, take time to do some research. A good method for doing this is to check out any available customer reviews and testimonials. Recommending any specific services is beyond the scope of this short article.

If you want to use the most qualified person to deal with your finances, a chartered accountant would be the choice. Larger companies in the Castle Cary area may choose to use their expert services. If you can afford one why not hire the best?

Of course, completing and sending in your own self-assessment form is the cheapest solution. Software is also available to make doing your self-assessment even easier. Some of the best ones include ACCTAX, Basetax, Andica, BTCSoftware, Ablegatio, GoSimple, Taxshield, Absolute Topup, Sage, Keytime, Forbes, Nomisma, Ajaccts, Capium, CalCal, TaxCalc, Gbooks, 123 e-Filing, Taxfiler, Xero and Taxforward. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns.

Auditors Castle Cary

An auditor is a person or a firm appointed by a company or organisation to carry out an audit, which is the official assessment of the accounts, generally by an unbiased entity. Auditors evaluate the financial behaviour of the company that appoints them to make certain of the unwavering functioning of the business. For anyone to start working as an auditor they need to have specific qualifications and be approved by the regulatory authority for auditing and accounting. (Tags: Auditor Castle Cary, Auditors Castle Cary, Auditing Castle Cary)

Financial Actuaries Castle Cary

An actuary advises on, assesses and manages financial risks. Such risks can have an impact on both sides of a company balance sheet and require specialist valuation, liability management and asset management skills. To be an actuary it's necessary to have an economic, statistical and mathematical awareness of day to day situations in the financial world. (Tags: Actuary Castle Cary, Financial Actuary Castle Cary, Actuaries Castle Cary)

Small Business Accountants Castle Cary

Making certain that your accounts are accurate and up-to-date can be a stressful job for any small business owner in Castle Cary. A dedicated small business accountant in Castle Cary will offer you a hassle-free approach to keep your annual accounts, tax returns and VAT in perfect order.

Helping you to expand your business, and offering sound financial advice relating to your specific circumstances, are just a couple of the means by which a small business accountant in Castle Cary can be of benefit to you. An accountancy firm in Castle Cary will provide an allocated small business accountant and adviser who will clear away the haze that veils the area of business taxation, in order to optimise your tax efficiency.

It is critical that you explain the structure of your business, your future plans and your current financial situation accurately to your small business accountant.

You can Improve Yourself and Your Business by Learning How to Manage Your Money Better

One of the most difficult parts of starting your own business is learning how to use proper money management techniques. It can seem like money management is something anyone should be able to do already by the time they get their business up and running. But managing your business finances is a lot different from managing your personal finances. It will help, though, if you are already experienced in the latter. Very few things in life can kill your confidence quite like how unintentionally ruining your financial situation does. In this article, we'll share a few tips you can apply to help you be a better money manager for your business.

Have an account that's just for your business expenses and another for your personal expenses. You're only going to make it hard on yourself if you insist on running everything through one account. For one, it's a lot harder to prove your income when your business expenses are running through a personal account. Moreover, come tax season, you'll be in for a tough time proving which expenses were business related and which ones were personal. Streamline your process with two accounts.

Even if you are a sole proprietor, you can still give yourself a salary and a regular paycheck. Paying yourself like you would a regular employee would make your business accounting so much easier. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. It's up to you how much salary you want to give yourself. Your salary can be an hourly rate or a portion of your business income.

Take control of your spending. When your business is steadily pulling in a nice income, you may be tempted to go on a buying spree and buy all those things you've always wanted to buy but couldn't afford. It's best if you spend money on things that will benefit your business. Put your money in your business savings account so that if unexpected business expenses come up, you'll have the means to deal with it in a prompt manner. You should also try buying your business supplies in bulk. For your office equipment, it's much better if you spend a little more on quality rather than on equipment that you will have to replace often. While it's a good idea to spend on your entertainment, be careful that you spend too much on it.

Proper money management involves a lot of things. It's not only about keeping a record of when you spent what. There are different things to keep track of and different ways to track them. The tips we have shared will help you track your money more easily. Your business and your self-confidence stand to benefit when you keep on learning how to manage your business finances better.

Castle Cary accountants will help with financial planning Castle Cary, company secretarial services, PAYE, accounting support services, charities Castle Cary, litigation support Castle Cary, audit and auditing Castle Cary, company formations, cashflow projections in Castle Cary, business outsourcing, bookkeeping in Castle Cary, financial statements in Castle Cary, National Insurance numbers, assurance services, sole traders Castle Cary, inheritance tax, partnership accounts, payslips, accounting services for buy to let property rentals, bureau payroll services in Castle Cary, tax investigations, accounting and financial advice, self-employed registration in Castle Cary, accounting services for media companies Castle Cary, partnership registrations, corporate tax Castle Cary, VAT registrations, personal tax, tax preparation in Castle Cary, accounting services for start-ups, small business accounting Castle Cary, workplace pensions and other accounting services in Castle Cary, Somerset. These are just a selection of the duties that are undertaken by local accountants. Castle Cary providers will inform you of their whole range of accounting services.

Castle Cary Accounting Services

- Castle Cary Tax Services

- Castle Cary Auditing

- Castle Cary Financial Advice

- Castle Cary Account Management

- Castle Cary Financial Audits

- Castle Cary Tax Returns

- Castle Cary Self-Assessment

- Castle Cary Chartered Accountants

- Castle Cary Tax Refunds

- Castle Cary Payroll Services

- Castle Cary VAT Returns

- Castle Cary Tax Advice

- Castle Cary Debt Recovery

- Castle Cary Personal Taxation

Also find accountants in: Vobster, Stawley, Ubley, Southstoke, Norton Hawkfield, Spaxton, Odd Down, Culbone, St Audries, Dundon, Cholwell, Liscombe, Ford Street, Holcombe, Farleigh Hungerford, Corston, Stapleton, Monksilver, Stogumber, West Quantoxhead, Curland, Willett, Simonsbath, Southway, Kingston St Mary, Lullington, High Ham, Fitzhead, Glastonbury, Whitestaunton, Chilton Polden, Four Forks, Banwell, Nynehead, Clutton and more.

Accountant Castle Cary

Accountant Castle Cary Accountants Near Castle Cary

Accountants Near Castle Cary Accountants Castle Cary

Accountants Castle CaryMore Somerset Accountants: Burnham-on-Sea Accountants, Minehead Accountants, Bridgwater Accountants, Nailsea Accountants, Clevedon Accountants, Yeovil Accountants, Crewkerne Accountants, Keynsham Accountants, Weston-Super-Mare Accountants, Taunton Accountants, Midsomer Norton Accountants, Portishead Accountants, Shepton Mallet Accountants, Chard Accountants, Street Accountants, Frome Accountants, Wellington Accountants, Bath Accountants, Wells Accountants and Radstock Accountants.

Cheap Accountant Castle Cary - Tax Return Preparation Castle Cary - Financial Advice Castle Cary - Financial Accountants Castle Cary - Tax Advice Castle Cary - Self-Assessments Castle Cary - Investment Accountant Castle Cary - Chartered Accountant Castle Cary - Bookkeeping Castle Cary